Get the free Senior Life Insurance Company P.O. Box 2447 Thomasville, GA ...

Show details

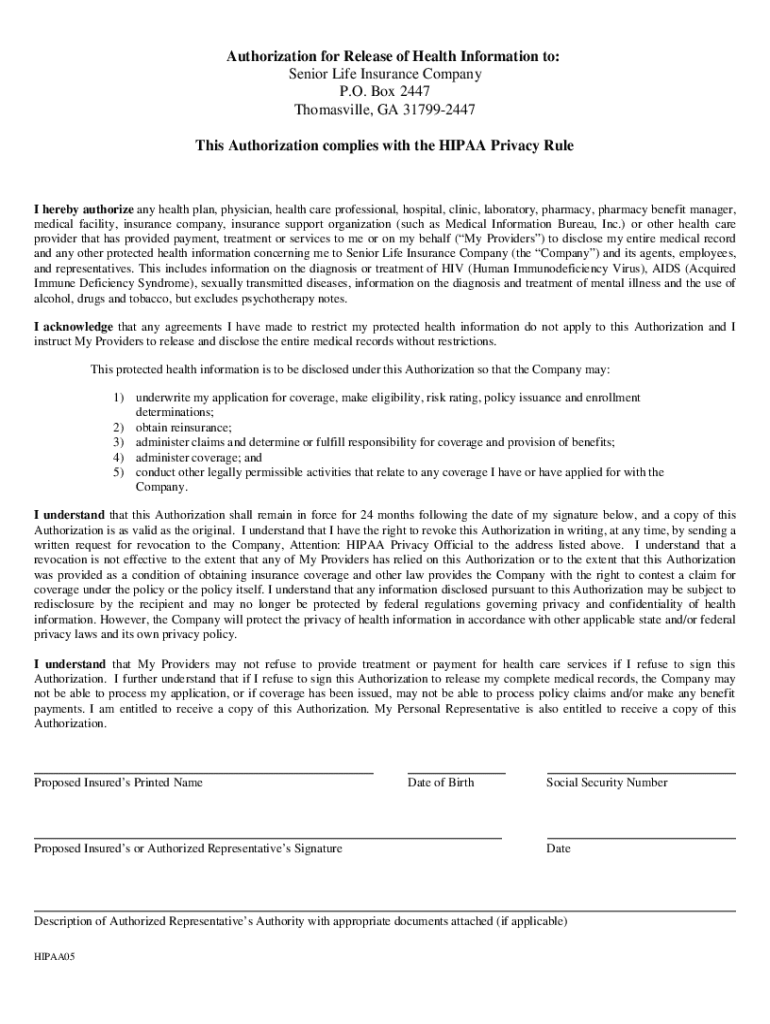

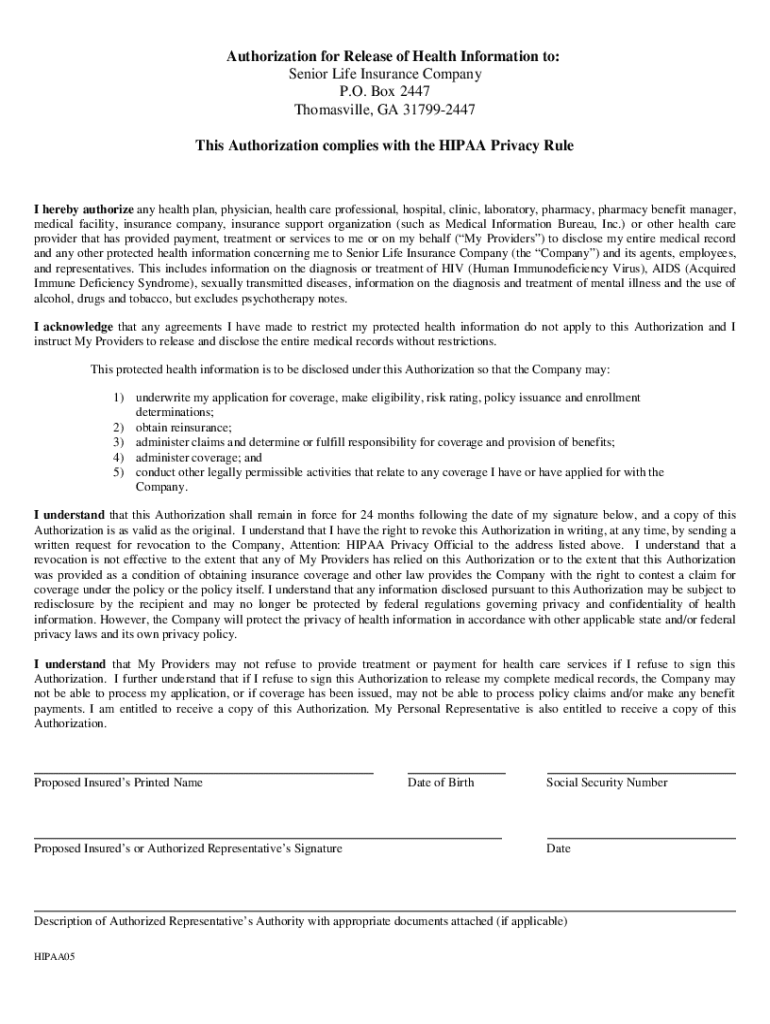

Authorization for Release of Health Information to: Senior Life Insurance Company P.O. Box 2447 Thomasville, GA 317992447 This Authorization complies with the HIPAA Privacy RuleI hereby authorize

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign senior life insurance company

Edit your senior life insurance company form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your senior life insurance company form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing senior life insurance company online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit senior life insurance company. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out senior life insurance company

How to fill out senior life insurance company

01

To fill out a senior life insurance application form, follow these steps:

02

Gather all necessary personal information, such as your full name, address, date of birth, and social security number.

03

Determine the coverage amount you need and the type of policy you want (whole life or term life).

04

Research and choose a reputable senior life insurance company.

05

Visit the company's website or contact their customer service to obtain the application form.

06

Carefully read the instructions and requirements provided with the form.

07

Fill out the form accurately and completely, providing all requested information.

08

Double-check the form for any errors or missing information before submitting.

09

Attach any required documents, such as identification proof or medical records, if requested.

10

Review the completed form once again to ensure everything is correct.

11

Submit the application form either online, by mail, or through a licensed insurance agent.

12

Keep a copy of the filled-out application form and any supporting documents for your records.

13

Wait for the insurance company to review your application and provide a response regarding acceptance or rejection.

Who needs senior life insurance company?

01

Senior life insurance is beneficial for the following individuals:

02

- Elderly individuals who want to provide financial security for their loved ones after their passing.

03

- Seniors who have outstanding debts or mortgage obligations that need to be paid off upon their death.

04

- Retired individuals who desire to leave a legacy or inheritance for their children or grandchildren.

