Get the free LVR: Understanding loan to value ratios and home loans

Show details

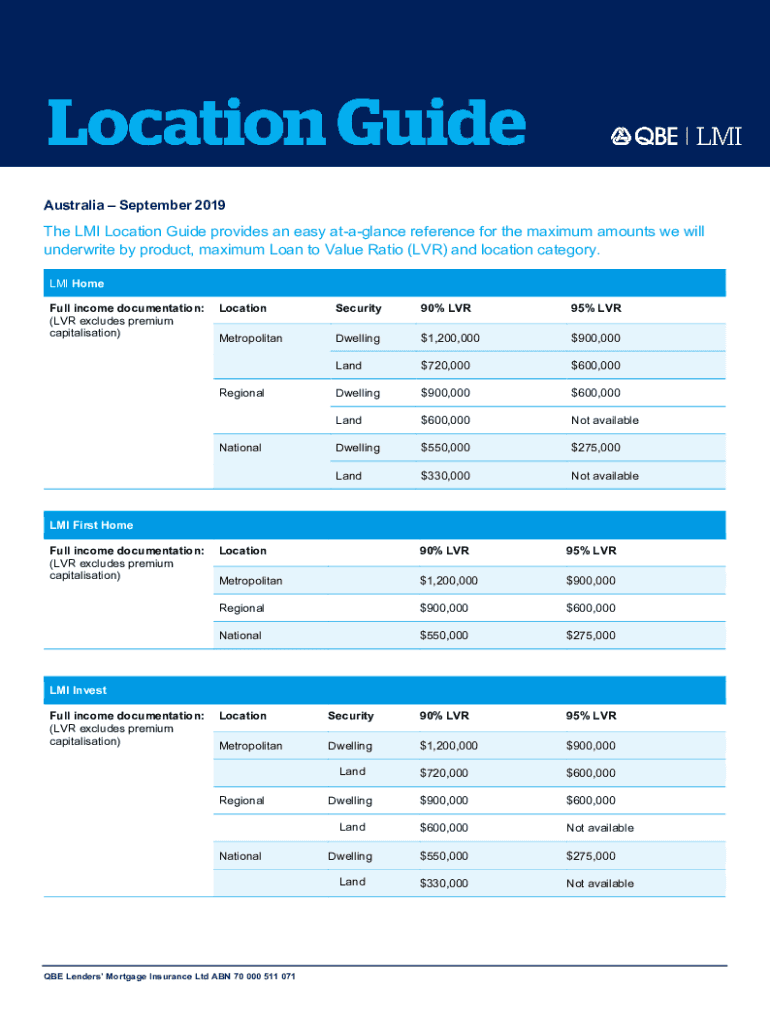

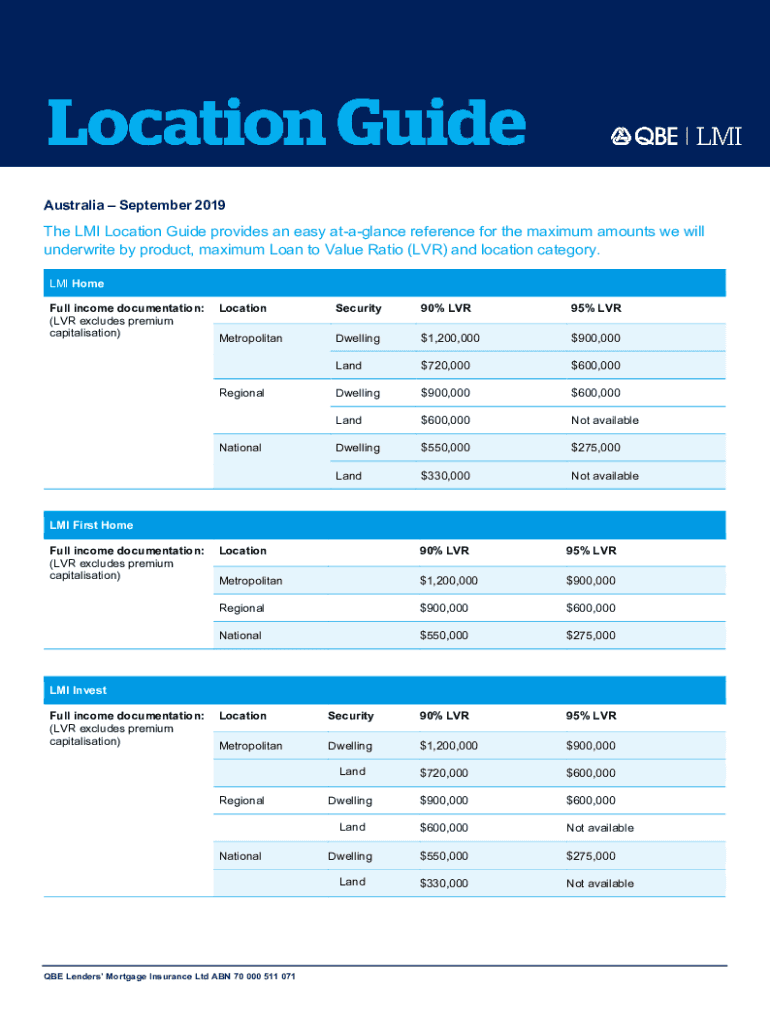

Australia September 2019The LMI Location Guide provides an easy ataglance reference for the maximum amounts we will underwrite by product, maximum Loan to Value Ratio (LVR) and location category.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lvr understanding loan to

Edit your lvr understanding loan to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lvr understanding loan to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lvr understanding loan to online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit lvr understanding loan to. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lvr understanding loan to

How to fill out lvr understanding loan to

01

To fill out LVR understanding loan to, follow these steps:

02

Start by understanding what LVR (Loan to Value Ratio) means. It is the proportion of the loan amount compared to the value of the property being mortgaged.

03

Gather all the necessary information required for calculating the LVR. This includes the loan amount, property value, and any additional costs or charges involved in the loan application.

04

Determine the LVR by dividing the loan amount by the property value and multiplying the result by 100. This will give you the percentage value of the LVR.

05

Understand the significance of LVR in loan applications. Lenders often use LVR to assess the level of risk associated with the loan. A higher LVR indicates a higher risk for the lender.

06

Use the calculated LVR to evaluate the loan options available. Different lenders may have different policies regarding acceptable LVRs. It is important to compare and consider these options.

07

Take measures to improve the LVR if necessary. This may include increasing the deposit amount or considering additional security for the loan.

08

Fill out the LVR understanding loan to form accurately and provide all the required details. Pay attention to any additional documents or information requested by the lender.

09

Review the filled-out form and ensure all information is correct. Make any necessary revisions or adjustments before submitting it to the lender.

10

Submit the completed LVR understanding loan to form to the lender along with any supporting documents they require. Keep copies of all the submitted documents for your records.

11

Follow up with the lender to ensure the loan application is progressing as expected. Be prepared to provide any additional information or documentation they may request.

12

