Get the free Indemnity Deed of Trust Agreement - Milestone Ctr

Show details

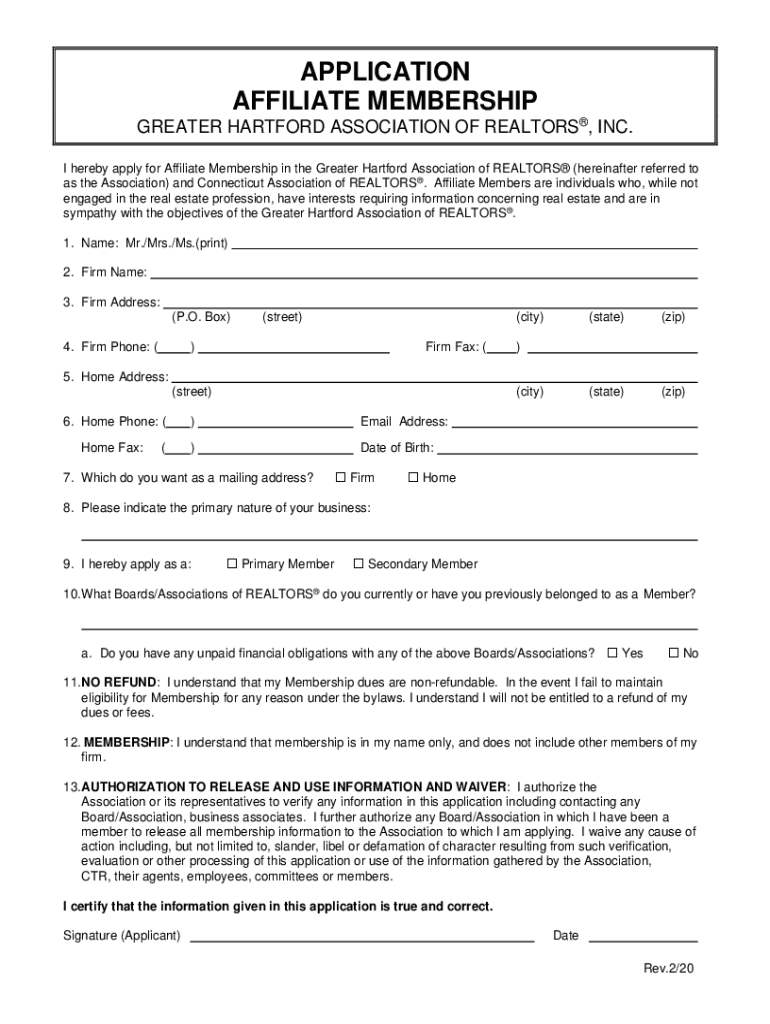

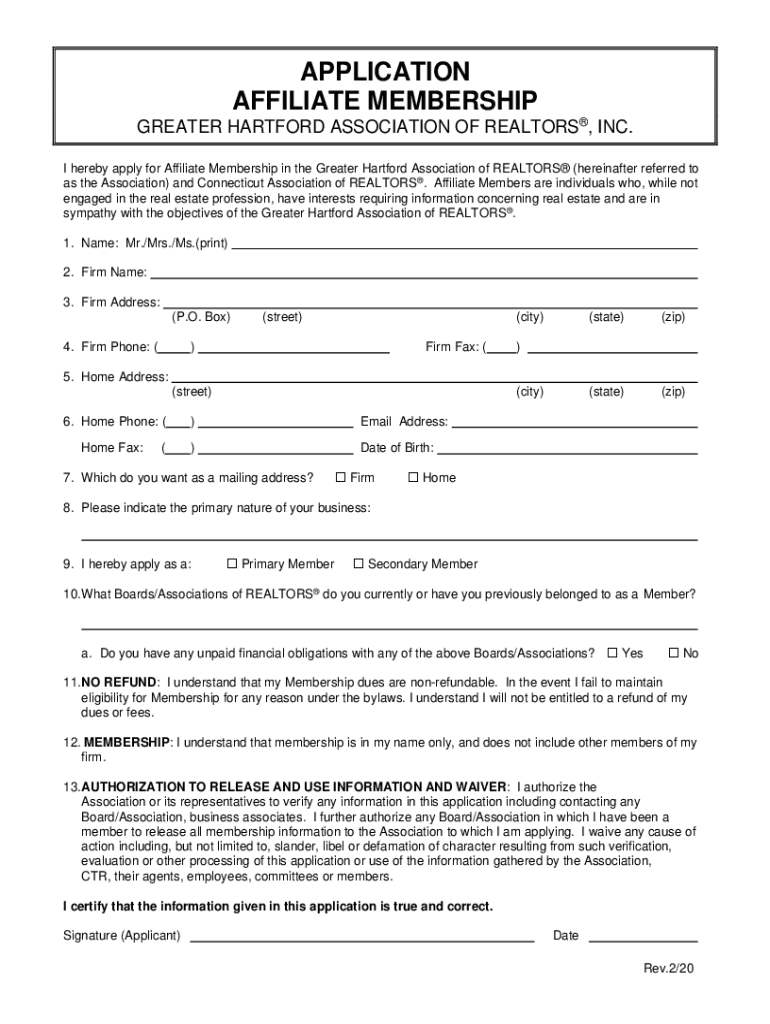

APPLICATION AFFILIATE MEMBERSHIP GREATER HARTFORD ASSOCIATION OF REALTORS, INC. I hereby apply for Affiliate Membership in the Greater Hartford Association of REALTORS (hereinafter referred to as

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indemnity deed of trust

Edit your indemnity deed of trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indemnity deed of trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit indemnity deed of trust online

To use our professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit indemnity deed of trust. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out indemnity deed of trust

How to fill out indemnity deed of trust

01

To fill out an indemnity deed of trust, follow these steps:

02

Begin by stating the names of the parties involved: the borrower, the lender, and the trustee.

03

Clearly describe the property being used as collateral for the loan. Include the legal description, address, and any identifying details.

04

Specify the loan amount and the terms of repayment, including the interest rate, duration, and any applicable penalties or late fees.

05

Outline the rights and responsibilities of each party. This may include obligations to maintain the property, obtain insurance, and provide updates on any changes in ownership or encumbrances.

06

Include provisions for default and foreclosure. Detail the circumstances under which the borrower would be considered in default and the steps the lender can take to initiate foreclosure proceedings.

07

Include any additional clauses or provisions that are relevant to the specific situation, such as provisions for partial releases or subordination agreements.

08

Make sure all parties involved have signed and dated the document. Each signature should be notarized to ensure its authenticity and legal validity.

09

Keep copies of the indemnity deed of trust for all parties involved, and file the original document with the appropriate county or municipal office for public record.

Who needs indemnity deed of trust?

01

An indemnity deed of trust is typically needed in real estate transactions where a borrower is obtaining a loan secured by a property. The parties involved in such transactions include:

02

