Get the free Chapter 9. Selected Debt Restructuring Experiences in the ...

Show details

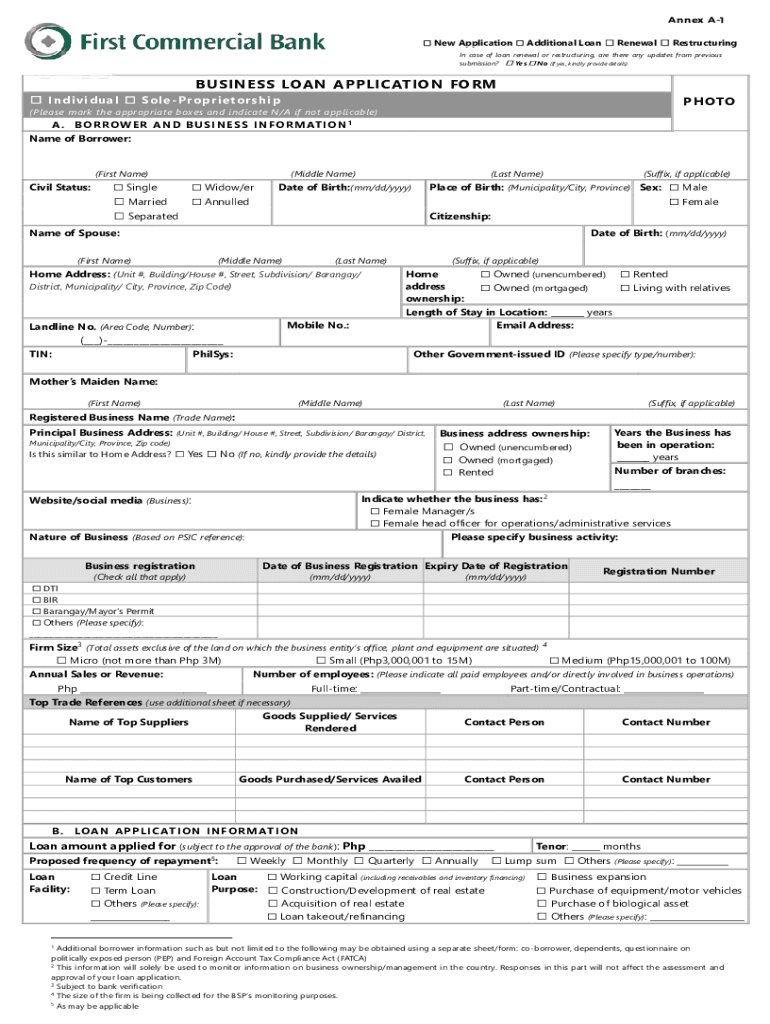

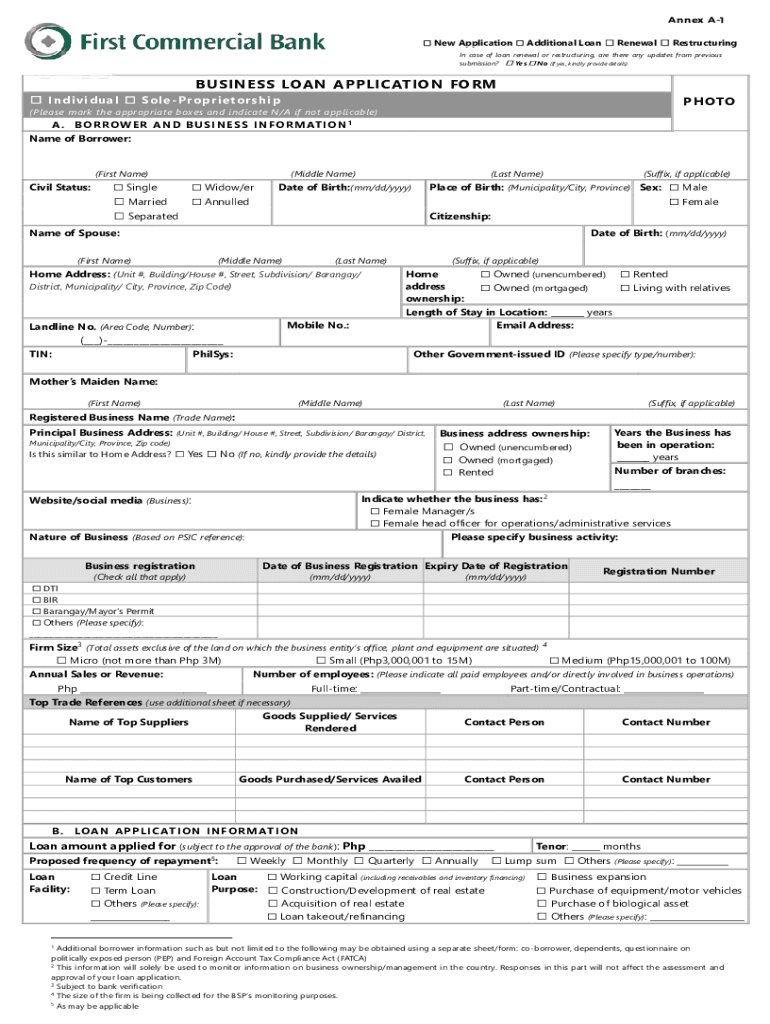

Annex A1 New Application Additional Loan Renewal Restructuring[Banks logo here]In case of loan renewal or restructuring, are there any updates from previous submission? Yes No (If yes, kindly provide

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 9 selected debt

Edit your chapter 9 selected debt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 9 selected debt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chapter 9 selected debt online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit chapter 9 selected debt. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 9 selected debt

How to fill out chapter 9 selected debt

01

Step 1: Begin by reviewing the requirements for Chapter 9 bankruptcy, including meeting the definition of a municipality.

02

Step 2: Gather all necessary financial documents and records, including a list of all creditors and the amount of debt owed to each.

03

Step 3: Consult with a bankruptcy attorney who specializes in Chapter 9 cases to guide you through the process.

04

Step 4: Prepare and file a petition for Chapter 9 bankruptcy with the appropriate bankruptcy court.

05

Step 5: Work with your attorney to develop a plan of adjustment that outlines how the municipality intends to repay or restructure its debts.

06

Step 6: Attend a creditors' meeting, where creditors have the opportunity to ask questions about the municipality's finances and proposed plan of adjustment.

07

Step 7: Obtain approval from the court for the proposed plan of adjustment.

08

Step 8: Implement the approved plan of adjustment, which may involve making regular payments to creditors or restructuring the debt.

09

Step 9: Complete all necessary documentation and fulfill all required obligations as outlined in the bankruptcy process.

10

Step 10: Once all debts have been repaid or restructured according to the plan of adjustment, the Chapter 9 bankruptcy process is complete.

Who needs chapter 9 selected debt?

01

Chapter 9 selected debt is needed by municipalities such as cities, towns, counties, and school districts when they are facing financial distress and are unable to meet their debt obligations.

