Get the free Valuation Multiples by Industry - eval.tech

Show details

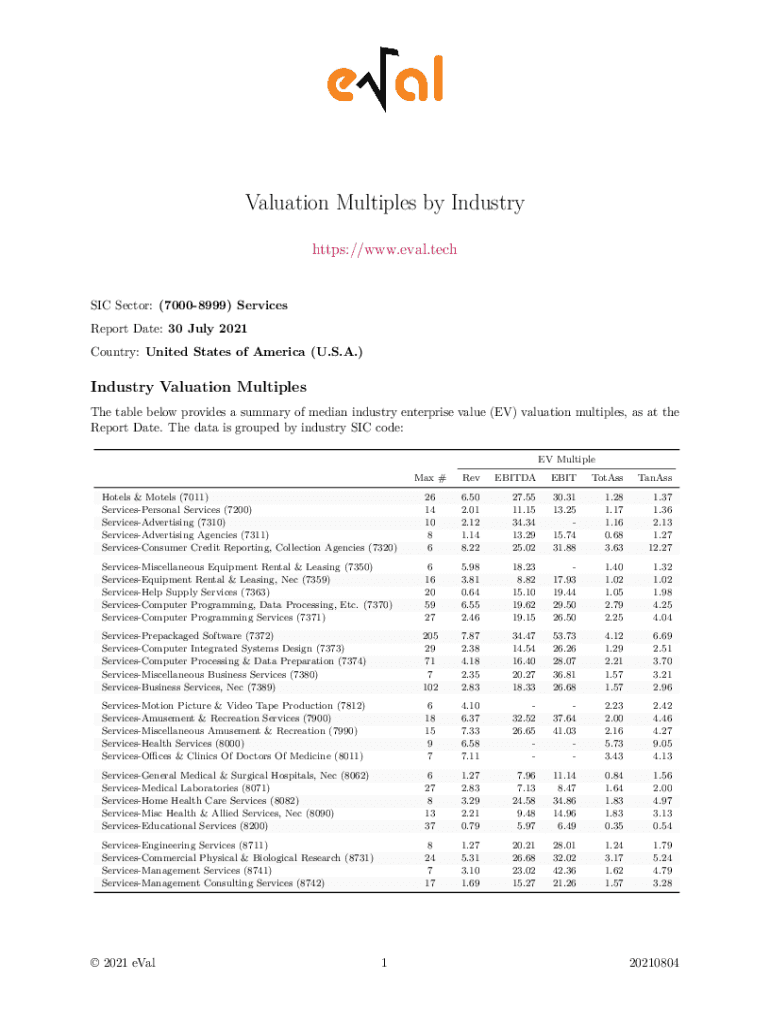

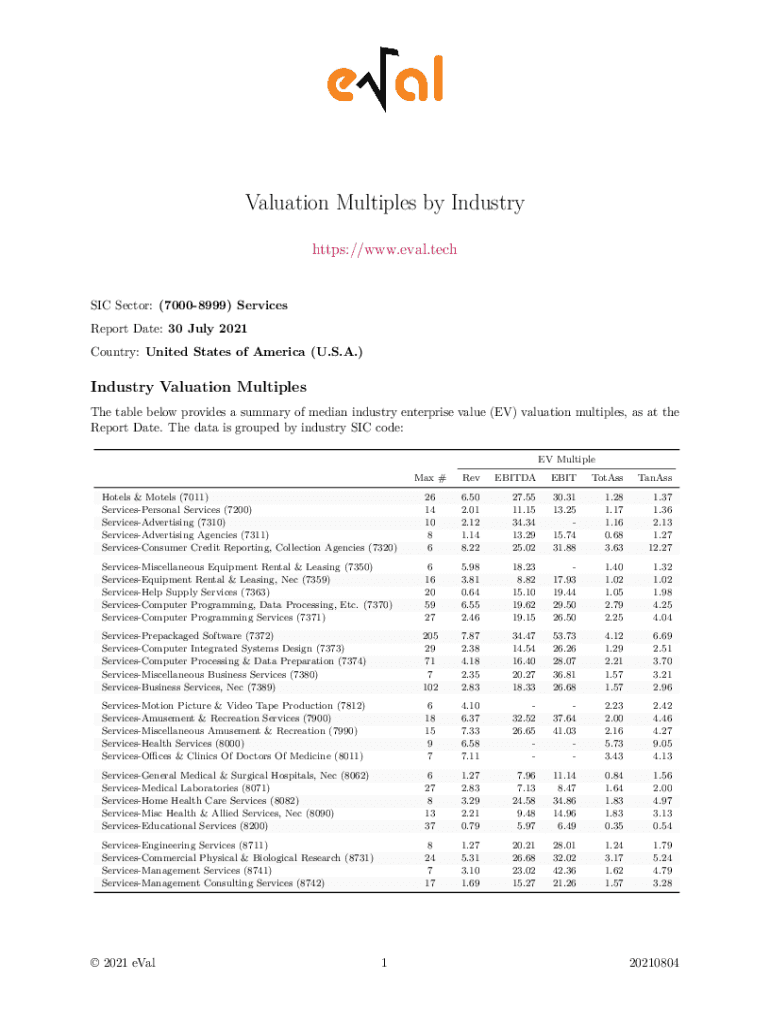

Valuation Multiples by Industry

https://www.eval.techSIC Sector: (70008999) Services

Report Date: 30 July 2021

Country: United States of America (U.S.A.) Industry Valuation Multiples

The table below

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign valuation multiples by industry

Edit your valuation multiples by industry form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your valuation multiples by industry form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing valuation multiples by industry online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit valuation multiples by industry. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out valuation multiples by industry

How to fill out valuation multiples by industry

01

Begin by selecting the appropriate valuation multiples for your industry. Common valuation multiples include price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and enterprise value-to-EBITDA (EV/EBITDA) ratio.

02

Gather financial information for the target company, such as its earnings, sales, and EBITDA.

03

Calculate the valuation multiples for the target company by dividing its market price (or enterprise value) by the relevant financial metric. For example, to calculate P/E ratio, divide the market price per share by the earnings per share.

04

Research similar companies in the industry and their valuation multiples. This can be done by analyzing financial statements, industry reports, or using financial databases.

05

Compare the valuation multiples of the target company with those of its industry peers. Look for any significant differences and identify possible reasons for the discrepancies.

06

Analyze the implications of the valuation multiples. Determine whether the target company is undervalued or overvalued compared to its industry peers.

07

Consider other factors that may affect the valuation multiples, such as industry trends, market conditions, and company-specific factors.

08

Regularly update the valuation multiples as new financial information becomes available or market conditions change.

Who needs valuation multiples by industry?

01

Investors: Investors use valuation multiples by industry to evaluate the attractiveness of investment opportunities. By comparing valuation multiples of different companies within the same industry, investors can identify potential undervalued or overvalued stocks.

02

Financial Analysts: Financial analysts use valuation multiples to assess the financial health and performance of companies within a specific industry. They can analyze trends and make informed recommendations based on the valuation multiples.

03

