Get the free College Scholarships - Tax Local 690's Website

Show details

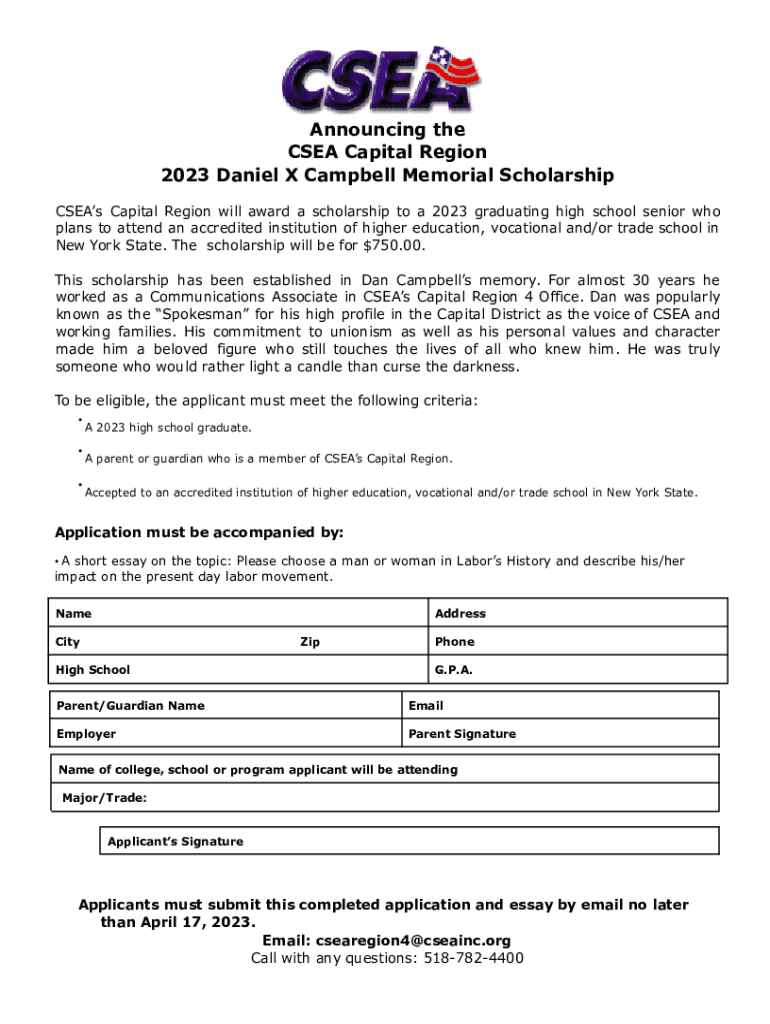

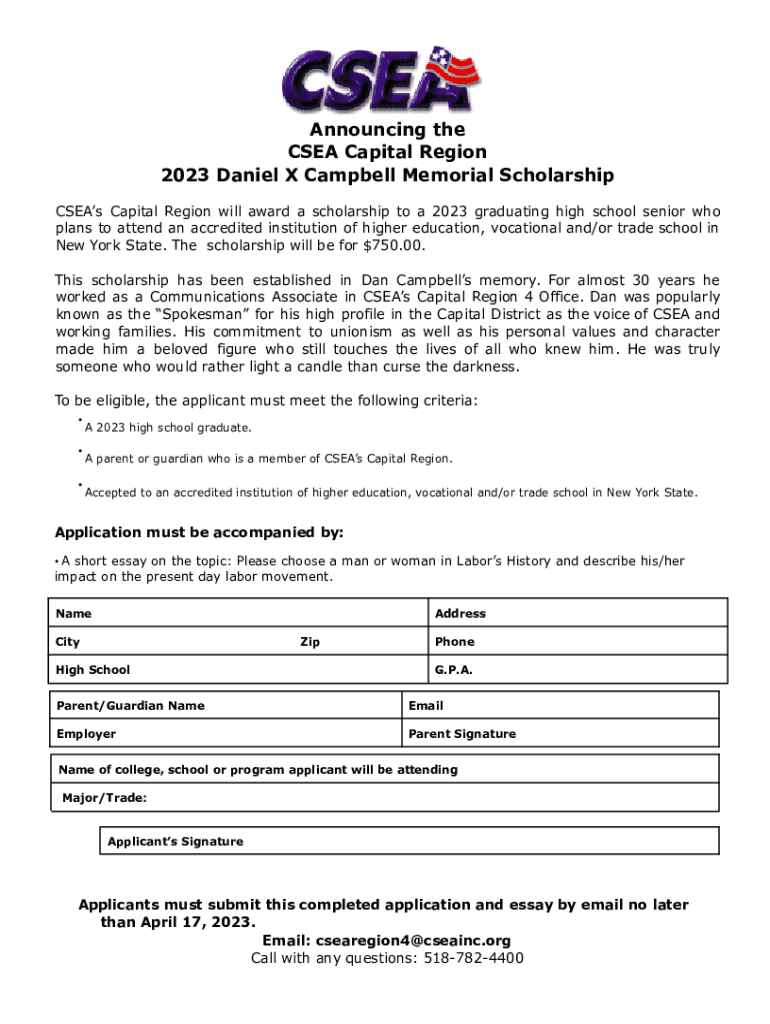

Announcing the CSEA Capital Region 2023 Daniel X Campbell Memorial Scholarship CSEAs Capital Region will award a scholarship to a 2023 graduating high school senior who plans to attend an accredited

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign college scholarships - tax

Edit your college scholarships - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your college scholarships - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit college scholarships - tax online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit college scholarships - tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out college scholarships - tax

How to fill out college scholarships - tax

01

Research and identify college scholarships that you may be eligible for.

02

Gather all the necessary documents and information that may be required to fill out the scholarship application, such as academic records, financial information, and personal statements.

03

Read the instructions carefully and make sure you understand the requirements and deadlines for each scholarship.

04

Fill out the application form accurately and provide all the required information.

05

Double-check your application for any errors or missing information before submitting it.

06

Submit your application before the deadline either through an online portal or via mail, depending on the instructions provided.

07

Keep records of all the scholarships you have applied for and their corresponding deadlines.

08

Follow up on your applications by checking for any updates or correspondence from the scholarship providers.

09

If you are selected as a recipient, complete any additional requirements or paperwork to receive the scholarship funds.

10

Make sure to report any scholarships or grants you receive on your tax return, as they may be subject to certain tax regulations.

Who needs college scholarships - tax?

01

College scholarships can be beneficial for:

02

- High school students planning to attend college

03

- Undergraduate students pursuing higher education degrees

04

- Graduating college students planning to continue their education

05

- Individuals facing financial difficulties and need financial assistance to pursue their educational goals

06

