Get the free Annual and Aggregate Loan Limits

Show details

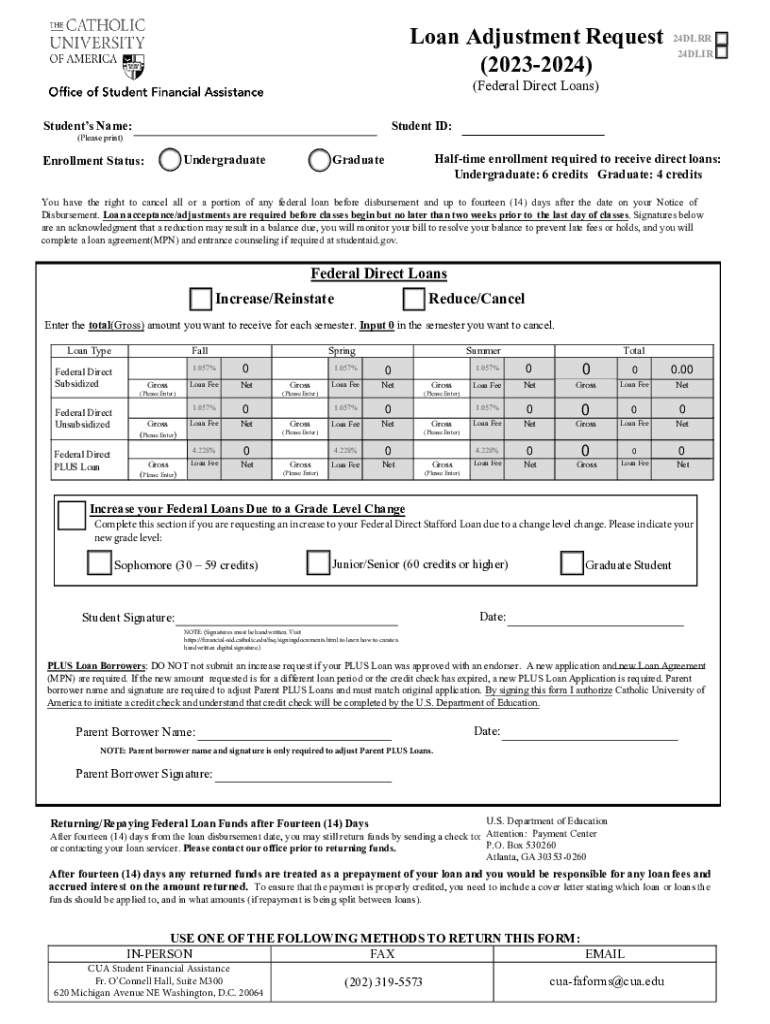

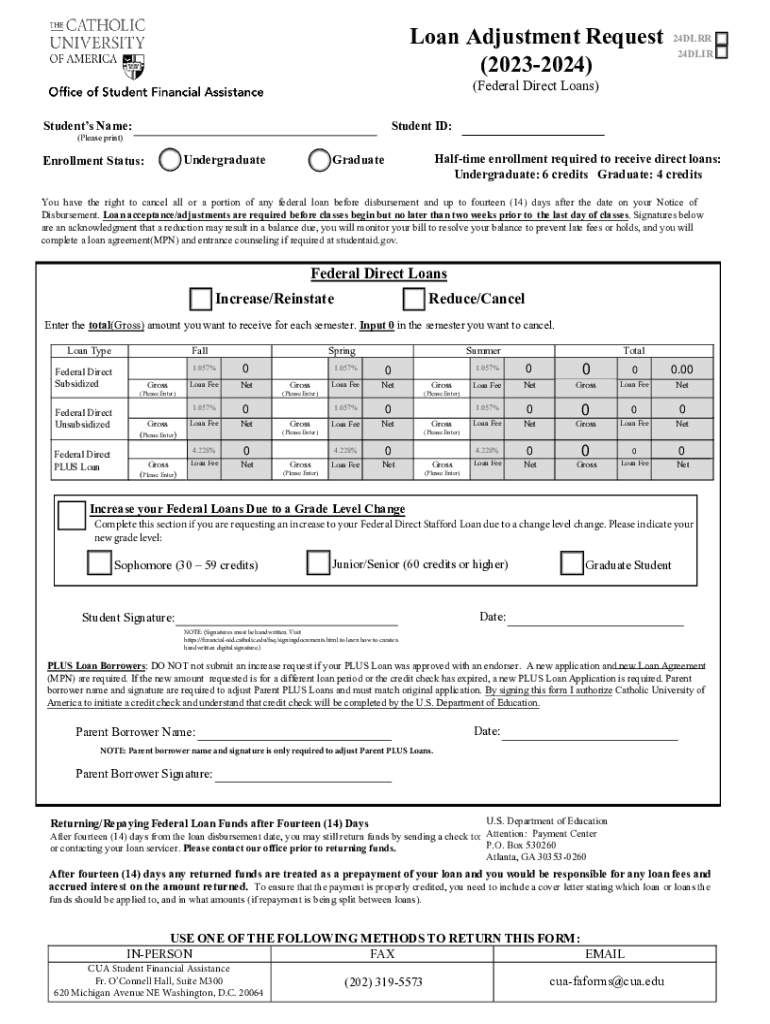

Loan Adjustment Request

(20232024)24DLRR

24DLIR(Federal Direct Loans)Students Name:Student ID:(Please print)UndergraduateEnrollment Status:Halftime enrollment required to receive direct loans:

Undergraduate:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual and aggregate loan

Edit your annual and aggregate loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual and aggregate loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annual and aggregate loan online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit annual and aggregate loan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual and aggregate loan

How to fill out annual and aggregate loan

01

To fill out the annual loan, follow these steps:

02

Gather all the required documents, such as your identification proof, income proof, and credit history.

03

Contact your loan provider or visit their website to obtain the application form for the annual loan.

04

Carefully read the instructions provided with the form and fill in the required information accurately.

05

Double-check all the details you have provided to ensure they are correct and complete.

06

Attach the necessary supporting documents along with the filled application form.

07

Submit the completed form and supporting documents to your loan provider, either by mail or in person.

08

Wait for the approval process to complete and follow up with your loan provider if necessary.

09

To fill out the aggregate loan, follow these steps:

10

Understand the requirements and purpose of the aggregate loan.

11

Gather all the necessary documents, including your loan agreements, repayment records, and financial statements.

12

Contact your loan provider or visit their website to obtain the aggregate loan application form.

13

Read the instructions provided with the form and fill in the required information accurately.

14

Review the provided information and ensure it reflects your loan details and financial situation accurately.

15

Attach the relevant supporting documents along with the completed application form.

16

Submit the filled form and supporting documents to your loan provider through the specified channels.

17

Keep track of the progress and communicate with your loan provider for any additional requirements or inquiries.

Who needs annual and aggregate loan?

01

Annual and aggregate loans are generally needed by individuals or businesses who require financial assistance to manage their expenses or investments.

02

Students pursuing higher education often rely on annual and aggregate loans to cover their tuition fees and other educational expenses.

