Get the free Finance Goals: 10 Examples and Why They Matter (Plus ...

Show details

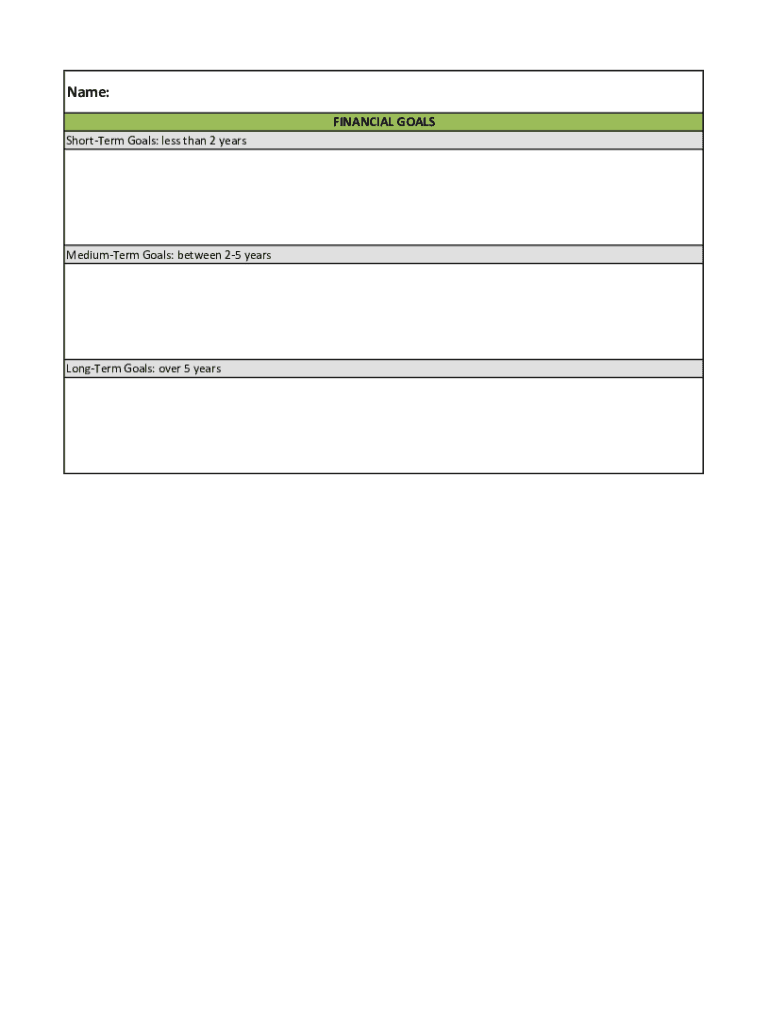

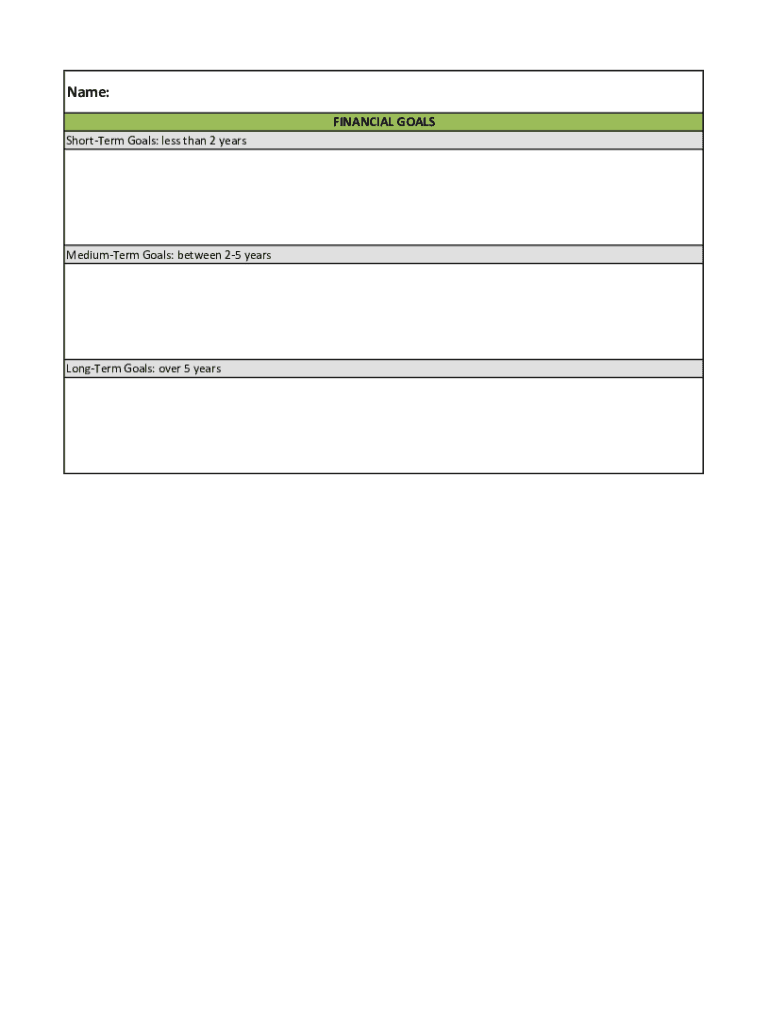

Name:

FINANCIAL GOALS

Shorter Goals: less than 2 yearsMediumTerm Goals: between 25 yearsLongTerm Goals: over 5 yearsINCOME

CURRENT LOCATIONPOTENTIAL Locationally or Zip Code

SERVICE MEMBER MONTHLY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign finance goals 10 examples

Edit your finance goals 10 examples form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your finance goals 10 examples form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit finance goals 10 examples online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit finance goals 10 examples. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out finance goals 10 examples

How to fill out finance goals 10 examples

01

Identify your short-term and long-term financial goals

02

Make sure your financial goals are specific, measurable, achievable, relevant, and time-bound (SMART)

03

Create a budget to understand your current financial situation

04

Prioritize your financial goals based on their importance and urgency

05

Break down each goal into smaller steps or milestones

06

Set deadlines for each milestone to keep yourself on track

07

Monitor your progress regularly and make adjustments as needed

08

Celebrate small victories along the way to stay motivated

09

Seek advice from financial experts or mentors if needed

10

Review and revise your financial goals periodically to reflect changes in your circumstances

Who needs finance goals 10 examples?

01

Young professionals who want to save for a down payment on a house

02

Recent college graduates looking to pay off student loans

03

Married couples planning for retirement

04

Single parents saving for their children's education

05

Small business owners looking to expand their operations

06

Freelancers aiming to stabilize their income

07

Individuals hoping to build an emergency fund

08

Entrepreneurs seeking funding for a new venture

09

Retirees wanting to maintain their standard of living

10

Anyone looking to achieve financial freedom and security

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get finance goals 10 examples?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific finance goals 10 examples and other forms. Find the template you need and change it using powerful tools.

How do I edit finance goals 10 examples online?

