Get the free Traditional / SEP and Roth IRA Application

Show details

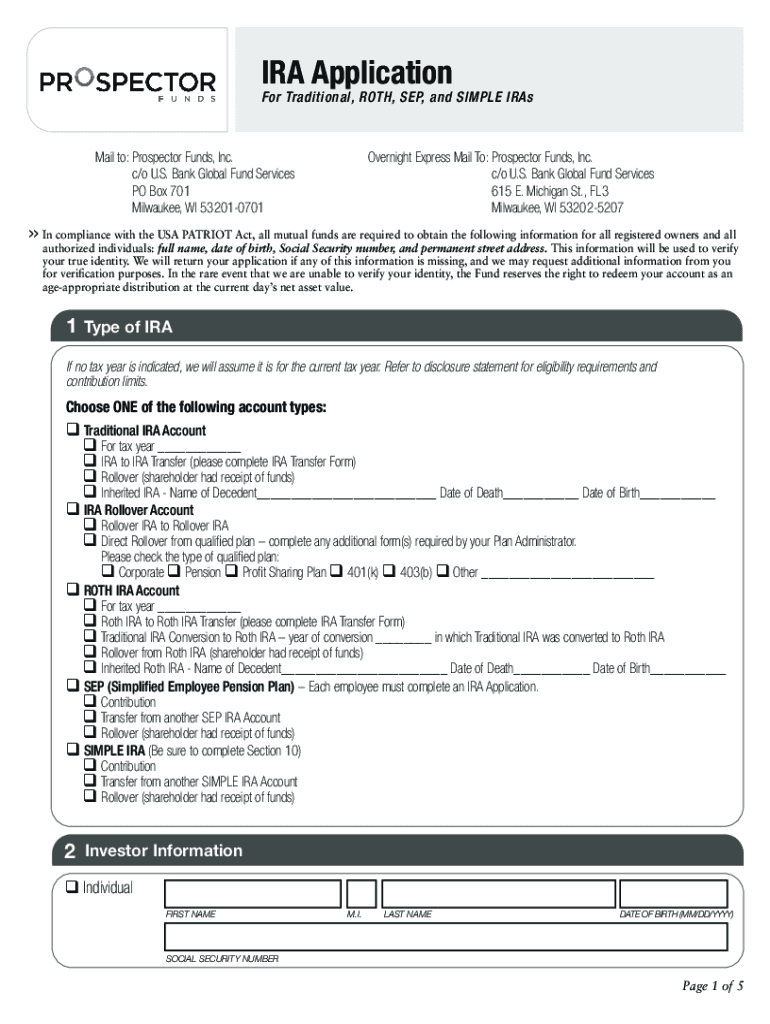

IRA ApplicationFor Traditional, ROTH, SEP, and SIMPLE IRAsMail to: Prospector Funds, Inc.c/o U.S. Bank Global Fund ServicesPO Box 701Milwaukee, WI 532010701Overnight Express Mail To: Prospector Funds,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign traditional sep and roth

Edit your traditional sep and roth form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your traditional sep and roth form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit traditional sep and roth online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit traditional sep and roth. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out traditional sep and roth

How to fill out traditional sep and roth

01

Determine whether you are eligible to contribute to a Traditional SEP or Roth IRA.

02

Gather the necessary documents, such as your Social Security number, employer identification number (EIN), and financial information.

03

Research and choose a financial institution or brokerage firm that offers Traditional SEP or Roth IRA accounts.

04

Open an account with the chosen institution by completing the required application forms.

05

Provide the necessary information to fund your Traditional SEP or Roth IRA. This may include making an initial deposit or setting up automatic contributions.

06

Understand the contribution limits and deadlines for Traditional SEP and Roth IRA accounts. Ensure you adhere to these limits.

07

Determine your investment strategy and choose suitable investment options within your Traditional SEP or Roth IRA.

08

Monitor the performance of your investments and make any necessary adjustments over time.

09

Report your contributions and withdrawals associated with your Traditional SEP or Roth IRA on your annual tax return.

10

Stay informed about any changes in tax laws and regulations that may affect your Traditional SEP or Roth IRA contributions and withdrawals.

Who needs traditional sep and roth?

01

Individuals who are self-employed or own a small business may benefit from a Traditional SEP IRA (Simplified Employee Pension IRA). This retirement account allows for potentially higher contribution limits compared to a traditional or Roth IRA.

02

Individuals who expect to be in a lower tax bracket during retirement may find a Roth IRA more advantageous. Contributions to a Roth IRA are made with after-tax dollars, but qualified withdrawals are tax-free.

03

Employees of companies that offer a Roth 401(k) or Traditional 401(k) plan may have the option to choose between these plans depending on their financial goals and current tax situation.

04

Those who want to diversify their retirement savings by utilizing different types of retirement accounts such as traditional and Roth IRAs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my traditional sep and roth directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your traditional sep and roth along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send traditional sep and roth for eSignature?

Once your traditional sep and roth is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make edits in traditional sep and roth without leaving Chrome?

traditional sep and roth can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is traditional sep and roth?

Traditional SEP (Simplified Employee Pension) is a retirement plan that allows employers to make contributions to their employees' retirement accounts, while Roth IRAs are individual retirement accounts that allow individuals to contribute after-tax income, providing tax-free growth and tax-free withdrawals in retirement.

Who is required to file traditional sep and roth?

Employers who have established a traditional SEP plan are required to file IRS Form 5500 if they have more than 100 participants. Individuals with a Roth IRA must file their personal tax returns but do not have a specific filing requirement for the IRA itself.

How to fill out traditional sep and roth?

To fill out Form 5305-SEP for a traditional SEP, employers must complete the form with details about the business and the plan, then provide it to eligible employees. For a Roth IRA, individuals typically open an account through a financial institution and must complete any required application forms.

What is the purpose of traditional sep and roth?

The purpose of a traditional SEP is to provide a simplified retirement plan for small businesses to help employees save for retirement, while a Roth IRA aims to allow individuals to save for retirement with tax-free growth and withdrawals.

What information must be reported on traditional sep and roth?

On a traditional SEP, the employer must report contributions made to each employee’s account on IRS Form 5498. For Roth IRAs, individuals must report contributions on Form 8606 if they exceed income limits or if they're making conversions.

Fill out your traditional sep and roth online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Traditional Sep And Roth is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.