Get the free Declaration of Electronic Filing - District of Arizona - azb uscourts

Show details

UNITED STATES BANKRUPTCY COURT DISTRICT OF ARIZONA)))))) Debtor(s)) Chapter Case Number DECLARATION RE: ELECTRONIC FILING PART I DECLARATION OF PETITIONER: I We a, the undersigned debtor(s), corporate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign declaration of electronic filing

Edit your declaration of electronic filing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your declaration of electronic filing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit declaration of electronic filing online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit declaration of electronic filing. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out declaration of electronic filing

How to fill out the declaration of electronic filing:

01

Start by downloading the declaration of electronic filing form from the appropriate website. This form is usually available on the website of the government agency or organization that requires it.

02

Carefully read the instructions accompanying the form. These instructions will provide important information about how to fill out the form accurately and completely.

03

Begin filling out the form by entering your personal information. This may include your full name, address, contact details, and any other relevant information requested.

04

Provide details about the type of filing you are making. If there are specific categories or options to choose from, select the appropriate one that applies to your situation.

05

Include any supporting documents or attachments that may be required with the declaration of electronic filing. This could be additional forms, receipts, or any other paperwork necessary to support your filing.

06

Double-check all the information you have entered to ensure its accuracy. Make sure there are no spelling mistakes or missing details that could cause delays or complications in the filing process.

07

Sign and date the declaration of electronic filing form. Some forms may require additional signatures from witnesses or notaries, so be sure to follow the instructions provided.

08

Submit the completed form and any accompanying documents as instructed. This may involve mailing the documents, uploading them electronically, or submitting them in person to the appropriate authority.

Who needs the declaration of electronic filing?

01

Individuals or businesses required to file taxes electronically: The declaration of electronic filing is often needed by individuals or businesses who are required by law to submit their tax returns electronically. This requirement may come from the government tax agency or other relevant authorities.

02

Organizations submitting official documents or reports: In some cases, organizations may need to file electronic declarations for various reasons, such as submitting financial reports, annual statements, or other official documents to regulatory bodies or government agencies.

03

Contractors or vendors responding to government bids or contracts: When bidding for government contracts or responding to requests for proposals, contractors or vendors may need to provide a declaration of electronic filing to demonstrate their compliance with certain standards, regulations, or requirements.

In conclusion, anyone required to file taxes electronically, organizations submitting official documents, or contractors/vendors responding to government bids/contracts may need to fill out the declaration of electronic filing. The process involves downloading the form, entering personal information, providing necessary details, attaching supporting documents, verifying accuracy, signing, and submitting it according to the instructions provided.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my declaration of electronic filing in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your declaration of electronic filing as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Where do I find declaration of electronic filing?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific declaration of electronic filing and other forms. Find the template you want and tweak it with powerful editing tools.

How do I fill out declaration of electronic filing using my mobile device?

Use the pdfFiller mobile app to fill out and sign declaration of electronic filing. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

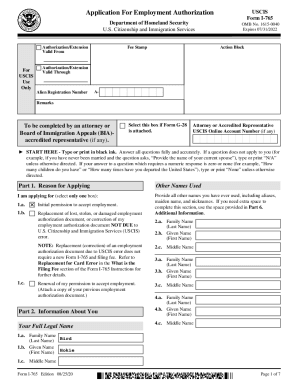

What is declaration of electronic filing?

The declaration of electronic filing is a document that indicates a taxpayer's intention to file their taxes electronically.

Who is required to file declaration of electronic filing?

Individuals and businesses who choose to file their taxes electronically are required to file a declaration of electronic filing.

How to fill out declaration of electronic filing?

The declaration of electronic filing can typically be filled out online on the tax authority's website or through tax preparation software.

What is the purpose of declaration of electronic filing?

The purpose of the declaration of electronic filing is to confirm the taxpayer's decision to file their taxes electronically and to provide their electronic signature.

What information must be reported on declaration of electronic filing?

The declaration of electronic filing typically requires basic information such as name, address, Social Security number, and confirmation of electronic filing method.

Fill out your declaration of electronic filing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Declaration Of Electronic Filing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.