05

- Anyone who wishes to cover funeral and burial expenses to alleviate the financial burden on their family.

06

- Seniors who want to supplement their existing life insurance coverage or replace a previous policy.

07

- Individuals who have dependents or family members relying on their financial support.

08

- Those who want to protect their spouse or partner from financial hardship after their death.

09

- People with limited savings or assets who want to ensure their loved ones are financially taken care of.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit senior life insurance company from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your senior life insurance company into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit senior life insurance company straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing senior life insurance company.

Can I edit senior life insurance company on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share senior life insurance company on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is senior life insurance company?

A senior life insurance company provides life insurance policies that are specifically designed for senior citizens, often offering coverage that is more accessible and tailored to the health and financial needs of older individuals.

Who is required to file senior life insurance company?

Typically, the senior life insurance company itself is required to file necessary regulatory documents and reports with state insurance departments to remain compliant with insurance laws.

How to fill out senior life insurance company?

Filling out forms for a senior life insurance company generally involves providing personal information, medical history, and financial details as required by the insurance provider during the application process.

What is the purpose of senior life insurance company?

The purpose of a senior life insurance company is to offer financial protection to seniors and their families through life insurance policies that can cover final expenses, debts, and provide a financial legacy.

What information must be reported on senior life insurance company?

Information that must be reported includes policyholder data, claim statistics, financial statements, and compliance metrics to regulatory bodies to ensure transparency and accountability.

Fill out your senior life insurance company online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Senior Life Insurance Company is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.