02

It provides a legal framework for these entities to reorganize their finances, negotiate with creditors, and develop a plan to repay or restructure their debts.

03

By filing for Chapter 9 bankruptcy, municipalities can gain protection from creditors, halt legal actions and collection efforts, and work towards regaining financial stability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit chapter 9 selected debt online?

With pdfFiller, it's easy to make changes. Open your chapter 9 selected debt in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit chapter 9 selected debt in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your chapter 9 selected debt, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I complete chapter 9 selected debt on an Android device?

Use the pdfFiller Android app to finish your chapter 9 selected debt and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is chapter 9 selected debt?

Chapter 9 refers to a chapter of the U.S. Bankruptcy Code that provides for the reorganization of municipalities in financial distress, allowing them to restructure their debts while continuing to operate.

Who is required to file chapter 9 selected debt?

Municipalities such as cities, towns, villages, counties, and other governmental entities that are unable to meet their financial obligations may file for Chapter 9 relief.

How to fill out chapter 9 selected debt?

To fill out Chapter 9 selected debt, municipalities must prepare a petition that includes financial statements, details of debts, a list of creditors, and a proposed plan for reorganization.

What is the purpose of chapter 9 selected debt?

The purpose of Chapter 9 is to provide financial relief to municipalities facing insolvency, enabling them to restructure debts and continue providing essential services to their communities.

What information must be reported on chapter 9 selected debt?

Information that must be reported includes the municipality's financial status, a list of all debts and creditors, cash flow projections, and any proposals for debt restructuring.

Fill out your chapter 9 selected debt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 9 Selected Debt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.