Get the free BOARD OF ACCOUNTANCY CPA LICENSE APPLICATION ... - maine

Show details

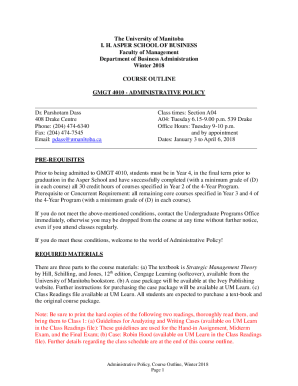

State of Maine Department of Professional & Financial Regulation Office of Professional & Occupational Regulation INDIVIDUAL LICENSE APPLICATION APPLICANT INFORMATION (please print) FIRST FULL LEGAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign board of accountancy cpa

Edit your board of accountancy cpa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your board of accountancy cpa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing board of accountancy cpa online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit board of accountancy cpa. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out board of accountancy cpa

How to fill out board of accountancy CPA:

01

Research the requirements: Before filling out any paperwork, it is important to understand the specific requirements for obtaining a Certified Public Accountant (CPA) license from the Board of Accountancy in your jurisdiction. Look up the necessary qualifications, education, and experience criteria.

02

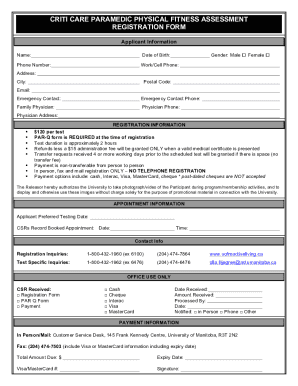

Gather the necessary documents: Prepare all the required documents to submit with your application. This may include transcripts, verification of work experience, proof of education, and other supporting documents. Make sure to check the exact documents required by your specific Board of Accountancy.

03

Complete the application form: Fill out the application form accurately and completely. Pay attention to all the requested information and provide necessary details regarding your personal information, education, work experience, and any additional information required.

04

Provide supporting documentation: Attach all the supporting documents that are requested along with the application form. This may include copies of your degrees, certifications, and other relevant documents.

05

Pay the application fee: Submit the required application fee as mentioned by the Board of Accountancy. The fee may vary depending on your jurisdiction.

06

Review and submit: Once you have completed the application form and gathered all the necessary documents, review everything for accuracy and completeness. Make sure all required fields have been filled out and all requested documents are attached. Double-check for any errors or omissions before submitting the application.

Who needs Board of Accountancy CPA:

01

Aspiring accountants: Individuals who want to pursue a professional career in accounting and work as Certified Public Accountants (CPAs) are required to obtain a license from the Board of Accountancy. This allows them to legally provide services such as auditing, tax preparation, and financial consulting.

02

Accounting students: Students who are studying accounting or are in the process of completing their accounting degree may need to meet the requirements set by the Board of Accountancy to eventually become licensed CPAs. It is important for accounting students to be familiar with the CPA licensure process and plan their educational path accordingly.

03

Current accountants: Accountants who are currently working in the field without a CPA license may consider pursuing licensure through the Board of Accountancy. Having a CPA license can enhance career opportunities, increase earning potential, and provide professional credibility in the accounting industry.

04

Career advancement: Professionals who want to advance their careers in accounting, finance, or related fields may find that obtaining a CPA license from the Board of Accountancy is beneficial. Many senior-level positions in accounting firms, corporations, and government agencies require or prefer candidates with a CPA license.

05

Legal compliance: In some jurisdictions, offering accounting services, particularly services requiring a high level of expertise like audits, without a CPA license from the Board of Accountancy may be illegal. It is important for individuals practicing accounting to ensure they meet the legal requirements and obtain the necessary license.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is board of accountancy cpa?

The Board of Accountancy CPA is a regulatory body that oversees the accounting profession and certifies Certified Public Accountants (CPAs).

Who is required to file board of accountancy cpa?

CPAs and accounting firms are required to file with the Board of Accountancy CPA.

How to fill out board of accountancy cpa?

To fill out the Board of Accountancy CPA, CPAs and accounting firms must provide detailed information about their practices, clients, and financial statements.

What is the purpose of board of accountancy cpa?

The purpose of the Board of Accountancy CPA is to ensure that CPAs and accounting firms adhere to professional standards and regulations to protect the public interest.

What information must be reported on board of accountancy cpa?

The Board of Accountancy CPA requires information such as financial statements, client lists, and compliance with professional standards.

How can I send board of accountancy cpa for eSignature?

When your board of accountancy cpa is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I edit board of accountancy cpa on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing board of accountancy cpa.

How do I complete board of accountancy cpa on an Android device?

Use the pdfFiller Android app to finish your board of accountancy cpa and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your board of accountancy cpa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Board Of Accountancy Cpa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.