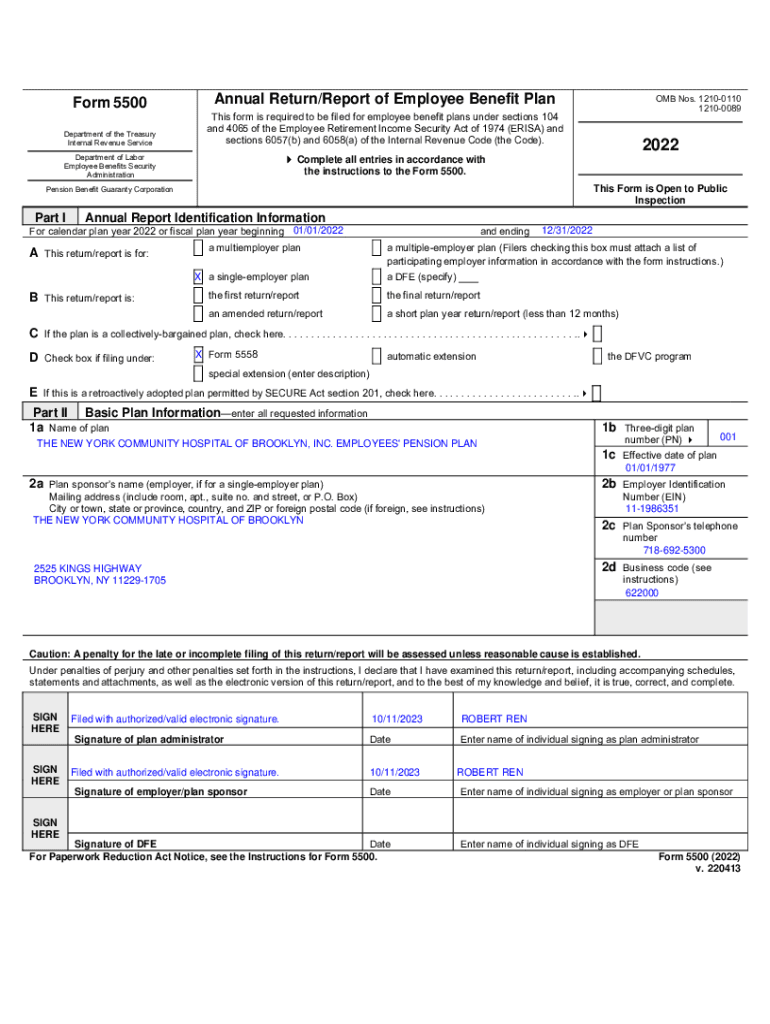

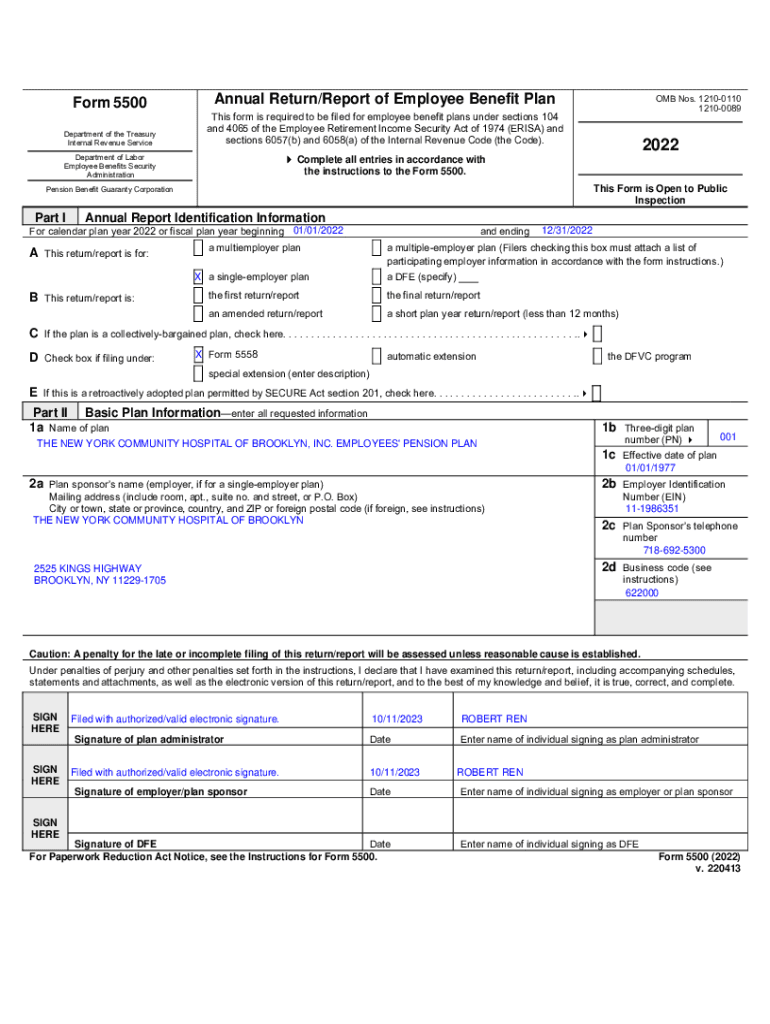

Get the free For calendar plan year 2022 or fiscal plan year beginning 01/01/2022

Show details

Department of the Treasury Internal Revenue ServiceThis form is required to be filed for employee benefit plans under sections 104 and 4065 of the Employee Retirement Income Security Act of 1974 (ERISA)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign for calendar plan year

Edit your for calendar plan year form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your for calendar plan year form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit for calendar plan year online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit for calendar plan year. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out for calendar plan year

How to fill out for calendar plan year

01

To fill out a calendar plan year, follow these steps:

02

Start by reviewing any existing plans or goals from the previous year.

03

Determine the duration of the calendar plan year. It could be based on a calendar year (January to December) or any other 12-month period.

04

Define specific objectives or targets for the plan year. These should be measurable and align with the overall goals of the organization.

05

Break down the objectives into smaller, actionable tasks or milestones.

06

Assign responsibilities to individuals or teams for each task or milestone.

07

Set deadlines for each task or milestone to ensure timely progress.

08

Create a calendar or timeline to visualize the plan year and mark important dates, deadlines, and milestones.

09

Regularly monitor and track the progress of the plan year to identify any deviations or areas that require adjustments.

10

Review and evaluate the completed plan year to identify successes, challenges, and areas for improvement.

11

Use the insights gained to inform the planning process for the next calendar plan year.

Who needs for calendar plan year?

01

A calendar plan year is beneficial for various individuals and organizations, including:

02

- Businesses and companies: It helps them strategize, set goals, and track progress.

03

- Project managers: It enables them to plan and manage projects within a defined time frame.

04

