Get the free Montgomery county homestead exemption form. Montgomery county homestead exemption fo...

Show details

Continue Montgomery county homestead exemption form

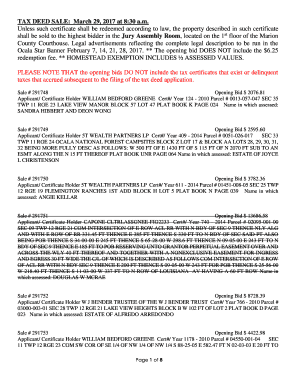

Religious, charitable, scientific or nonprofit educational institutions may apply to have property owned by that organization exempt from property taxes if the property is currently being used exclusively to carry out one or more of the purposes for which the organization was created.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign montgomery county homestead exemption

Edit your montgomery county homestead exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your montgomery county homestead exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing montgomery county homestead exemption online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit montgomery county homestead exemption. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out montgomery county homestead exemption

How to fill out montgomery county homestead exemption

01

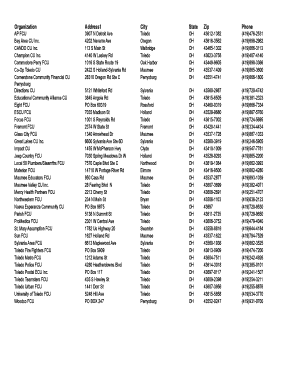

Obtain the Montgomery County Homestead Exemption application form, which can be found on the official website of Montgomery County or obtained from the Montgomery County Tax Assessor's Office.

02

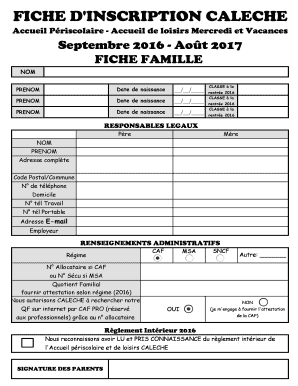

Fill out all the required personal information such as your name, address, and contact details.

03

Provide documentation supporting your eligibility for the homestead exemption, such as proof of ownership of the property and proof of residency.

04

Complete all the necessary sections of the application form, including any additional forms or documentation required by the county.

05

Double-check all the information provided to ensure accuracy and completeness.

06

Submit the completed application form and supporting documents to the Montgomery County Tax Assessor's Office either in person or by mail.

07

Wait for the county to process your application. You may be contacted for any additional information or documentation if needed.

08

Once approved, you will receive a notification or confirmation letter from the Montgomery County Tax Assessor's Office.

09

Review your property tax bill to ensure that the homestead exemption has been applied correctly.

10

Renew the homestead exemption annually as required by Montgomery County.

Who needs montgomery county homestead exemption?

01

Montgomery County Homestead Exemption is available to eligible homeowners who use their property as their primary residence.

02

Homeowners who meet certain criteria, such as being at least 65 years old or having a disability, may be eligible for additional exemptions or reductions in property taxes.

03

It is beneficial for homeowners who wish to reduce their property taxes by exempting a portion of their home's assessed value.

04

Specific eligibility requirements may vary depending on the county regulations and laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

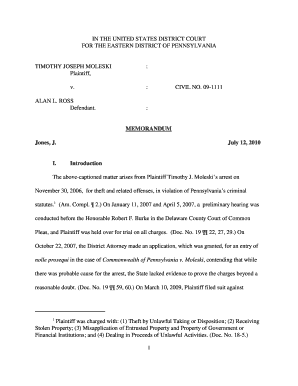

How can I send montgomery county homestead exemption to be eSigned by others?

When your montgomery county homestead exemption is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I sign the montgomery county homestead exemption electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your montgomery county homestead exemption and you'll be done in minutes.

Can I create an eSignature for the montgomery county homestead exemption in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your montgomery county homestead exemption and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is montgomery county homestead exemption?

The Montgomery County Homestead Exemption is a tax relief program that reduces the taxable value of a primary residence for eligible homeowners, thereby lowering their property tax bill.

Who is required to file montgomery county homestead exemption?

Homeowners who occupy their property as their primary residence are required to file for the Montgomery County Homestead Exemption to receive the benefits.

How to fill out montgomery county homestead exemption?

To fill out the Montgomery County Homestead Exemption application, homeowners need to complete the designated form provided by the county, provide proof of identity and residency, and submit it by the deadline.

What is the purpose of montgomery county homestead exemption?

The purpose of the Montgomery County Homestead Exemption is to provide financial relief to homeowners by reducing their property tax burden and promoting homeownership.

What information must be reported on montgomery county homestead exemption?

Homeowners must report their personal information, property details, and proof of residency, such as a driver's license or utility bill, on the Montgomery County Homestead Exemption application.

Fill out your montgomery county homestead exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Montgomery County Homestead Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.