CA Business License Tax Application - City of Stockton 2023-2025 free printable template

Show details

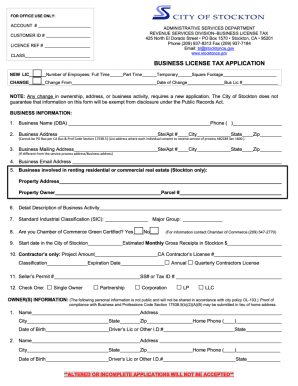

FOR OFFICE USE ONLY:ACCOUNT #ADMINISTRATIVE SERVICES DEPARTMENT

REVENUE SERVICES DIVISIONBUSINESS LICENSE TAX 425

North El Dorado Street PO Box 1570 Stockton, CA 95201

Phone (209) 9378313

Email: bl@stocktonca.govCUSTOMER

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA Business License Tax Application

Edit your CA Business License Tax Application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Business License Tax Application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA Business License Tax Application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA Business License Tax Application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Business License Tax Application - City of Stockton Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA Business License Tax Application

How to fill out CA Business License Tax Application - City

01

Download the CA Business License Tax Application from the city’s official website.

02

Fill in the business name and address in the designated fields.

03

Provide the owner's personal information, including name, address, and contact number.

04

Indicate the type of business structure (e.g., sole proprietorship, partnership, corporation).

05

Specify the nature of your business and activities conducted.

06

Enter the estimated gross receipts for your business.

07

Tick any applicable boxes regarding your business operations (e.g., retail, service, etc.).

08

Attach any required documentation, such as identification or proof of any necessary permits.

09

Review your application for accuracy and completeness.

10

Submit the application along with the required fee to the appropriate city department.

Who needs CA Business License Tax Application - City?

01

Any individual or entity planning to conduct business within the city limits.

02

Owners of new businesses starting operations in the city.

03

Existing businesses that are updating their information or renewing their license.

04

Entrepreneurs engaging in activities that require licensing by the city for legal compliance.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get a business Licence in California?

How long does the approval process take? Review and investigation of a completed license application may take up to 45 days for a General Business License. An application is considered completed when all required information and fees have been submitted.

How much does it cost to get a business license in CA?

In general, most CA small businesses will pay between $50 and $100 for a general business license. Larger corporations may be subject to charges based on their projected revenue.

How fast can I get a business license in California?

How fast can I get a business license in California? You'll usually receive your license or a certificate with a business license number within a few weeks in the mail. Once you get it, you might be required to post it at your place of business – generally the case if you're open to the public.

What do I need to get a business Licence in California?

Steps to Get a California Business License Name and form your company. Apply for a California business license. Determine which other local licenses may be applicable. Apply for any additional statewide license(s) you need. Apply for federal licenses and tax treatment (as necessary)

How much does a business license cost in California?

How much does a business license cost in California? Business licenses are administered by cities in California, so prices vary from place to place. Typically, business licenses cost between $50 and $100.

How long does it take to get a California business license?

How long does the approval process take? Review and investigation of a completed license application may take up to 45 days for a General Business License. An application is considered completed when all required information and fees have been submitted.

How much does it cost to apply for business license in California?

In general, most CA small businesses will pay between $50 and $100 for a general business license. Larger corporations may be subject to charges based on their projected revenue.

How do I verify a local business license?

Contact the state licensing board to check on a state license. Many states require business owners to apply for a state license via the secretary of state.

Can you look up a business license in California?

The California Business Search provides access to available information for corporations, limited liability companies and limited partnerships of record with the California Secretary of State, with free PDF copies of over 17 million imaged business entity documents, including the most recent imaged Statements of

How do I get a seller's permit in Stockton CA?

A business license application may be submitted via mail, email, or in person at the City of Stockton Community Development located at 345 N. El Dorado Street Stockton, CA 95202.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit CA Business License Tax Application from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your CA Business License Tax Application into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Where do I find CA Business License Tax Application?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the CA Business License Tax Application in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How can I fill out CA Business License Tax Application on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your CA Business License Tax Application. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is CA Business License Tax Application - City?

The CA Business License Tax Application - City is a form that businesses must complete to apply for a business license in a specific city in California. This application is part of the process to legally operate a business within a city’s jurisdiction.

Who is required to file CA Business License Tax Application - City?

Any individual or entity that conducts business activities within a city in California is required to file the CA Business License Tax Application. This includes sole proprietors, partnerships, corporations, and LLCs operating in that city.

How to fill out CA Business License Tax Application - City?

To fill out the CA Business License Tax Application, you need to provide your business name, address, type of business, ownership details, expected gross receipts, and any other information requested on the form. After completing the application, submit it to the local city licensing authority along with the appropriate fees.

What is the purpose of CA Business License Tax Application - City?

The purpose of the CA Business License Tax Application is to ensure that businesses operating within a city are properly registered, comply with local laws, and pay any applicable taxes or fees related to their business activities.

What information must be reported on CA Business License Tax Application - City?

The information that must be reported includes the business name, business address, type of business activity, ownership structure, estimated gross receipts, and any relevant licenses or permits. Additional information may be required depending on the specific city regulations.

Fill out your CA Business License Tax Application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Business License Tax Application is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.