Get the free Personal Financial Statement - Spouse's SSN

Show details

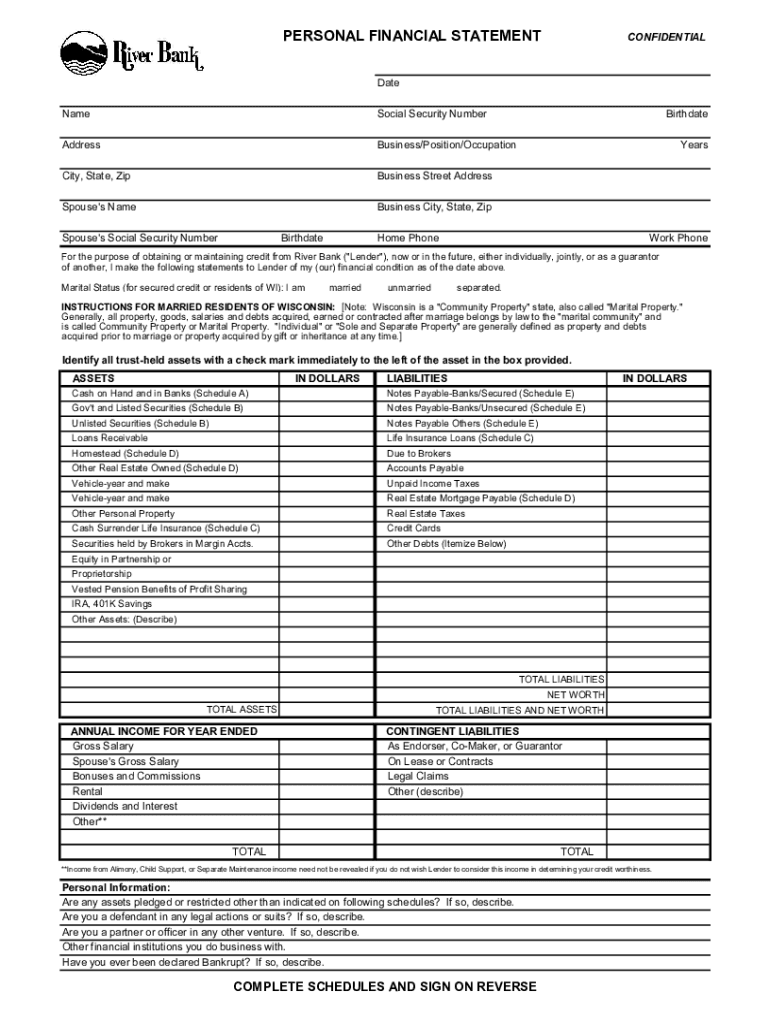

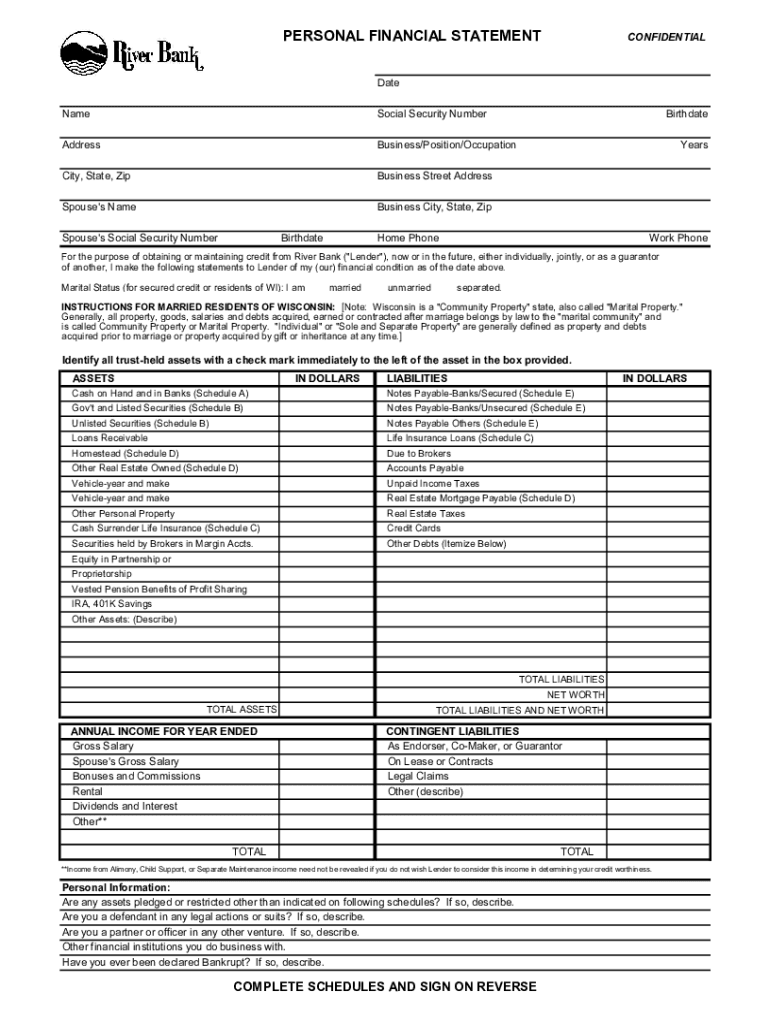

PERSONAL FINANCIAL STATEMENTCONFIDENTIALDate

Asocial Security NumberAddressBusiness/Position/Occupationally, State, Business Street AddressSpouse\'s NameBusiness City, State, Spouse\'s Social Security

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal financial statement

Edit your personal financial statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal financial statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal financial statement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit personal financial statement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal financial statement

How to fill out personal financial statement

01

Gather all your financial records, including bank statements, investment statements, tax returns, and any other relevant documents.

02

Start by filling out your personal information, such as your name, address, and contact details.

03

List all your assets, including cash, savings, investments, real estate, and valuables.

04

Calculate the total value of your assets and enter it in the designated field.

05

Move on to listing your liabilities, such as loans, credit card debt, and mortgages.

06

Calculate the total amount of your liabilities and enter it in the appropriate field.

07

Subtract your total liabilities from your total assets to determine your net worth.

08

Provide additional information about your income, including your salary, rental income, or any other sources of income.

09

Specify your monthly expenses, such as mortgage or rent payments, utilities, insurance, and transportation costs.

10

Review the completed personal financial statement for accuracy and make any necessary adjustments.

11

Sign and date the statement to validate its authenticity.

12

Keep a copy of the personal financial statement for your records.

Who needs personal financial statement?

01

Any individual or entity with financial interests or obligations can benefit from a personal financial statement.

02

Individuals who wish to better manage their personal finances and track their net worth.

03

Entrepreneurs and business owners who need to provide financial information to lenders, investors, or potential partners.

04

Loan applicants who need to demonstrate their financial stability and ability to repay the loan.

05

