Get the free Student Debt and Young America

Show details

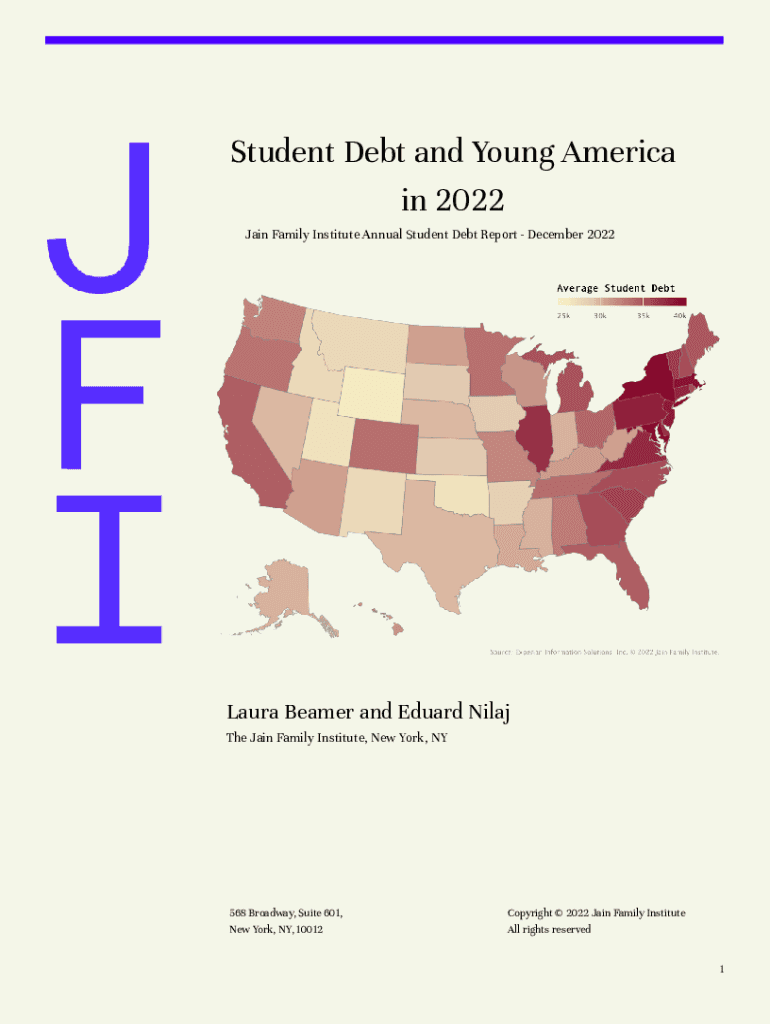

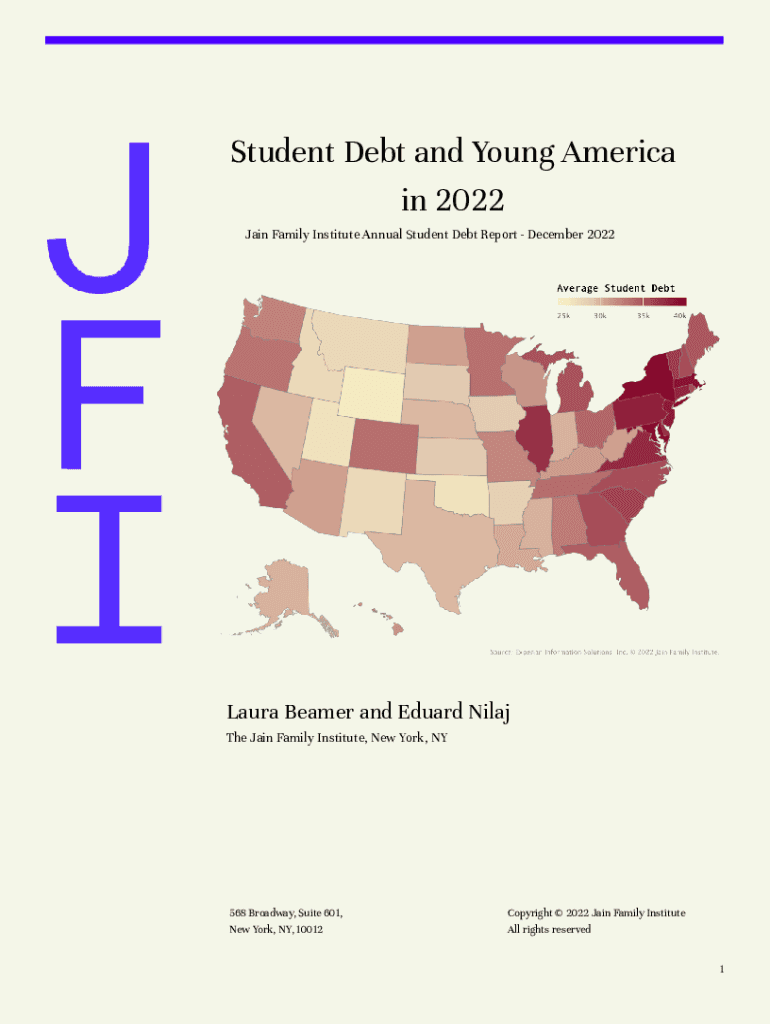

Student Debt and Young America

in 2022

Jain Family Institute Annual Student Debt Report December 2022Laura Beamer and Eduard Milan

The Jain Family Institute, New York, NY568 Broadway, Suite 601,

New

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign student debt and young

Edit your student debt and young form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your student debt and young form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit student debt and young online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit student debt and young. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out student debt and young

How to fill out student debt and young

01

Start by gathering all the necessary documents such as your personal identification, financial information, and educational details.

02

Research and compare different student loan options to find the one that best fits your financial situation and educational needs.

03

Fill out the student loan application, providing accurate and complete information.

04

Submit the application along with any required supporting documents.

05

Review any loan offers received and compare the terms and conditions before accepting.

06

If approved, carefully read and understand the loan agreement before signing it.

07

Attend any required loan counseling sessions, if applicable.

08

Use the borrowed funds responsibly for educational expenses only.

09

Keep track of your loan repayment options and terms, including any interest rates or grace periods.

10

Make timely payments on your student loan to avoid penalties or default.

11

Consider exploring loan forgiveness or repayment assistance programs if you qualify.

12

Stay informed about any updates or changes to student loan regulations or policies.

Who needs student debt and young?

01

Students who are pursuing higher education and require financial assistance for tuition fees, living expenses, books, or other educational costs.

02

Young individuals who might not have sufficient savings or income to fund their education without taking on student debt.

03

Individuals who prioritize investing in their education and believe that the long-term benefits outweigh the short-term financial burden.

04

