Get the free Senior Life Insurance Company - Helping Families, Building ...

Show details

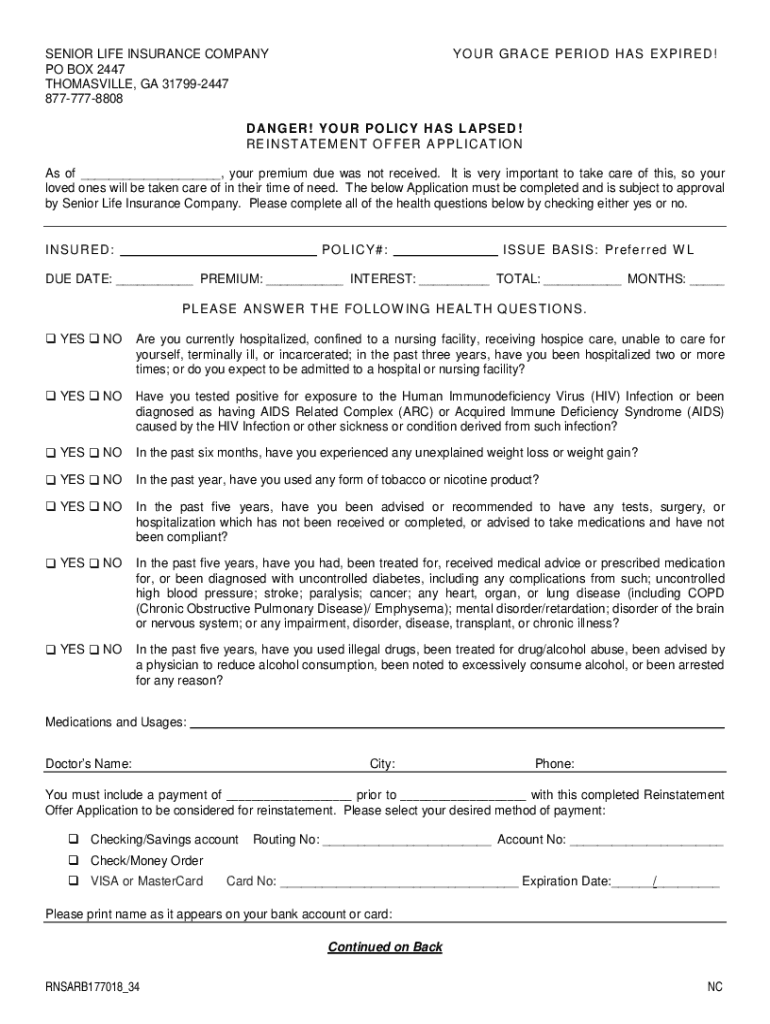

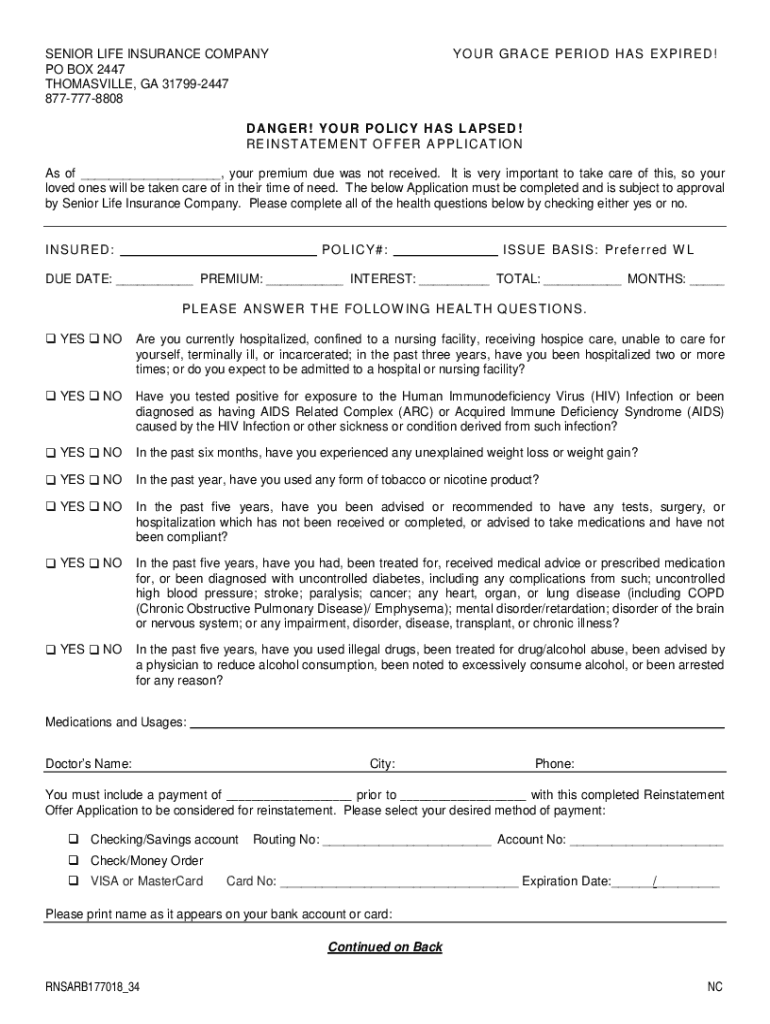

SENIOR LIFE INSURANCE COMPANY PO BOX 2447 THOMASVILLE, GA 317992447 8777778808YO UR G R A C E P ER IO D HA S EX PI R ED!D AN G ER ! Y O U R PO LI CY H AS L AP S E D ! RE IN ST AT EM E NT O F FE R

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign senior life insurance company

Edit your senior life insurance company form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your senior life insurance company form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit senior life insurance company online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit senior life insurance company. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out senior life insurance company

How to fill out senior life insurance company

01

To fill out senior life insurance company, follow these steps:

02

- Gather all necessary information such as personal details, contact information, and medical history.

03

- Research different senior life insurance companies and compare their policies, benefits, and premiums.

04

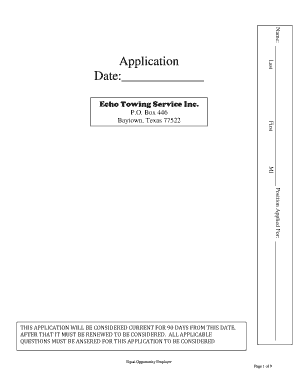

- Contact the chosen senior life insurance company or visit their website to request an application form.

05

- Carefully read and understand the application form, ensuring all questions are answered accurately.

06

- Provide all required information in the application form, including personal information, beneficiary details, coverage amount, and any additional information as requested.

07

- Double-check and review the completed application form for any errors or missing information.

08

- Submit the filled-out application form to the senior life insurance company through their preferred method, which could be mailing it or submitting it online.

09

- Await confirmation from the senior life insurance company regarding the acceptance of the application.

10

- If necessary, provide any additional documentation or undergo medical examinations as requested by the senior life insurance company.

11

- Once the application is approved, review and sign the policy documents provided by the senior life insurance company.

12

- Make the required premium payments as per the policy terms to activate the senior life insurance coverage.

13

It is advisable to consult with a financial advisor or an insurance agent to ensure you understand all aspects of the senior life insurance policy before filling out the application form.

Who needs senior life insurance company?

01

Senior life insurance company is designed for individuals who:

02

- Are in their senior years, typically above the age of 50 or 60.

