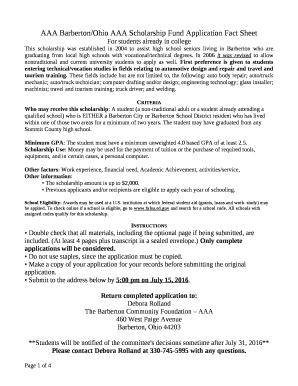

Get the free Flexible financing for manufacturing equipment

Show details

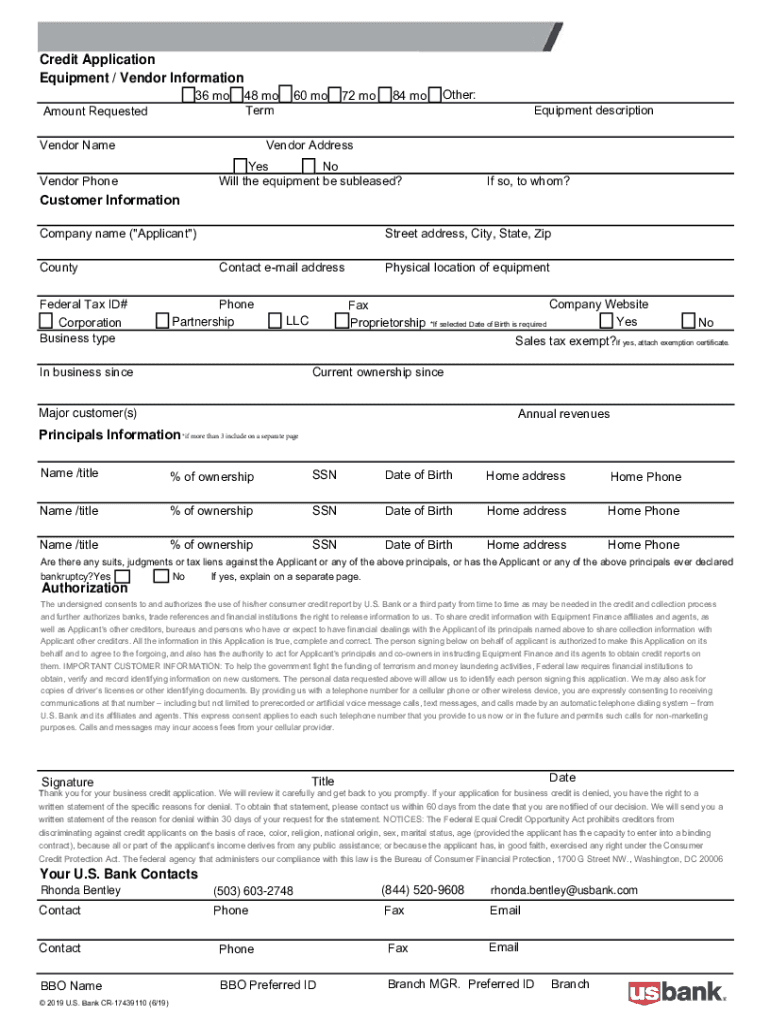

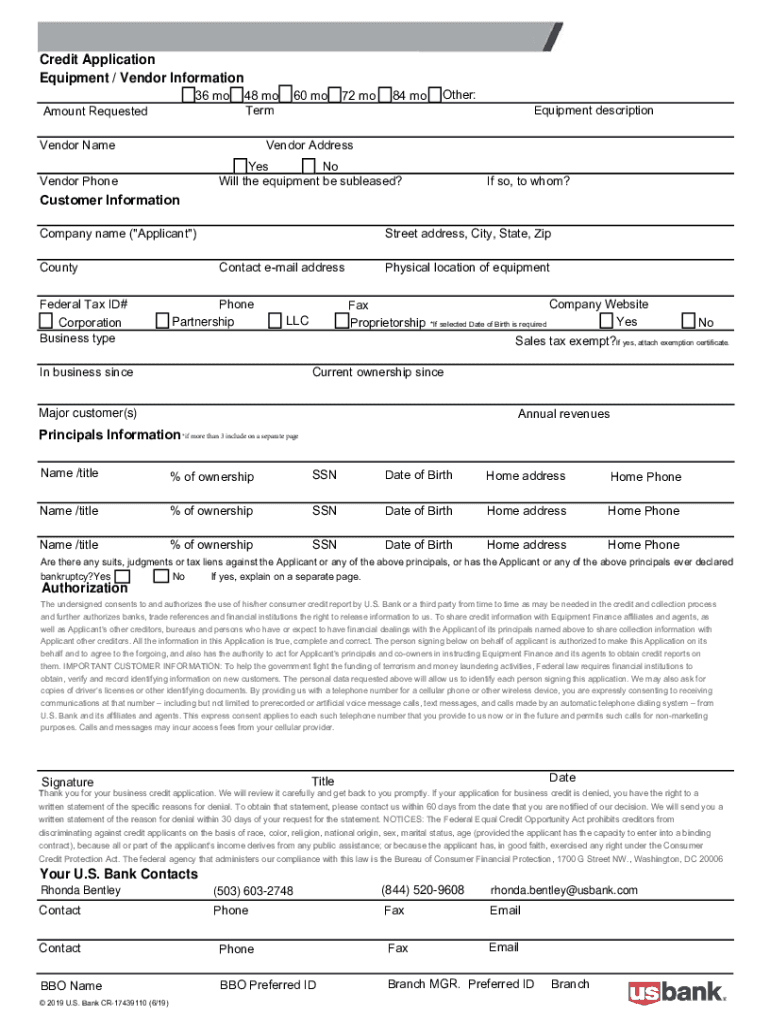

Credit Application Equipment / Vendor Information 36 moAmount Requested48 mo Term60 mo72 mo84 moVendor NameVendor AddressVendor PhoneYes No Will the equipment be subleased?Other:Equipment descriptionIf

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flexible financing for manufacturing

Edit your flexible financing for manufacturing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flexible financing for manufacturing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit flexible financing for manufacturing online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit flexible financing for manufacturing. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flexible financing for manufacturing

How to fill out flexible financing for manufacturing

01

Step 1: Gather all necessary financial documents such as income statements, balance sheets, and cash flow statements.

02

Step 2: Research and identify flexible financing options suitable for manufacturing, such as equipment financing or inventory financing.

03

Step 3: Contact potential lenders or financial institutions to inquire about their flexible financing options for manufacturing.

04

Step 4: Provide the required information and documents to the lender, demonstrating your manufacturing business's financial stability and ability to repay the loan.

05

Step 5: Review and compare the offered terms and conditions from different lenders, including interest rates, repayment schedules, and any additional fees.

06

Step 6: Select the most suitable flexible financing option for your manufacturing business and proceed with the application process.

07

Step 7: Fill out the application form accurately, providing all the necessary details about your manufacturing business and the financing amount required.

08

Step 8: Submit the completed application along with the required documents to the lender.

09

Step 9: Wait for the lender's review and decision on your flexible financing application. This may involve a credit check and evaluation of your manufacturing business's financial health.

10

Step 10: If approved, carefully review the terms and conditions of the financing agreement before signing the contract.

11

Step 11: Upon signing, utilize the flexible financing to support your manufacturing operations or investment needs.

12

Step 12: Make timely repayments according to the agreed-upon schedule to maintain a good credit history and potentially access additional financing in the future.

Who needs flexible financing for manufacturing?

01

Manufacturing businesses of all sizes who require additional financial support to fund various aspects of their operations.

02

Startups or small manufacturing companies that may face challenges in securing traditional loans due to limited operating history or collateral.

03

Growing manufacturing businesses that need to invest in new equipment, expand their production capacity, or optimize their supply chain.

04

