What is I-864 Financial Calculation - Joint Sponsor Form?

The I-864 Financial Calculation - Joint Sponsor is a fillable form in MS Word extension needed to be submitted to the relevant address in order to provide specific information. It has to be filled-out and signed, which is possible manually, or using a certain software like PDFfiller. It lets you fill out any PDF or Word document directly from your browser (no software requred), customize it depending on your purposes and put a legally-binding e-signature. Right away after completion, the user can send the I-864 Financial Calculation - Joint Sponsor to the appropriate person, or multiple individuals via email or fax. The template is printable too due to PDFfiller feature and options presented for printing out adjustment. Both in electronic and in hard copy, your form should have a organized and professional look. You can also turn it into a template for later, there's no need to create a new file again. All you need to do is to customize the ready document.

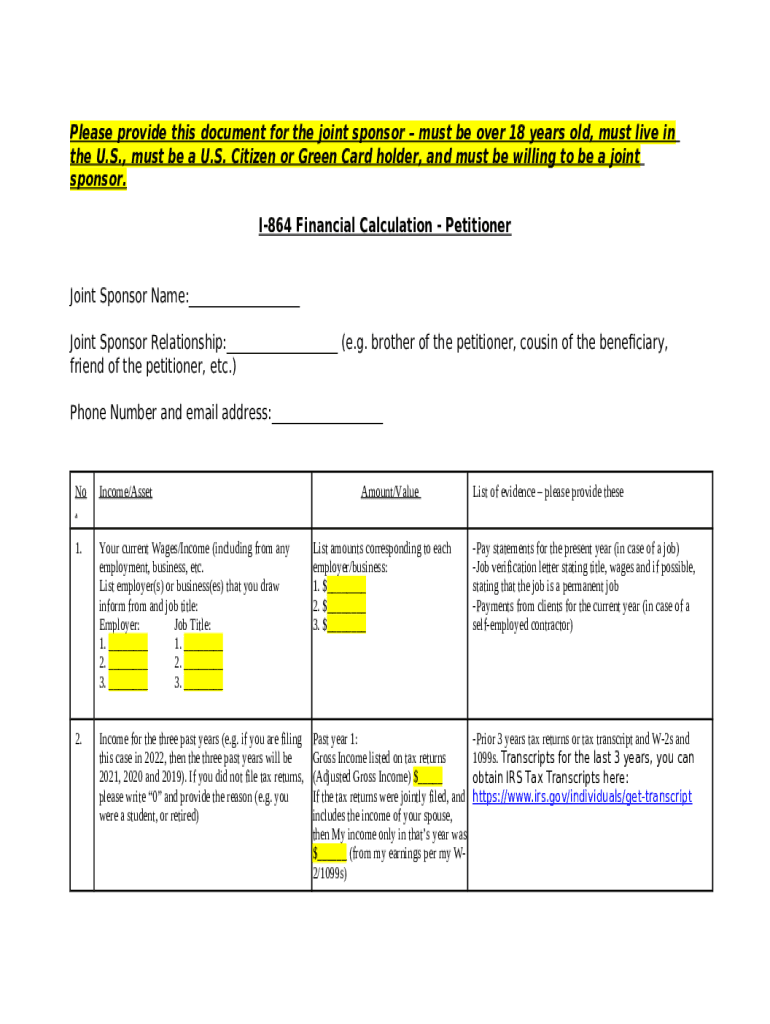

Instructions for the form I-864 Financial Calculation - Joint Sponsor

Before filling out I-864 Financial Calculation - Joint Sponsor Word template, ensure that you prepared enough of information required. It's a mandatory part, because some typos can trigger unwanted consequences from re-submission of the whole entire word template and finishing with deadlines missed and even penalties. You should be really careful when working with figures. At a glimpse, you might think of it as to be dead simple. Nevertheless, you might well make a mistake. Some use some sort of a lifehack keeping their records in another document or a record book and then attach it into sample documents. Anyway, try to make all efforts and provide actual and genuine information in your I-864 Financial Calculation - Joint Sponsor word template, and doublecheck it while filling out all the fields. If it appears that some mistakes still persist, you can easily make corrections when you use PDFfiller application without missing deadlines.

Frequently asked questions about I-864 Financial Calculation - Joint Sponsor template

1. I have some personal word forms to fill out and sign. Is there any risk somebody else would have got access to them?

Applications working with personal info (even intel one) like PDFfiller are obliged to provide safety measures to customers. We offer you::

- Cloud storage where all files are kept protected with sophisticated encryption. The user is the only person who has to access their personal files. Disclosure of the information is strictly prohibited.

- To prevent document falsification, every single one receives its unique ID number upon signing.

- If you think this is not enough for you, choose additional security features you prefer then. They manage you to request the two-factor verification for every person trying to read, annotate or edit your file. PDFfiller also offers specific folders where you can put your I-864 Financial Calculation - Joint Sponsor fillable template and encrypt them with a password.

2. Is electronic signature legal?

Yes, it is totally legal. After ESIGN Act concluded in 2000, an e-signature is considered like physical one is. You can fill out a file and sign it, and to official businesses it will be the same as if you signed a hard copy with pen, old-fashioned. While submitting I-864 Financial Calculation - Joint Sponsor form, you have a right to approve it with a digital solution. Be sure that it suits to all legal requirements as PDFfiller does.

3. Can I copy my information and transfer it to the form?

In PDFfiller, there is a feature called Fill in Bulk. It helps to make an extraction of data from file to the online word template. The big thing about this feature is, you can use it with Microsoft Excel spreadsheets.