Investment Bankers: Investment bankers use valuation multiples to determine the fair value of companies for mergers and acquisitions, IPOs, or other financial transactions. Valuation multiples help in determining the appropriate price and negotiating deals.

04

Business Owners: Business owners can benefit from valuation multiples by industry to understand the value of their own company and compare it with industry benchmarks. This can help them identify areas of improvement and potential growth opportunities.

05

Market Researchers: Market researchers use valuation multiples to analyze industry trends, market competitiveness, and performance benchmarks. Valuation multiples provide insights into the relative value of companies within the industry.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my valuation multiples by industry in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your valuation multiples by industry and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send valuation multiples by industry to be eSigned by others?

When your valuation multiples by industry is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I sign the valuation multiples by industry electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your valuation multiples by industry and you'll be done in minutes.

What is valuation multiples by industry?

Valuation multiples by industry are financial metrics that express the value of a company relative to a key performance indicator, such as earnings, sales, or assets, within a specific industry. They are used to compare companies and assess their relative value.

Who is required to file valuation multiples by industry?

Entities such as public companies, private firms seeking investment, and those involved in mergers and acquisitions are typically required to file valuation multiples by industry to provide transparency to stakeholders and potential investors.

How to fill out valuation multiples by industry?

To fill out valuation multiples by industry, collect relevant financial data for the companies in the industry, calculate the multiples (e.g., Price-to-Earnings, Enterprise Value to EBITDA), and organize the data in a report format, often including averages or medians for comparison.

What is the purpose of valuation multiples by industry?

The purpose of valuation multiples by industry is to provide a benchmark for evaluating the market value of companies, helping investors make informed decisions regarding investment opportunities and facilitating comparisons across similar businesses.

What information must be reported on valuation multiples by industry?

Information that must be reported typically includes the valuation multiples, the companies analyzed, relevant financial figures (like earnings, revenue, debt), industry trends, and any assumptions made during the valuation process.

Fill out your valuation multiples by industry online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Valuation Multiples By Industry is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.