03

Small businesses may require annual and aggregate loans to support their operations, invest in new equipment, or expand their business.

04

Individuals facing unexpected medical expenses or emergencies may opt for annual and aggregate loans to cover the financial burden.

05

Professionals looking to invest in real estate or other ventures may seek annual and aggregate loans for the necessary capital.

06

Anyone who needs a significant amount of money for a specific purpose and cannot access immediate funds may consider annual and aggregate loans.

07

It is crucial to assess your financial situation and repayment capability before availing any loan to ensure responsible borrowing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send annual and aggregate loan to be eSigned by others?

When you're ready to share your annual and aggregate loan, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete annual and aggregate loan online?

Filling out and eSigning annual and aggregate loan is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out annual and aggregate loan on an Android device?

Use the pdfFiller mobile app to complete your annual and aggregate loan on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is annual and aggregate loan?

An annual loan refers to a loan that is reported on a yearly basis, while aggregate loans include the total amount of loans taken by an individual or entity over a period, typically reflecting the sum of all loans outstanding.

Who is required to file annual and aggregate loan?

Entities or individuals who have received loans that meet specific thresholds set by regulatory bodies are typically required to file annual and aggregate loan reports.

How to fill out annual and aggregate loan?

To fill out annual and aggregate loan forms, individuals or entities must gather essential financial data, including loan amounts, lender information, and the purpose of the loans, and then complete the designated regulatory forms accurately.

What is the purpose of annual and aggregate loan?

The purpose of annual and aggregate loan reports is to provide transparency regarding the borrowing activities of individuals or entities to regulatory bodies, helping to monitor financial health and compliance.

What information must be reported on annual and aggregate loan?

Information required typically includes the loan amount, interest rates, terms of the loan, the purpose of the loan, and identifying details about lenders and borrowers.

Fill out your annual and aggregate loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual And Aggregate Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.