Get the free NRI Home LoanLoan Against Property for NRI - HSBC IN

Show details

In

Na for

to

DI st

Ad reapplication form for Individual/ NRI

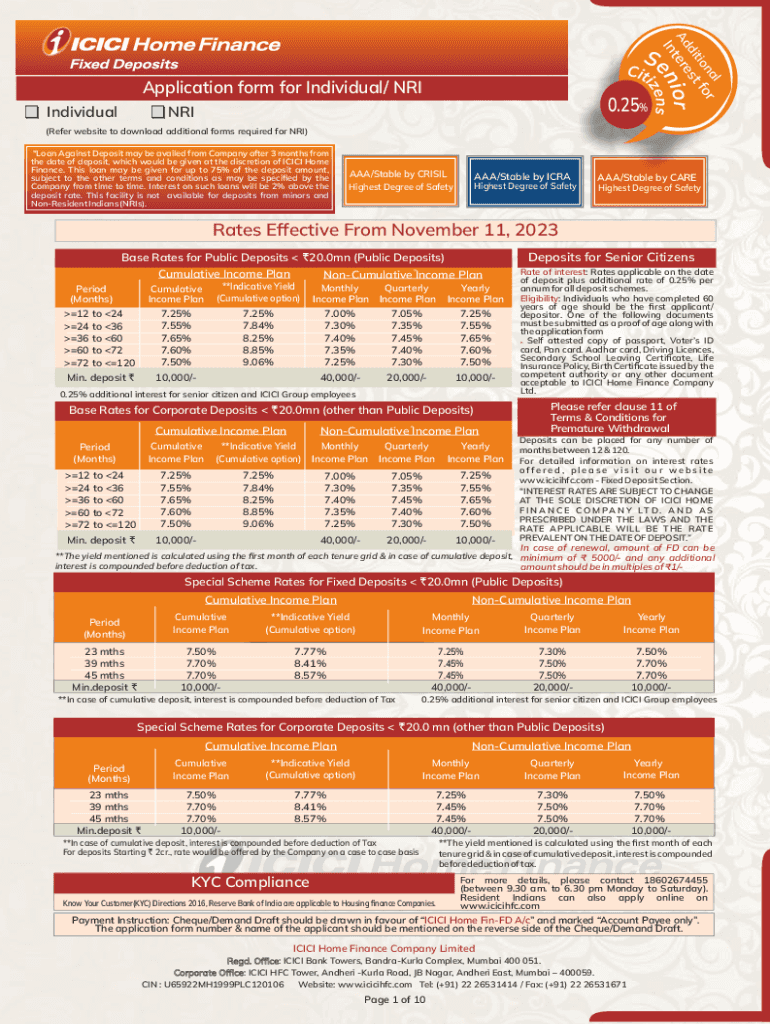

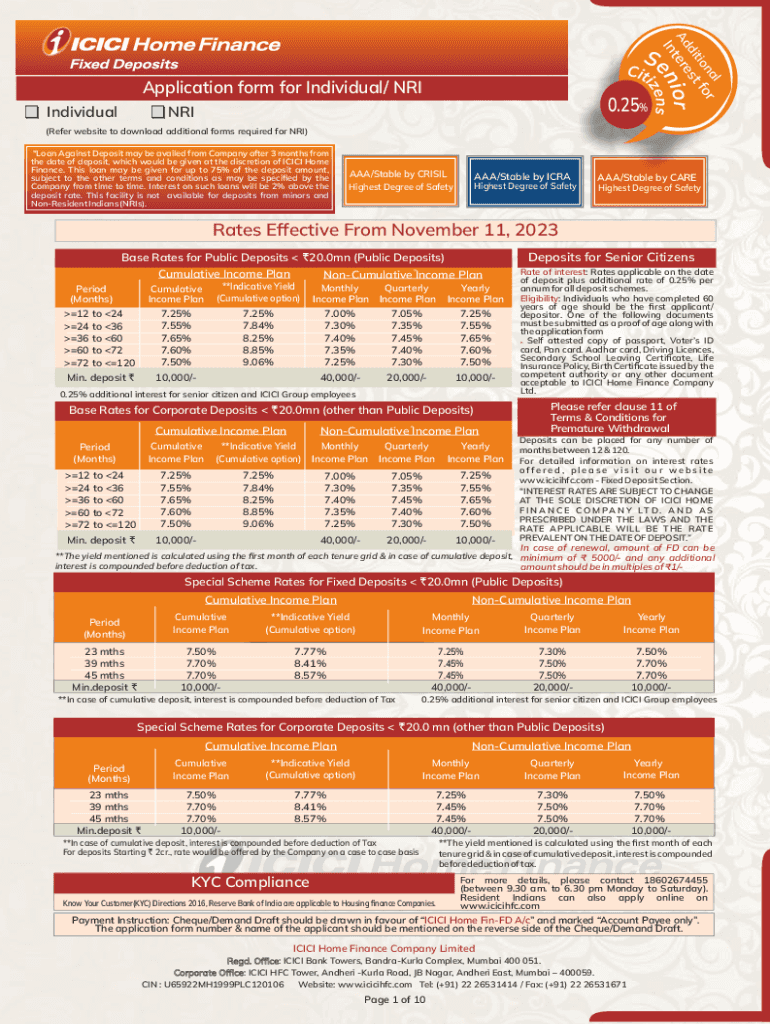

Individual0.25%NRI(Refer website to download additional forms required for NRI)

\”Loan Against Deposit may be availed from Company after

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nri home loanloan against

Edit your nri home loanloan against form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nri home loanloan against form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nri home loanloan against online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit nri home loanloan against. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nri home loanloan against

How to fill out nri home loanloan against

01

To fill out an NRI home loan loan against, follow these steps:

02

Gather all the necessary documents such as identity proof, address proof, income proof, bank statements, etc.

03

Research different banks or financial institutions that offer NRI home loans or loan against properties.

04

Compare the interest rates, loan terms, and eligibility criteria provided by different lenders.

05

Visit the chosen bank's website or branch to obtain the application form.

06

Fill out the application form accurately with all the required details.

07

Attach the necessary documents along with the application form.

08

Submit the completed application form and documents to the bank or financial institution.

09

Wait for the bank's verification process and approval.

10

Once the loan is approved, carefully review the terms and conditions before signing the loan agreement.

11

Fulfill any additional requirements or documentation requested by the bank.

12

Receive the loan amount in your bank account or as per the agreed terms.

13

Repay the loan amount and interest as per the agreed repayment schedule.

14

Keep track of your loan account and ensure timely repayment.

15

In case of any queries or issues, contact the bank's customer service for assistance.

Who needs nri home loanloan against?

01

NRI home loan or loan against property is typically needed by individuals who:

02

- Are non-resident Indians (NRIs) looking to purchase a home or invest in real estate in their home country.

03

- Want to renovate or repair their existing property in India.