Remember, it is always advisable to seek professional advice or consult with a mortgage broker when dealing with LVR understanding loan applications.

Who needs lvr understanding loan to?

01

LVR understanding loan to is needed by individuals or entities who are planning to apply for a mortgage or a loan secured by a property.

02

It is particularly important for borrowers who want to assess their loan options, understand the risk associated with their loan, and make informed decisions about their borrowing capacity.

03

Lenders also need LVR understanding loan to in order to evaluate the level of risk associated with a loan application and determine the terms and conditions of the loan offer.

04

Real estate agents, mortgage brokers, and financial advisors may also need to understand LVR for their professional roles in assisting clients with loan applications and property transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit lvr understanding loan to from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like lvr understanding loan to, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I edit lvr understanding loan to on an Android device?

With the pdfFiller Android app, you can edit, sign, and share lvr understanding loan to on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I fill out lvr understanding loan to on an Android device?

Use the pdfFiller Android app to finish your lvr understanding loan to and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is lvr understanding loan to?

LVR stands for Loan-to-Value Ratio, which measures the ratio of a loan to the value of an asset purchased. It helps lenders assess the risk of a loan.

Who is required to file lvr understanding loan to?

Typically, borrowers applying for loans secured by real estate or other collateral are required to understand and file LVR documents.

How to fill out lvr understanding loan to?

To fill out an LVR understanding, you will need to provide information about the asset's value, the loan amount, and other financial details required by the lender.

What is the purpose of lvr understanding loan to?

The purpose of the LVR understanding is to determine the loan amount a borrower is eligible for by assessing the risk associated with the secured asset.

What information must be reported on lvr understanding loan to?

Information such as the loan amount, appraised value of the asset, borrower's financial details, and market conditions must be reported.

Fill out your lvr understanding loan to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lvr Understanding Loan To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.