Get the free Lamont proposes tax cut for small and mid-sized businesses

Show details

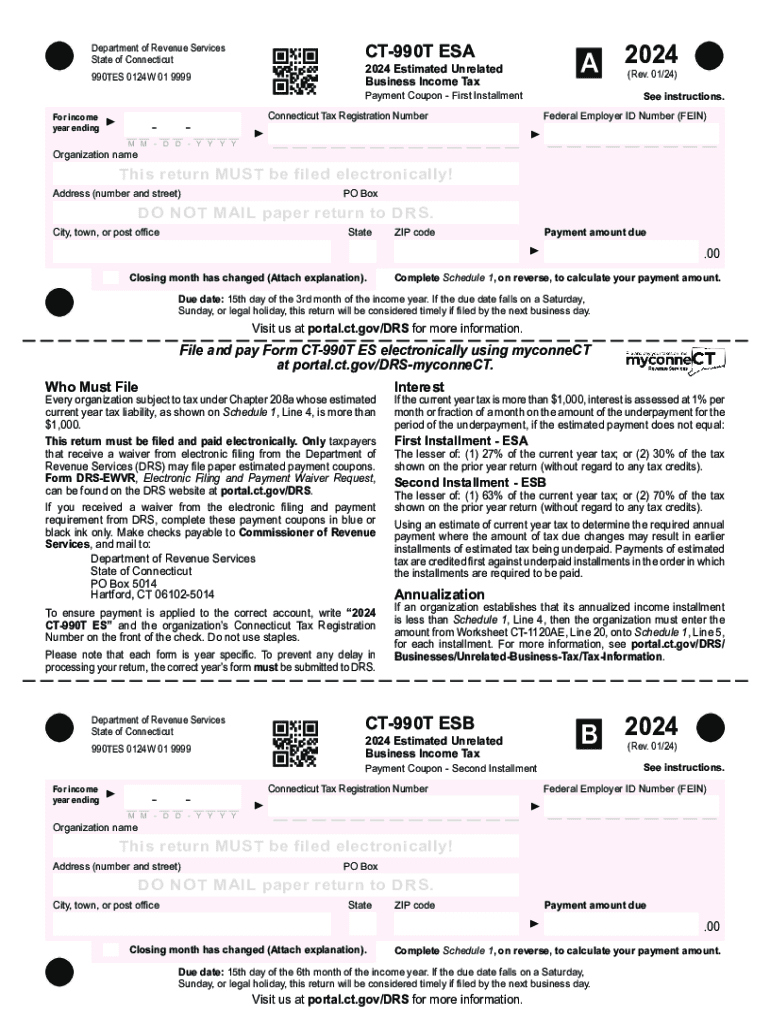

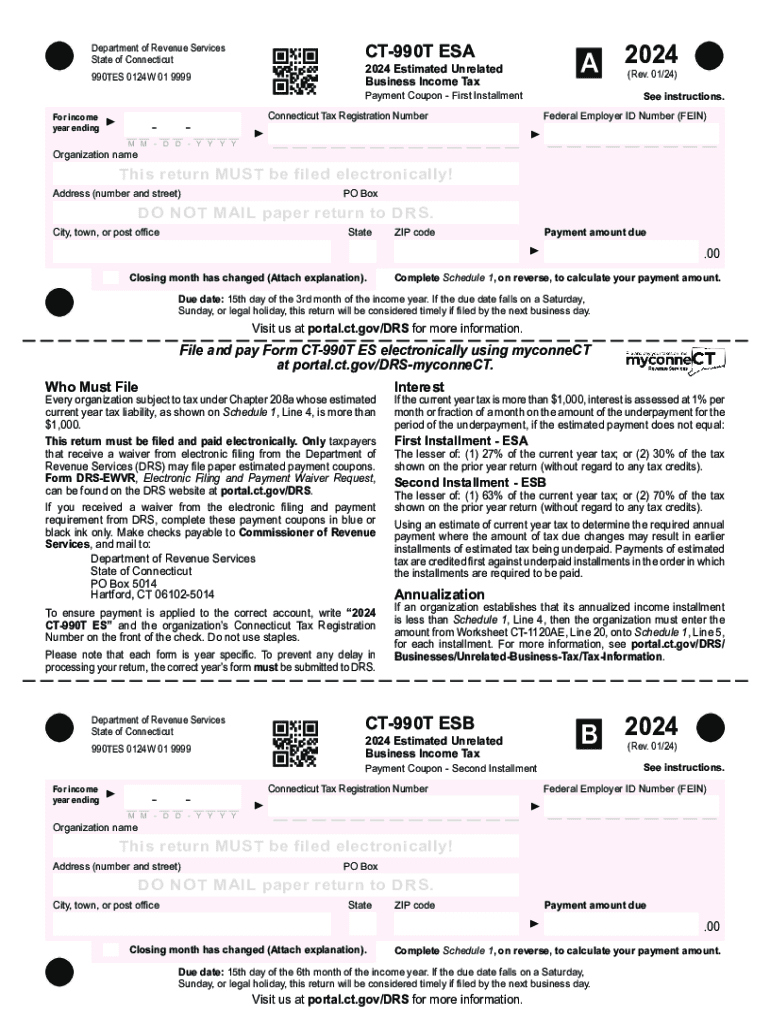

A 2024CT990T Department of Revenue Services

State of Connecticut2024 Estimated Unrelated

Business Income Tax990TES 0124W 01 9999(Rev. 01/24)See instructions. Payment Coupon First Installment income

For.

Year

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lamont proposes tax cut

Edit your lamont proposes tax cut form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lamont proposes tax cut form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lamont proposes tax cut online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit lamont proposes tax cut. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lamont proposes tax cut

How to fill out lamont proposes tax cut

01

To fill out Lamont's proposed tax cut, follow these steps:

02

Obtain a copy of the proposed tax cut plan by visiting the official website or contacting the relevant government department.

03

Read through the entire proposal to understand the proposed changes in tax rates and any other relevant details.

04

Gather all the necessary financial information, such as your income statements, deductions, and expenses.

05

Use the provided tax cut calculation formula or tools to determine how the proposed changes will affect your specific tax situation.

06

Fill out the required forms or applications as indicated in the proposal. Make sure to provide accurate and complete information.

07

Double-check all the entered information to ensure its accuracy and verify that you have included all the required supporting documents.

08

Submit your filled-out tax cut form or application through the specified channels, such as online submission or in-person submission at a government office.

09

Keep a copy of the filled-out form and supporting documents for your records.

10

Follow any additional instructions or requirements mentioned in the proposal, such as attending information sessions or providing feedback on the tax cut proposal.

11

Monitor updates and announcements regarding the progress and implementation of the tax cut proposal to stay informed.

Who needs lamont proposes tax cut?

01

Lamont's proposed tax cut is designed to benefit individuals, families, and businesses who meet specific criteria, such as:

02

