NY SW 4 2009 free printable template

Show details

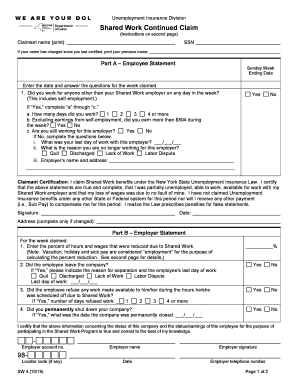

New York State Department of Labor Unemployment Insurance Division Shared Work Continued Claim Social Security Number Waiting Week Certification (Instructions on Reverse) Claimant Name (Please Print)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY SW 4

Edit your NY SW 4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY SW 4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY SW 4 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY SW 4. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY SW 4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY SW 4

How to fill out NY SW 4

01

Obtain the NY SW 4 form from the New York State Department of Taxation and Finance website or your local tax office.

02

Read the instructions provided with the form carefully to understand the information required.

03

Fill out your personal identification information, including your name, address, and social security number.

04

Complete the sections regarding your income and deductions as per the guidelines.

05

Ensure that you double-check all entries for accuracy and completeness.

06

Sign and date the form at the designated area.

07

Submit the completed form according to the filing instructions (mail or electronically).

Who needs NY SW 4?

01

Individuals or businesses who need to report their income for state tax purposes in New York.

02

Any taxpayer seeking to claim residency or filing status for New York State taxes.

03

Anyone who has earned income within New York State and is required to comply with state tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do I file for unemployment for the first time in NY?

Call our Telephone Claim Center, toll-free during business hours to file a claim. 1-888-209-8124. Telephone filing hours are as follows: Monday through Friday, 8:00 am to 5:00 pm.

What documents do I need to file for unemployment in ny?

Ready? Make sure you have with you: Your Social Security number. Your driver license or Motor Vehicle ID card number (if you have either one) Your complete mailing address and zip code. A phone number where we can reach you from 8 am - 5 pm, Monday –Friday.

What is the fax number for the ny Department of Labor?

Fax: (518) 457-9378. Be sure that your Social Security number appears at the top right hand corner on all pages. Save your fax confirmation sheet as we do not confirm the receipt of a fax or written correspondence.

How do I contact ny Department of Labor for unemployment?

Telephone Claims Center. Call the Telephone Claims Center (TCC) toll-free at (888) 209-8124 during the hours of operation: Monday - Friday 8:00 AM - 5:00 PM. Email. Write. Fax. Weekly Benefits. Debit Card Questions. Request a Hearing. Suspected Fraud.

What is the phone number for the ny State Department of Labor?

If you have not received a response to your request within 7 business days, please call the NYS Department of Labor at (518) 485-1283.

How do I file a claim with NYS?

Have your helper call the Telephone Claims Center at 1-888-783-1370. Call a relay operator first at 1-800-662-1220, and ask the operator to call the Telephone Claims Center at 1-888-783-1370. For more information visit our Using the Tel-Service Line page.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NY SW 4 in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your NY SW 4 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send NY SW 4 to be eSigned by others?

Once your NY SW 4 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I fill out NY SW 4 on an Android device?

Use the pdfFiller mobile app to complete your NY SW 4 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is NY SW 4?

NY SW 4 is a New York State withholding exemption certificate that allows employees to claim exemptions from state withholding taxes.

Who is required to file NY SW 4?

Employees who are exempt from New York State income tax withholding or who are claiming exemption from withholding for the current year must file NY SW 4.

How to fill out NY SW 4?

To fill out NY SW 4, employees must provide their personal information, such as their name, address, and Social Security number, and indicate the basis for their exemption.

What is the purpose of NY SW 4?

The purpose of NY SW 4 is to inform employers whether an employee is eligible for an exemption from state income tax withholding.

What information must be reported on NY SW 4?

The information that must be reported on NY SW 4 includes the employee's name, address, Social Security number, and the specific reason for claiming exemption from withholding.

Fill out your NY SW 4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY SW 4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.