Companies in the manufacturing industry undergoing seasonal fluctuations in cash flow and require flexible financing to cover expenses during slower periods.

05

Entrepreneurs or innovators looking to bring new products to market and need financing to fund research, development, and production.

06

Manufacturers facing unexpected costs or emergencies who need quick access to funds without disrupting their operations.

07

Manufacturing businesses aiming to improve cash flow by optimizing their working capital and utilizing flexible financing options.

08

Manufacturers exploring opportunities for mergers, acquisitions, or partnerships that require additional capital investment.

09

Companies in the manufacturing industry seeking to stay competitive by adopting new technologies or improving their manufacturing processes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my flexible financing for manufacturing directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign flexible financing for manufacturing and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I modify flexible financing for manufacturing without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your flexible financing for manufacturing into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit flexible financing for manufacturing on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute flexible financing for manufacturing from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is flexible financing for manufacturing?

Flexible financing for manufacturing refers to financial solutions that provide manufacturers with various funding options tailored to their specific needs, allowing them to manage cash flow, invest in equipment, and support growth without rigid repayment terms.

Who is required to file flexible financing for manufacturing?

Manufacturing businesses that utilize flexible financing options are typically required to file relevant documentation with financial institutions or government agencies to ensure compliance with funding regulations.

How to fill out flexible financing for manufacturing?

To fill out flexible financing documentation for manufacturing, businesses must provide detailed information about their financial status, project plans, intended use of funds, and any necessary supporting documentation as specified by the funding agency.

What is the purpose of flexible financing for manufacturing?

The purpose of flexible financing for manufacturing is to provide manufacturers with accessible funding that supports their operational needs, enhances productivity, promotes innovation, and allows them to adapt to changing market demands.

What information must be reported on flexible financing for manufacturing?

Reported information typically includes the business's financial statements, details of the manufacturing operation, projected costs, funding requirements, and any anticipated financial outcomes related to the financing.

Fill out your flexible financing for manufacturing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flexible Financing For Manufacturing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.