Get the free Stephanie Newman, EA - Slater IA Tax Preparer

Show details

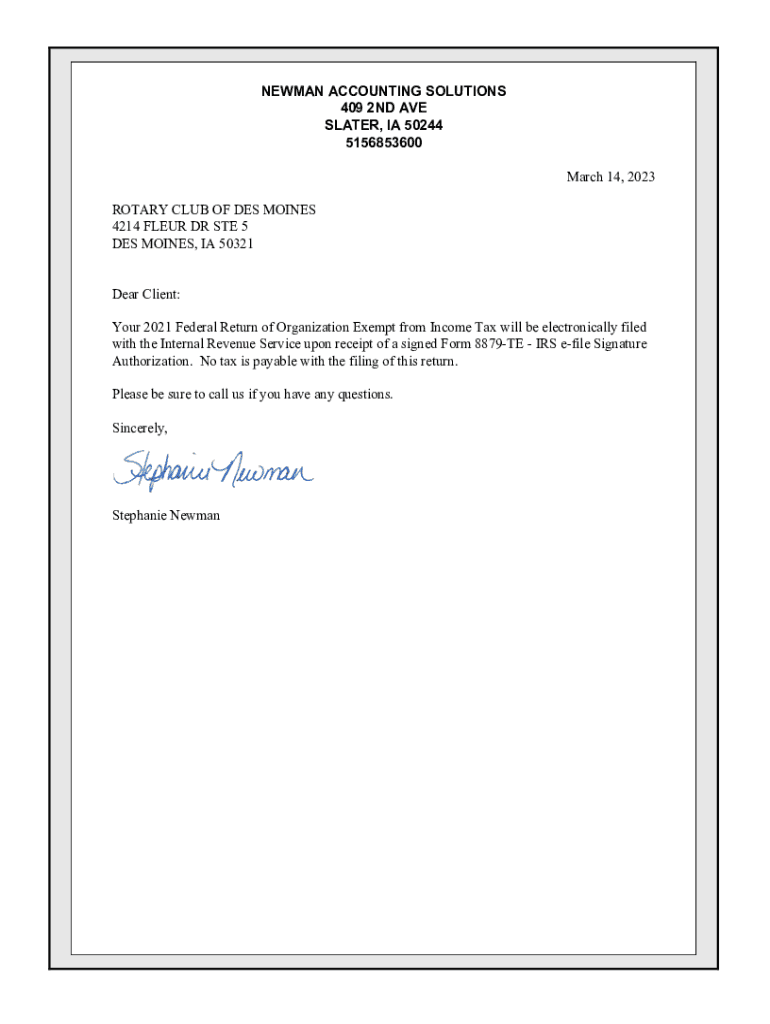

NEWMAN ACCOUNTING SOLUTIONS 409 2ND AVE SLATER, IA 50244 5156853600 March 14, 2023 ROTARY CLUB OF DES MOINES 4214 FLEUR DR STE 5 DES MOINES, IA 50321 Dear Client: Your 2021 Federal Return of Organization

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign stephanie newman ea

Edit your stephanie newman ea form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your stephanie newman ea form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit stephanie newman ea online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit stephanie newman ea. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out stephanie newman ea

How to fill out stephanie newman ea

01

To fill out Stephanie Newman EA, follow these steps:

02

Start by gathering all the necessary information and documents related to your financial and tax matters.

03

Begin filling out the form by accurately providing your personal information, including your full name, address, Social Security number, and any other requested details.

04

Proceed by carefully entering your income information, such as wages, tips, interest, dividends, and any other sources of income you have received throughout the year.

05

Deductions and credits play a vital role in tax returns, so make sure to carefully review and include all eligible deductions, including itemized deductions or standard deduction, and any applicable tax credits.

06

If you have any dependents, provide their necessary details, such as names, Social Security numbers, and relationship to you.

07

Report any other relevant information requested by the form, such as health coverage, foreign accounts, or any unique circumstances that apply to your tax situation.

08

Double-check all the information you have provided to ensure accuracy and completeness.

09

Sign and date the form, and if applicable, attach any supporting documents as required.

10

Make a copy of the filled-out form and all supporting documents for your records.

11

Finally, submit the completed form either electronically or by mail, following the instructions provided by the IRS.

12

Remember, it is always beneficial to consult a tax professional or use tax software to ensure you are accurately completing your tax returns.

Who needs stephanie newman ea?

01

Stephanie Newman EA is recommended for individuals who require assistance in preparing and filing their tax returns. This may include individuals with varying income sources, complex financial situations, or those who want to ensure accuracy and compliance with tax laws. Stephanie Newman EA can provide guidance, offer tax planning advice, and help maximize eligible tax deductions and credits. Whether you are an employee, small business owner, freelancer, or have investments, Stephanie Newman EA can help simplify the tax filing process and potentially optimize your tax situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify stephanie newman ea without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including stephanie newman ea. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send stephanie newman ea for eSignature?

stephanie newman ea is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out the stephanie newman ea form on my smartphone?

Use the pdfFiller mobile app to fill out and sign stephanie newman ea. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is stephanie newman ea?

Stephanie Newman EA refers to a specific tax-related form or process associated with an individual named Stephanie Newman who serves as an Enrolled Agent (EA) in the field of taxation.

Who is required to file stephanie newman ea?

Individuals who seek to engage with or utilize the services provided by Stephanie Newman EA for tax preparation or representation before the IRS may be required to file this form.

How to fill out stephanie newman ea?

To fill out the Stephanie Newman EA, you would typically provide personal information, income details, deductions, and any other relevant financial data as guided by the instructions associated with this form.

What is the purpose of stephanie newman ea?

The purpose of Stephanie Newman EA is to facilitate tax preparation, offer representation before the IRS, and provide expert guidance in tax-related matters.

What information must be reported on stephanie newman ea?

The information that must be reported on Stephanie Newman EA would include the taxpayer’s personal details, income sources, deductions, credits, and any other pertinent financial information as required for accurate tax reporting.

Fill out your stephanie newman ea online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Stephanie Newman Ea is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.