04

- Wish to expand their business or invest in a new venture by using their property as collateral for obtaining funds.

05

- Have financial emergencies or require funds for personal reasons.

06

- Seek higher education for themselves or their family members and require financial assistance.

07

- Need to consolidate their debts or manage their finances more effectively.

08

- Desire to purchase a second home or vacation home in India.

09

- Are looking for better investment opportunities and want to leverage their existing property.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nri home loanloan against to be eSigned by others?

When you're ready to share your nri home loanloan against, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit nri home loanloan against in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing nri home loanloan against and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How can I edit nri home loanloan against on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing nri home loanloan against, you can start right away.

What is nri home loan loan against?

An NRI home loan loan against property allows non-resident Indians to borrow against the value of a property they own to finance various personal or business expenses.

Who is required to file nri home loan loan against?

Non-resident Indians who take out a home loan against their property are required to file documentation related to the loan with financial institutions and tax authorities.

How to fill out nri home loan loan against?

To fill out an NRI home loan loan against application, applicants typically need to provide personal details, property information, financial history, and supporting documents such as proof of income and property ownership.

What is the purpose of nri home loan loan against?

The purpose of an NRI home loan loan against property is to enable NRIs to leverage their property for additional funds that can be used for investments, emergencies, or large expenses.

What information must be reported on nri home loan loan against?

Information that must be reported includes the loan amount, interest rate, property details, repayment schedule, and personal identification information.

Fill out your nri home loanloan against online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nri Home Loanloan Against is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.