- Borrowers: Individuals or entities seeking financing to purchase or refinance a property.

03

- Lenders: Financial institutions or private lenders providing the funds for the loan.

04

- Trustees: Neutral third parties responsible for holding the legal title of the property until the loan is fully repaid.

05

In general, anyone involved in a real estate transaction where a loan is being secured by a property may require an indemnity deed of trust to establish the legal rights and obligations of each party.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send indemnity deed of trust to be eSigned by others?

When you're ready to share your indemnity deed of trust, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for signing my indemnity deed of trust in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your indemnity deed of trust right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I fill out indemnity deed of trust on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your indemnity deed of trust. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is indemnity deed of trust?

An indemnity deed of trust is a legal document that establishes a trust agreement in which a borrower provides an indemnity to the lender, assuring that they will cover any loss or damages incurred by the lender.

Who is required to file indemnity deed of trust?

Typically, any borrower who is securing a loan or mortgage may be required to file an indemnity deed of trust as part of the borrowing process.

How to fill out indemnity deed of trust?

To fill out an indemnity deed of trust, borrowers should provide necessary information such as the names of all parties involved, a description of the property, the loan amount, terms of the loan, and signatures from all parties.

What is the purpose of indemnity deed of trust?

The purpose of an indemnity deed of trust is to protect the lender from financial loss by providing a legal framework for recourse if the borrower defaults on the loan or breaches the terms of the agreement.

What information must be reported on indemnity deed of trust?

Information required on an indemnity deed of trust includes the names of the borrower and lender, the property description, loan details, and any pertinent terms and conditions of the trust.

Fill out your indemnity deed of trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indemnity Deed Of Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.