Parents or guardians who want to support their children's educational aspirations but require additional financial aid.

05

Individuals who want to pursue specific career paths that often require advanced degrees and certifications, which can be expensive without student loans.

06

Students who come from low-income backgrounds and need financial support to level the playing field and access educational opportunities.

07

Anyone who wants to invest in their personal and professional growth but needs financial assistance to do so.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the student debt and young electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your student debt and young in minutes.

How can I edit student debt and young on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing student debt and young.

How do I complete student debt and young on an Android device?

Use the pdfFiller Android app to finish your student debt and young and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is student debt and young?

Student debt refers to the money borrowed by students to pay for their education, often in the form of loans. 'Young' may refer to young borrowers, typically recent graduates or those still in school.

Who is required to file student debt and young?

Individuals who have taken out student loans, particularly those who are currently in repayment or seeking loan forgiveness options, may be required to compile and file their student debt information.

How to fill out student debt and young?

To fill out student debt-related forms, borrowers typically need to provide information such as personal identification, loan details, and income information, following guidelines outlined by the relevant financial or educational institution.

What is the purpose of student debt and young?

The purpose of documenting student debt is to manage repayment plans, understand loan obligations, apply for forgiveness programs, and obtain financial aid or assistance.

What information must be reported on student debt and young?

Borrowers must report details such as loan amounts, interest rates, repayment status, income, and any changes in financial circumstances that may affect their loan obligations.

Fill out your student debt and young online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Student Debt And Young is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.