- Individuals: It provides a structured approach to personal goal setting and achievement.

05

- Educational institutions: It assists in designing curriculum, scheduling academic activities, and managing academic years.

06

- Non-profit organizations: It aids in planning fundraising activities, volunteer programs, and community initiatives.

07

- Government agencies: It facilitates the planning and implementation of public policies, projects, and programs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send for calendar plan year for eSignature?

When you're ready to share your for calendar plan year, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit for calendar plan year straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing for calendar plan year.

How do I fill out for calendar plan year using my mobile device?

Use the pdfFiller mobile app to complete and sign for calendar plan year on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is for calendar plan year?

The calendar plan year refers to a 12-month period that starts on January 1 and ends on December 31, used for financial and reporting purposes.

Who is required to file for calendar plan year?

Entities and individuals that operate on a calendar year basis and are obligated to submit annual reports, tax returns, or financial statements are required to file for the calendar plan year.

How to fill out for calendar plan year?

To fill out for the calendar plan year, one must gather relevant financial data for the entire year, complete the necessary forms or documents, and ensure that all information complies with applicable regulations before submission.

What is the purpose of for calendar plan year?

The purpose of the calendar plan year is to provide a standardized timeframe for accounting and reporting, allowing entities to summarize their financial performance and comply with legal obligations.

What information must be reported on for calendar plan year?

Information that must be reported includes income, expenses, assets, liabilities, and any other relevant financial data as required by regulatory authorities or governing bodies.

Fill out your for calendar plan year online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

For Calendar Plan Year is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.