Get the free History of Medicare Deductibles, Co-Payments and ...

Show details

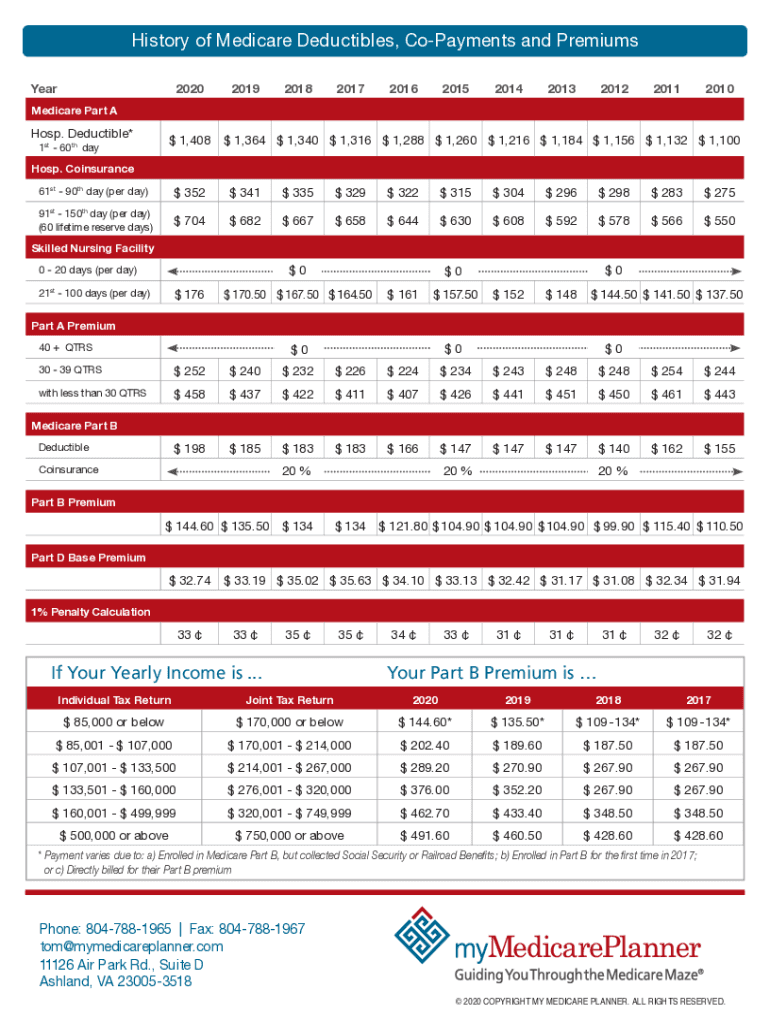

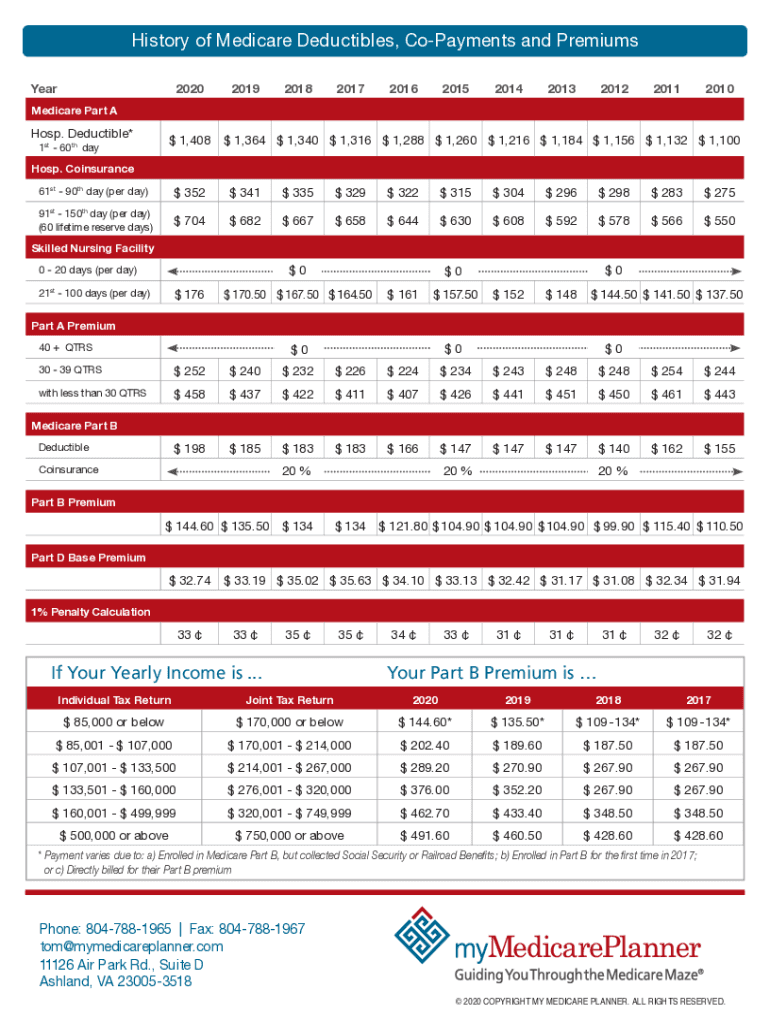

History of Medicare Deductibles, CoPayments and Premiums Year20202019201820172016201520142013201220112010Medicare Part AHosp. Deductible*$ 1,4081st 60th day$ 1,364 $ 1,340 $ 1,316 $ 1,288 $ 1,260

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign history of medicare deductibles

Edit your history of medicare deductibles form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your history of medicare deductibles form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit history of medicare deductibles online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit history of medicare deductibles. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out history of medicare deductibles

How to fill out history of medicare deductibles

01

Collect all of your Medicare statements from the past year.

02

Make a list of all the deductibles you have paid for each service.

03

Organize the information in a spreadsheet or document for easy reference.

Who needs history of medicare deductibles?

01

Individuals who want to keep track of their healthcare expenses and deductible payments.

02

Insurance agents and healthcare providers who need to review a patient's deductible history.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit history of medicare deductibles straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing history of medicare deductibles right away.

How do I fill out history of medicare deductibles using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign history of medicare deductibles and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit history of medicare deductibles on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share history of medicare deductibles on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is history of medicare deductibles?

The history of Medicare deductibles refers to the annual amounts that beneficiaries must pay out-of-pocket for healthcare services before Medicare starts to pay its share. These deductibles have changed over the years due to adjustments in healthcare costs and policy reforms.

Who is required to file history of medicare deductibles?

Generally, Medicare beneficiaries who have incurred medical expenses are required to report their deductible history for the purpose of maintaining accurate records and ensuring proper billing.

How to fill out history of medicare deductibles?

To fill out the history of Medicare deductibles, beneficiaries need to gather their medical bills and paperwork, identify the deducted amounts for each service, and record these figures on the appropriate forms or online platforms as required by Medicare.

What is the purpose of history of medicare deductibles?

The purpose of recording the history of Medicare deductibles is to track the amounts paid by beneficiaries, ensure accurate claims processing, and facilitate budgeting for future healthcare expenses.

What information must be reported on history of medicare deductibles?

The information that must be reported includes the dates of service, types of services received, the costs associated with each service, and the deductible amounts paid by the beneficiary.

Fill out your history of medicare deductibles online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

History Of Medicare Deductibles is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.