Miss Guam Liberation Queen Contest Rules & Registration Form 2013-2025 free printable template

Show details

69th MISS GUAM LIBERATION QUEEN CONTEST RULES & REGULATIONS PART 1 GUIDELINES/RULES 1. Contestant must be a born female, a U.S. citizen and a resident of Guam for at least six (6) months before July

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guam taxes - mcog

Edit your guam taxes - mcog form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guam taxes - mcog form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing guam taxes - mcog online

Follow the steps below to use a professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit guam taxes - mcog. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guam taxes - mcog

How to fill out Miss Guam Liberation Queen Contest Rules &

01

Read the official contest rules thoroughly to understand the requirements.

02

Gather necessary documents, such as proof of residency and eligibility.

03

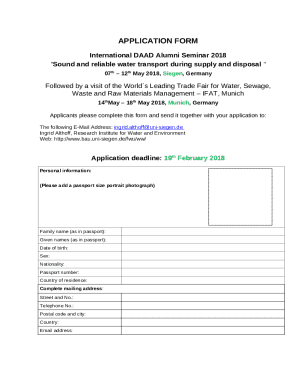

Complete the application form with accurate personal information.

04

Prepare a statement of intent explaining why you want to participate.

05

Select a talent or skill to showcase during the contest.

06

Submit your completed application and any required materials before the deadline.

07

Attend any pre-contest meetings or orientation sessions as prescribed.

Who needs Miss Guam Liberation Queen Contest Rules &?

01

Potential contestants seeking to enter the Miss Guam Liberation Queen Contest.

02

Event organizers who need guidelines to ensure participants meet the criteria.

03

Judges and reviewers who need to assess eligibility and compliance of applicants.

04

Participants' supporters who want to understand the contest framework.

Fill

form

: Try Risk Free

People Also Ask about

What taxes do you Pay in Guam?

Guam does not use a state withholding form because there is no personal income tax in Guam.

Do I have to file a Guam tax return?

More In File An individual who has income from American Samoa, the Commonwealth of the Northern Mariana Islands (CNMI), Guam, Puerto Rico or the U.S. Virgin Islands will usually have to file a tax return with the tax department of one of these territories.

Do you pay federal income tax in Guam?

Guam tax law mirrors US federal tax law, and the Guam corporate tax rate is the same as the US federal corporate tax: 21%. Full-time residents of Guam file taxes with the Government of Guam, with the exception is self-employment taxes, which are filed with the US.

Does Guam have to Pay taxes?

The income tax is the major tax in Guam, providing 60 percent of its locally collected tax revenues. These revenues are supplemented by the transfer from the Federal treasury to the Guam treasury of Federal income taxes withheld from U.S. military and civilian personnel stationed in Guam.

What taxes do Guam residents Pay?

Guam does not use a state withholding form because there is no personal income tax in Guam.

Do I need to file a Guam tax return?

More In File An individual who has income from American Samoa, the Commonwealth of the Northern Mariana Islands (CNMI), Guam, Puerto Rico or the U.S. Virgin Islands will usually have to file a tax return with the tax department of one of these territories.

Is Guam considered a foreign country for tax purposes?

The term "foreign country" does not include U.S. territories such as Puerto Rico, Guam, the Commonwealth of the Northern Mariana Islands, the U.S. Virgin Islands, or American Samoa.

Does Guam have to pay taxes?

The income tax is the major tax in Guam, providing 60 percent of its locally collected tax revenues. These revenues are supplemented by the transfer from the Federal treasury to the Guam treasury of Federal income taxes withheld from U.S. military and civilian personnel stationed in Guam.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in guam taxes - mcog?

The editing procedure is simple with pdfFiller. Open your guam taxes - mcog in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for the guam taxes - mcog in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your guam taxes - mcog in minutes.

How can I fill out guam taxes - mcog on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your guam taxes - mcog by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is Miss Guam Liberation Queen Contest Rules &?

The Miss Guam Liberation Queen Contest Rules outline the eligibility requirements, conduct guidelines, judging criteria, and other regulations governing the contest.

Who is required to file Miss Guam Liberation Queen Contest Rules &?

Contestants who wish to participate in the Miss Guam Liberation Queen Contest must file the rules as part of their entry application.

How to fill out Miss Guam Liberation Queen Contest Rules &?

To fill out the Miss Guam Liberation Queen Contest Rules, contestants should carefully read through the rules, complete the application form according to the instructions, and submit it along with any required documentation.

What is the purpose of Miss Guam Liberation Queen Contest Rules &?

The purpose of the Miss Guam Liberation Queen Contest Rules is to ensure fair competition, maintain high standards of conduct among contestants, and honor the cultural significance of the event.

What information must be reported on Miss Guam Liberation Queen Contest Rules &?

Contestants must report personal information such as name, age, contact details, background information, and agreement to abide by the conduct rules stated in the contest guidelines.

Fill out your guam taxes - mcog online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guam Taxes - Mcog is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.