Get the free RRSP, RESP, TFSA, RDSP

Show details

Liturgical Publications3171 LENWORTH DR. #12 MISSISSAUGA, ON L4X 2G6 90562444221372 QUEEN ST. W.4165357542Church ofPARKDALE Investments RRSP, RESP, TFSA, RDSP Retirement Strategies 4165041265 Intergenerational,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rrsp resp tfsa rdsp

Edit your rrsp resp tfsa rdsp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rrsp resp tfsa rdsp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rrsp resp tfsa rdsp online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rrsp resp tfsa rdsp. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rrsp resp tfsa rdsp

How to fill out rrsp resp tfsa rdsp

01

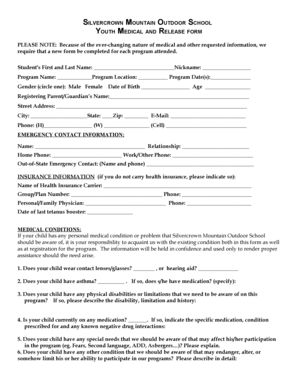

To fill out an RRSP (Registered Retirement Savings Plan), you will need to follow these steps:

1. Determine your contribution limit for the year.

2. Complete the RRSP contribution slip provided by your financial institution.

3. Specify the amount you wish to contribute.

4. Decide whether you want to make a cash contribution or transfer existing investments.

5. Submit the contribution slip to your financial institution along with the funds or instructions for transfer.

To fill out an RESP (Registered Education Savings Plan), you need to:

1. Determine the beneficiary of the plan (the child who will receive the funds).

2. Choose a specific RESP provider or financial institution.

3. Complete the necessary application forms provided by the chosen provider.

4. Provide personal and banking information.

5. Decide how much money you want to contribute and how often.

6. Submit the application and make the initial contribution.

To fill out a TFSA (Tax-Free Savings Account), follow these steps:

1. Determine your contribution limit for the year.

2. Choose a financial institution or TFSA provider.

3. Complete the application form provided by the institution.

4. Provide personal and banking information.

5. Decide how much money you want to contribute.

6. Submit the application and make the initial contribution.

To fill out an RDSP (Registered Disability Savings Plan), you must:

1. Determine if you or someone you are legally authorized to act for is eligible for the plan.

2. Choose a financial institution or RDSP provider.

3. Complete the application form provided by the institution.

4. Provide personal and financial information.

5. Determine the frequency and amount of contributions.

6. Submit the application and make the initial contribution.

Who needs rrsp resp tfsa rdsp?

01

RRSP: RRSPs are suitable for individuals who want to save for retirement and reduce their taxable income.

RESP: RESPs are beneficial for parents or guardians who want to save for their child's education and take advantage of government grants.

TFSA: TFSAs are ideal for individuals who want to save for various financial goals, such as a down payment on a house or a vacation, without incurring taxes on their investment growth.

RDSP: RDSPs are designed for individuals with disabilities or their legal representatives who want to save for long-term financial security and take advantage of government grants and bonds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find rrsp resp tfsa rdsp?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the rrsp resp tfsa rdsp. Open it immediately and start altering it with sophisticated capabilities.

How do I complete rrsp resp tfsa rdsp online?

Filling out and eSigning rrsp resp tfsa rdsp is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How can I fill out rrsp resp tfsa rdsp on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your rrsp resp tfsa rdsp, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is rrsp resp tfsa rdsp?

RRSP (Registered Retirement Savings Plan), RESP (Registered Education Savings Plan), TFSA (Tax-Free Savings Account), and RDSP (Registered Disability Savings Plan) are all types of Canadian savings accounts designed to help individuals save and invest for specific purposes such as retirement, education, or disability.

Who is required to file rrsp resp tfsa rdsp?

Generally, individuals who contribute to or withdraw from RRSPs, RESPs, TFSAs, and RDSPs must file certain information regarding these accounts with the Canada Revenue Agency (CRA) as part of their tax returns.

How to fill out rrsp resp tfsa rdsp?

To fill out RRSP, RESP, TFSA, or RDSP forms, individuals should gather necessary documents such as contribution receipts, account statements, and personal identification. Follow the specific instructions provided by the CRA for each type of plan to accurately report contributions and withdrawals.

What is the purpose of rrsp resp tfsa rdsp?

The purpose of these plans is to promote savings among Canadians. RRSPs are primarily for retirement savings, RESPs are for funding education, TFSAs are for flexible tax-free saving and investment, and RDSPs are for assisting individuals with disabilities in saving for their long-term needs.

What information must be reported on rrsp resp tfsa rdsp?

Individuals must report contributions made, withdrawals taken, and any income earned on their RRSP, RESP, TFSA, or RDSP accounts. Specific tax forms may be required depending on the type of account.

Fill out your rrsp resp tfsa rdsp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rrsp Resp Tfsa Rdsp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.