Get the free PRESERVATION TAX CREDIT 2023-003 MEMORANDUM DATE ...

Show details

PRESERVATION TAX CREDIT 2023003

MEMORANDUM

DATE:June 12, 2023TO:Historic Preservation Commission:Thomas Gross, Planning Supervisor, Historic Preservation SectionFROM:Daniel Taney, Planner III, Historic

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign preservation tax credit 2023-003

Edit your preservation tax credit 2023-003 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your preservation tax credit 2023-003 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing preservation tax credit 2023-003 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit preservation tax credit 2023-003. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

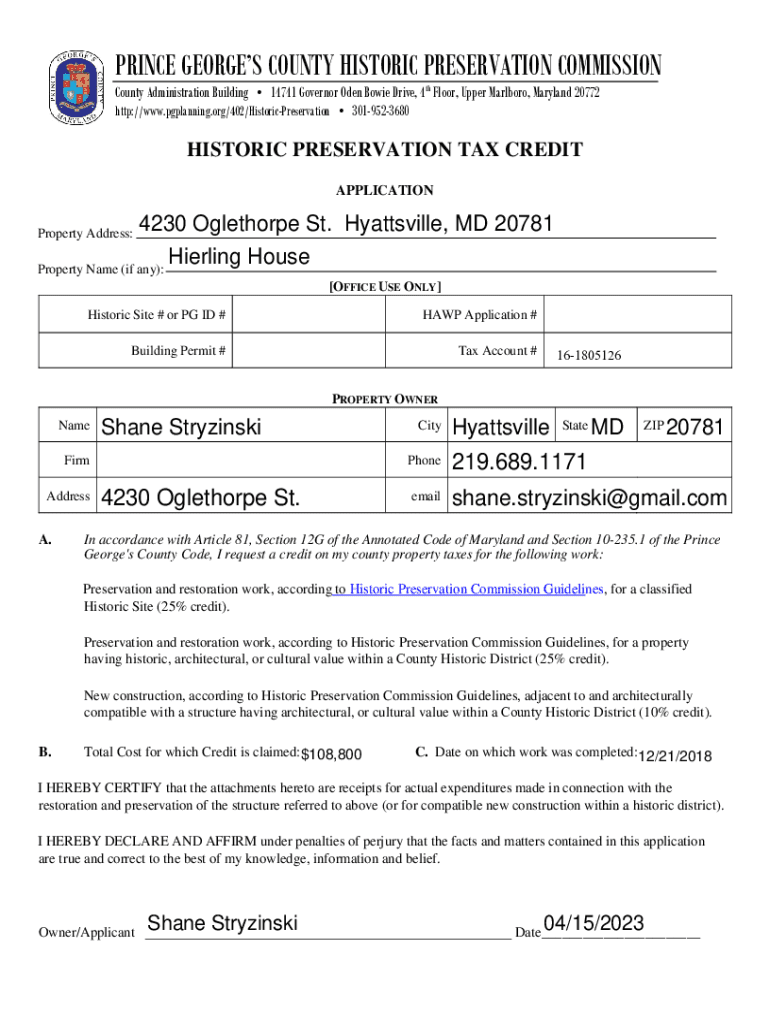

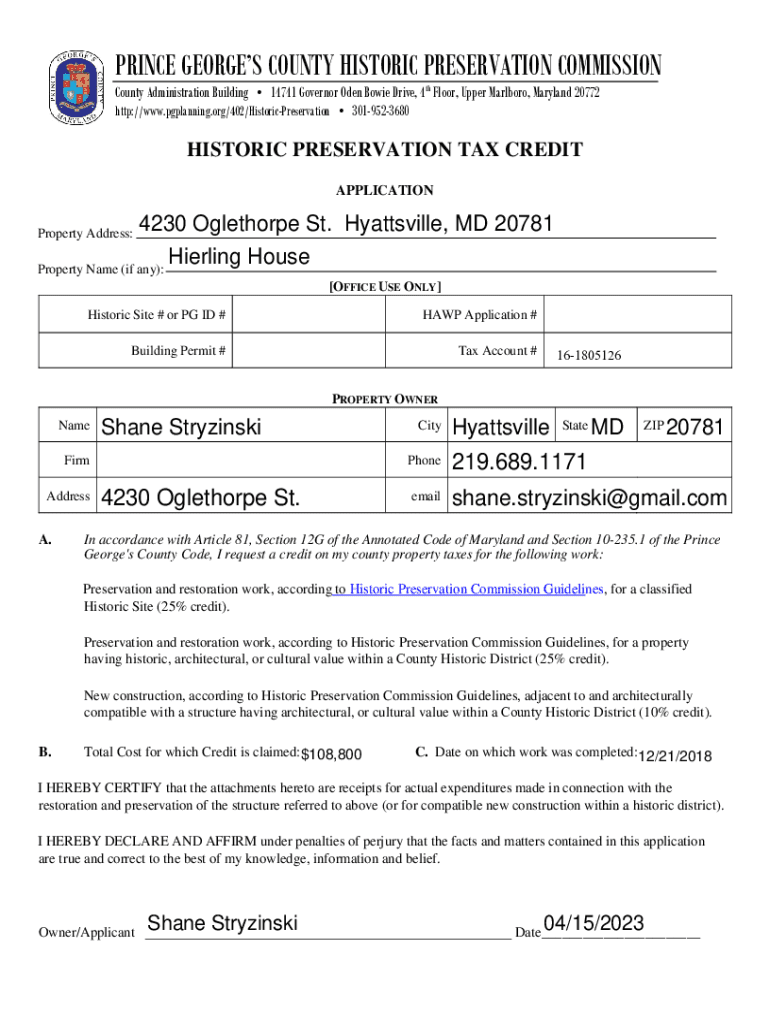

How to fill out preservation tax credit 2023-003

How to fill out preservation tax credit 2023-003

01

To fill out preservation tax credit 2023-003, follow these steps:

02

Start by gathering all the necessary documents such as the application form, supporting documentation, and any relevant financial information.

03

Review the instructions provided with the tax credit form to ensure you understand the requirements and eligibility criteria.

04

Fill out the application form accurately, providing all the required information including personal details, project description, and financial data.

05

Attach the supporting documentation and any additional evidence that may strengthen your eligibility for the tax credit.

06

Double-check all the information provided and ensure that it is complete, accurate, and up-to-date.

07

Submit the filled-out application form and supporting documents to the designated authority or tax department responsible for processing the preservation tax credit.

08

Keep copies of all the submitted documents for your records.

09

Wait for the processing time specified by the authority. In case of any inquiries or updates, stay in contact with the relevant department.

10

Once the application is reviewed and processed, you will receive a response regarding the approval or rejection of the preservation tax credit.

11

If approved, follow any additional instructions provided to claim the tax credit or utilize it as per the regulations.

12

It is advisable to consult with a tax professional or seek expert advice if you have any doubts or need assistance throughout the process.

Who needs preservation tax credit 2023-003?

01

Preservation tax credit 2023-003 is intended for individuals or entities involved in eligible preservation projects. This may include property owners, developers, investors, or anyone engaged in the restoration, rehabilitation, or preservation of historic buildings, structures, or sites.