- Students with outstanding academic achievements or exceptional talents

07

- Individuals belonging to minority groups or underrepresented communities

08

- Students pursuing specific fields or careers that have scholarships dedicated to them

09

- Any individual who wants to minimize the financial burden of college education by obtaining financial aid through scholarships

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my college scholarships - tax directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your college scholarships - tax along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I complete college scholarships - tax online?

With pdfFiller, you may easily complete and sign college scholarships - tax online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for signing my college scholarships - tax in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your college scholarships - tax and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is college scholarships - tax?

College scholarships are financial aid awards given to students to help pay for their college education. These scholarships may be taxable or non-taxable depending on how they are used and the source of the funds.

Who is required to file college scholarships - tax?

Students who receive scholarship funds that exceed their qualified educational expenses or who use scholarship funds for non-qualified expenses are required to report these amounts on their tax return.

How to fill out college scholarships - tax?

To fill out college scholarships tax information, students should report the scholarship amounts on their tax return, usually on Form 1040, and complete any additional required forms like Form 8863 for education credits if applicable.

What is the purpose of college scholarships - tax?

The purpose of college scholarships tax reporting is to ensure that students correctly report any taxable income received from scholarships and to verify that qualifying educational expenses are met.

What information must be reported on college scholarships - tax?

Students must report the amount of scholarship income received, the amount used for qualified educational expenses, and any other pertinent financial information that affects their tax situation.

Fill out your college scholarships - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

College Scholarships - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.