Investors who want to assess the financial health of a company or individual before making investment decisions.

06

Divorce attorneys and legal professionals who require financial information for divorce settlements or alimony calculations.

07

Financial advisors or wealth managers who need a comprehensive overview of their clients' financial situation.

08

Estate planners or executors who need to determine the value of an individual's estate for tax or inheritance purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find personal financial statement?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific personal financial statement and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete personal financial statement online?

Filling out and eSigning personal financial statement is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my personal financial statement in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your personal financial statement and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is personal financial statement?

A personal financial statement is a document that provides an overview of an individual's financial position, detailing assets, liabilities, income, and expenses.

Who is required to file personal financial statement?

Individuals seeking loans, applying for financial aid, or needing to verify their financial status, such as business owners, high-net-worth individuals, or those applying for certain licenses may be required to file a personal financial statement.

How to fill out personal financial statement?

To fill out a personal financial statement, list all assets and their values, detail all liabilities and their amounts, summarize income sources, and itemize monthly expenses. Be sure to provide accurate and up-to-date information.

What is the purpose of personal financial statement?

The purpose of a personal financial statement is to provide a clear financial picture, assist in obtaining loans or credit, facilitate investment decisions, or meet regulatory requirements.

What information must be reported on personal financial statement?

A personal financial statement must report personal assets (such as cash, real estate, and investments), liabilities (such as loans and credit card debt), income (such as salary and rental income), and monthly expenses.

Fill out your personal financial statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Financial Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.