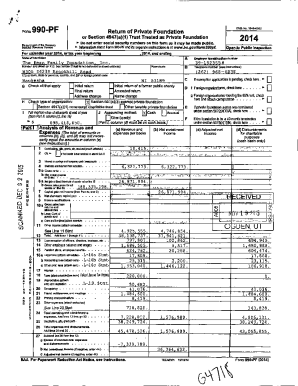

What is My federal tax return was accepted six months ago, and my ... - khwp org Form?

The My federal tax return was accepted six months ago, and my ... - khwp org is a fillable form in MS Word extension you can get filled-out and signed for specific needs. Then, it is provided to the actual addressee in order to provide certain info and data. The completion and signing is able manually or using a suitable solution e. g. PDFfiller. These tools help to fill out any PDF or Word file without printing them out. While doing that, you can customize its appearance depending on the needs you have and put an official legal electronic signature. Once done, the user sends the My federal tax return was accepted six months ago, and my ... - khwp org to the respective recipient or several of them by email and also fax. PDFfiller includes a feature and options that make your Word form printable. It provides a variety of settings when printing out. It does no matter how you deliver a form after filling it out - physically or by email - it will always look neat and firm. In order not to create a new editable template from the beginning over and over, make the original document as a template. After that, you will have a customizable sample.

My federal tax return was accepted six months ago, and my ... - khwp org template instructions

Once you're ready to start filling out the My federal tax return was accepted six months ago, and my ... - khwp org form, you should make certain all required information is prepared. This very part is highly significant, as far as errors and simple typos can result in unwanted consequences. It can be distressing and time-consuming to resubmit entire word form, not to mention penalties resulted from blown due dates. To cope with the digits requires more focus. At first glimpse, there’s nothing tricky about this task. Nonetheless, there's no anything challenging to make a typo. Experts advise to save all sensitive data and get it separately in a different file. Once you've got a template, it will be easy to export this info from the file. Anyway, you ought to pay enough attention to provide actual and solid information. Check the information in your My federal tax return was accepted six months ago, and my ... - khwp org form carefully while completing all necessary fields. You also use the editing tool in order to correct all mistakes if there remains any.

Frequently asked questions about the form My federal tax return was accepted six months ago, and my ... - khwp org

1. Is it legal to complete documents digitally?

In accordance with ESIGN Act 2000, Word forms written out and authorized by using an e-signature are considered as legally binding, similarly to their physical analogs. It means that you are free to fully fill and submit My federal tax return was accepted six months ago, and my ... - khwp org form to the establishment required using digital solution that suits all requirements according to its legitimate purposes, like PDFfiller.

2. Is it secure to submit sensitive information from web application?

Of course, it is completely risk-free because of features provided by the application you use for your work flow. Like, PDFfiller delivers the benefits like these:

- All data is stored in the cloud supplied with multi-tier encryption. Every document is secured from rewriting or copying its content this way. It's only you the one who controls to whom and how this writable document can be shown.

- Each file signed has its own unique ID, so it can’t be forged.

- You can set extra security such as user authentication by picture or password. There is an folder encryption option. Just put your My federal tax return was accepted six months ago, and my ... - khwp org form and set your password.

3. Is there any way to export required data to the writable template?

Yes, but you need a specific feature to do that. In PDFfiller, you can find it as Fill in Bulk. Using this one, you can actually take data from the Excel spreadsheet and insert it into your document.