Get the free Florida Tax Power of Attorney (Form DR-835)

Show details

FLORIDA LIMITED POWER OF ATTORNEY BE IT ACKNOWLEDGED that I, ___ (principal name), with a social security number of ___ (SSN), the Principal, do hereby grant a limited and specific power of attorney

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign florida tax power of

Edit your florida tax power of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your florida tax power of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing florida tax power of online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit florida tax power of. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

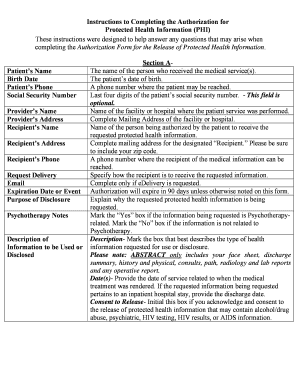

How to fill out florida tax power of

How to fill out florida tax power of

01

Obtain the Florida tax power of attorney form: You can find the form on the official website of the Florida Department of Revenue or request a physical copy from their office.

02

Read and understand the instructions: Familiarize yourself with the instructions provided with the form to ensure you fill it out correctly.

03

Fill in your personal information: Provide your full legal name, address, and contact information as the taxpayer granting the power of attorney.

04

Identify the representative: Indicate the full name, address, and contact information of the person you are granting power of attorney to.

05

Specify the powers granted: Clearly state the specific powers you are granting to the representative. This can include filing tax returns, making payments, and accessing confidential information.

06

Specify the tax matters involved: Indicate the tax years or periods for which the power of attorney is applicable.

07

Sign and date the form: Both the taxpayer and the representative should sign and date the form in the designated spaces.

08

Submit the form: Send the completed form to the Florida Department of Revenue address provided in the instructions. Keep a copy of the form for your records.

Who needs florida tax power of?

01

Anyone who wants to authorize another individual or representative to handle their tax matters in Florida may need a Florida tax power of attorney.

02

This may include individuals who are unable to manage their own tax affairs due to physical or mental incapacity, individuals who are out of the country for an extended period, or individuals who simply prefer to have someone else handle their tax matters.

03

Additionally, businesses may also need a tax power of attorney if they want to authorize someone to act on their behalf regarding Florida tax matters.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send florida tax power of to be eSigned by others?

Once you are ready to share your florida tax power of, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for the florida tax power of in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your florida tax power of in seconds.

How do I edit florida tax power of on an iOS device?

Use the pdfFiller mobile app to create, edit, and share florida tax power of from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is florida tax power of?

Florida tax power of refers to the legal authority granted to an individual or entity to represent another in matters related to tax obligations, dealings, and filings in the state of Florida.

Who is required to file florida tax power of?

Individuals or entities that wish to designate someone else to handle their tax affairs in Florida are required to file a Florida tax power of attorney. This commonly includes business owners and individuals with complex tax situations.

How to fill out florida tax power of?

To fill out the Florida tax power of, you need to complete the appropriate form, which includes detailing the principal's information, the agent's information, and the scope of the authority granted. Ensure all required signatures are included.

What is the purpose of florida tax power of?

The purpose of the Florida tax power of is to allow a designated representative to act on behalf of the individual or entity in matters related to tax filings, communications, and representations with the Florida Department of Revenue.

What information must be reported on florida tax power of?

The information that must be reported includes the names and addresses of both the principal and the agent, the specific tax responsibilities being authorized, and the duration of the authority, if applicable.

Fill out your florida tax power of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Florida Tax Power Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.