03

- Want to ensure financial security and provide for their loved ones after their passing.

04

- Have dependents or beneficiaries who rely on them financially.

05

- May have outstanding debts, mortgages, or financial obligations that they want to cover.

06

- Want to leave a financial legacy or inheritance for their family or loved ones.

07

- Have specific final expenses, such as funeral costs, medical bills, or estate taxes, that they want to prepare for.

08

- Are concerned about leaving a burden of financial responsibility on their family members.

09

- Seek peace of mind and a sense of financial protection during their senior years.

10

However, it is important for each individual to assess their own financial and family situation before deciding if senior life insurance is necessary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my senior life insurance company in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your senior life insurance company and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I make edits in senior life insurance company without leaving Chrome?

senior life insurance company can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for signing my senior life insurance company in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your senior life insurance company directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is senior life insurance company?

A senior life insurance company specializes in providing life insurance policies tailored specifically for seniors, often with features that consider the unique needs and risks associated with aging.

Who is required to file senior life insurance company?

Insurance companies that offer senior life insurance products are typically required to file with regulatory agencies to ensure compliance with state and federal regulations.

How to fill out senior life insurance company?

Filling out a senior life insurance application typically involves providing personal information, selecting coverage amounts, and answering health-related questions to assess risk.

What is the purpose of senior life insurance company?

The purpose of a senior life insurance company is to provide financial protection for seniors and their beneficiaries, helping to cover final expenses, debts, or provide legacy benefits.

What information must be reported on senior life insurance company?

Information that must be reported includes details about the policies offered, claims data, financial statements, and adherence to regulatory requirements.

Fill out your senior life insurance company online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Senior Life Insurance Company is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.