The editing procedure is simple with pdfFiller. Open your finance goals 10 examples in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I complete finance goals 10 examples on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your finance goals 10 examples, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is finance goals 10 examples?

1. Saving for retirement 2. Building an emergency fund 3. Paying off debt 4. Saving for a house 5. Funding a child's education 6. Investing for wealth accumulation 7. Creating a budget 8. Establishing a diversified investment portfolio 9. Planning for taxes 10. Setting up a charity fund

Who is required to file finance goals 10 examples?

1. Individuals with investment income 2. Business owners 3. Self-employed individuals 4. Homeowners with a mortgage 5. Students applying for financial aid 6. Non-profits seeking grants 7. Taxpayers with specific tax deductions 8. Investors in particular asset classes 9. Individuals saving for retirement plans 10. People with significant financial assets

How to fill out finance goals 10 examples?

1. Assess your current financial situation 2. Define SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) 3. Create a budget plan 4. List priorities for savings and investments 5. Outline steps to achieve each goal 6. Set deadlines for review 7. Keep track of progress 8. Adjust as necessary based on financial changes 9. Seek professional financial advice if needed 10. Document all goals and strategies

What is the purpose of finance goals 10 examples?

1. To provide direction for financial planning 2. To prioritize spending 3. To ensure readiness for emergencies 4. To achieve financial independence 5. To accumulate wealth over time 6. To prepare for retirement 7. To manage and eliminate debt effectively 8. To organize financial responsibilities 9. To capitalize on investment opportunities 10. To enable charitable giving

What information must be reported on finance goals 10 examples?

1. Total income sources 2. Current savings amounts 3. Investment account balances 4. Debt levels 5. Budget allocation for each goal 6. Progress tracking for each financial goal 7. Timeframe for achieving each goal 8. Risk assessment for investments 9. Planned expenses 10. Financial forecasts and growth expectations

Fill out your finance goals 10 examples online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Finance Goals 10 Examples is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.