- Taxpayers with income falling within certain tax brackets outlined in the proposal.

03

- Individuals or families who have eligible deductions and expenses that would result in a reduction in their overall tax liability.

04

- Businesses that would benefit from lower tax rates and increased tax incentives as per the proposed plan.

05

It is important to review the specific eligibility criteria mentioned in the proposal to determine if you qualify for the tax cut and its benefits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute lamont proposes tax cut online?

Easy online lamont proposes tax cut completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit lamont proposes tax cut online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your lamont proposes tax cut and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I make edits in lamont proposes tax cut without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing lamont proposes tax cut and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is Lamont proposes tax cut?

Lamont proposes tax cut refers to a tax reduction plan initiated by Governor Ned Lamont aimed at providing financial relief to taxpayers in Connecticut, which may include cuts in income tax rates, property tax relief, or other forms of tax reduction.

Who is required to file Lamont proposes tax cut?

Individuals and businesses that meet certain income thresholds and residency requirements in Connecticut may be required to file to take advantage of the Lamont proposed tax cuts.

How to fill out Lamont proposes tax cut?

To fill out the Lamont proposes tax cut forms, taxpayers should gather necessary financial documents, complete the appropriate state tax forms, and follow the application instructions provided by the Connecticut Department of Revenue Services.

What is the purpose of Lamont proposes tax cut?

The purpose of the Lamont proposes tax cut is to alleviate the tax burden on residents, stimulate economic growth, and provide financial relief to low and middle-income families.

What information must be reported on Lamont proposes tax cut?

Taxpayers must report their income, deductions, credits, and any other relevant financial information when filing for the Lamont proposes tax cut.

Fill out your lamont proposes tax cut online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lamont Proposes Tax Cut is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.