02

Those who seek financial incentives or assistance for the costs incurred in preserving historic properties, maintaining historical integrity, or contributing to heritage conservation may benefit from preservation tax credit 2023-003.

03

It is recommended to review the specific requirements, guidelines, and eligibility criteria associated with the preservation tax credit to determine if you qualify as a potential beneficiary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the preservation tax credit 2023-003 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your preservation tax credit 2023-003 in minutes.

Can I create an electronic signature for signing my preservation tax credit 2023-003 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your preservation tax credit 2023-003 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete preservation tax credit 2023-003 on an Android device?

Complete preservation tax credit 2023-003 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is preservation tax credit 003?

Preservation Tax Credit 003 is a tax incentive program designed to encourage the rehabilitation and preservation of historic structures in the United States by providing federal tax credits to property owners.

Who is required to file preservation tax credit 003?

Property owners or developers who undertake qualifying rehabilitation projects on certified historic properties are required to file Preservation Tax Credit 003.

How to fill out preservation tax credit 003?

To fill out Preservation Tax Credit 003, taxpayers must complete the designated application forms, providing detailed information about the property, the nature of the rehabilitation work, and associated costs. It's essential to follow the IRS guidelines and include any required documentation.

What is the purpose of preservation tax credit 003?

The purpose of Preservation Tax Credit 003 is to incentivize the restoration and preservation of historic buildings, thereby maintaining cultural heritage and stimulating local economies through increased property values and tourism.

What information must be reported on preservation tax credit 003?

Taxpayers must report information such as the property's location, description of the rehabilitation work, historical significance, cost of the project, and any other relevant details that support the eligibility for the tax credit.

Fill out your preservation tax credit 2023-003 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Preservation Tax Credit 2023-003 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.