Get the free Tax-Forfeited Land Sales - Becker County

Show details

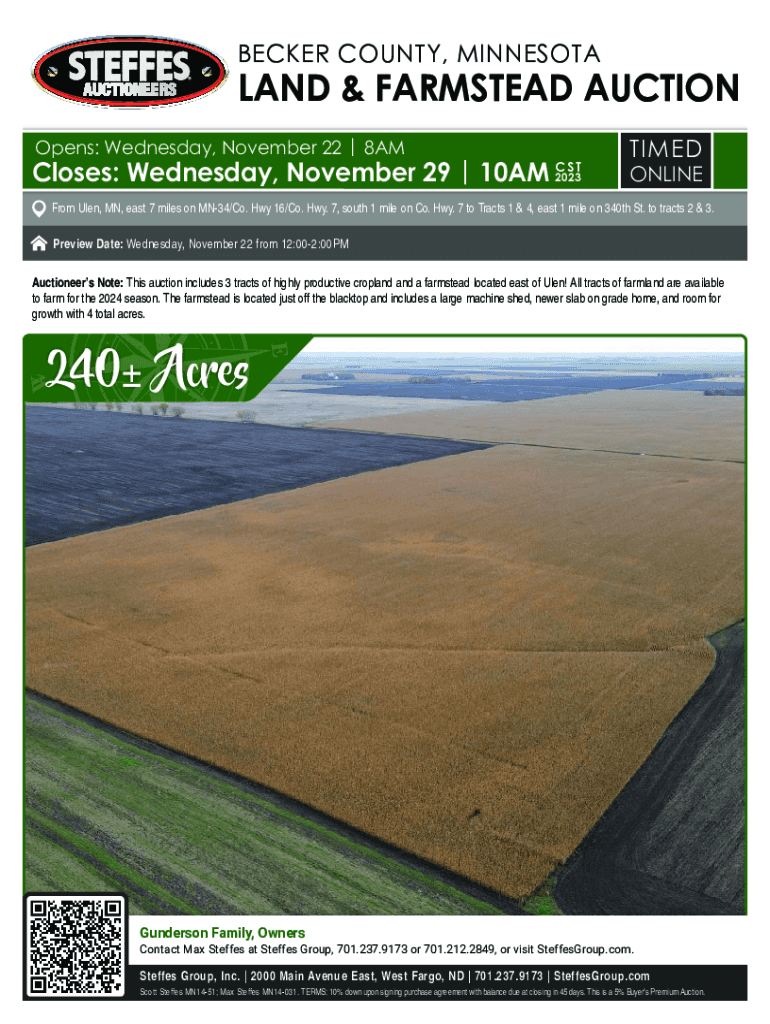

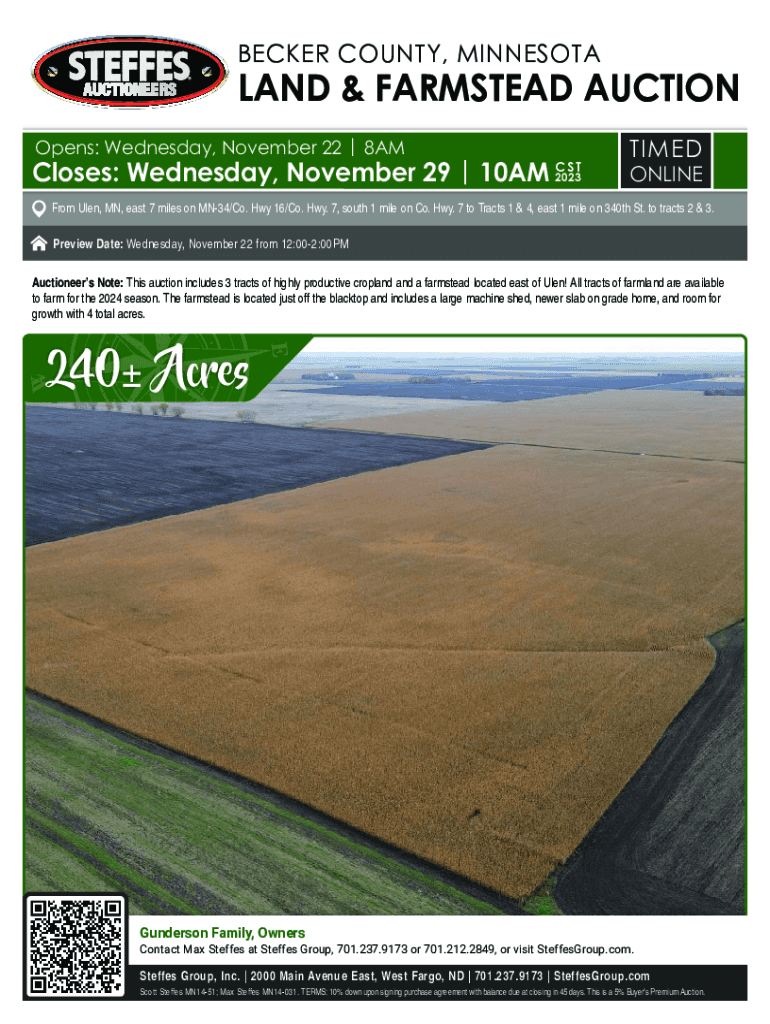

BECKER COUNTY, MINNESOTALAND & FARMSTEAD AUCTION Opens: Wednesday, November 22 | 8AMCloses: Wednesday, November 29 | 10AM 2023CSTTIMED ONLINEFrom Ulen, MN, east 7 miles on MN34/Co. Hwy 16/Co. Hwy.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax-forfeited land sales

Edit your tax-forfeited land sales form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax-forfeited land sales form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax-forfeited land sales online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax-forfeited land sales. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax-forfeited land sales

How to fill out tax-forfeited land sales

01

Determine which tax-forfeited land sales are available in your area.

02

Research the specific requirements for purchasing tax-forfeited land in your area.

03

Obtain the necessary forms and paperwork for the tax-forfeited land sale.

04

Fill out the forms completely and accurately, providing all requested information.

05

Submit the completed forms along with any required fees or deposits to the appropriate governing body.

06

Keep track of any deadlines or important dates related to the tax-forfeited land sale process.

07

Attend any required hearings or meetings related to the tax-forfeited land sale.

08

Wait for the decision on your application for the tax-forfeited land sale.

Who needs tax-forfeited land sales?

01

Investors looking to purchase land at a potentially lower cost.

02

Developers interested in acquiring property for future projects.

03

Local governments aiming to put tax-forfeited land back on the tax rolls.

04

Individuals or organizations seeking to invest in real estate opportunities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax-forfeited land sales from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your tax-forfeited land sales into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send tax-forfeited land sales to be eSigned by others?

Once your tax-forfeited land sales is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an electronic signature for the tax-forfeited land sales in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your tax-forfeited land sales and you'll be done in minutes.

What is tax-forfeited land sales?

Tax-forfeited land sales refer to the process by which property that has been forfeited to the government due to unpaid property taxes is sold at auction to recover the owed taxes and manage the land.

Who is required to file tax-forfeited land sales?

Entities or individuals who have acquired tax-forfeited properties through a sale are typically required to file tax-forfeited land sales documentation.

How to fill out tax-forfeited land sales?

To fill out tax-forfeited land sales, one must complete the designated forms provided by the local government or tax authority, ensuring all required information about the property and transaction is accurately documented.

What is the purpose of tax-forfeited land sales?

The purpose of tax-forfeited land sales is to recover lost tax revenue, return property to productive use, and manage public land resources efficiently.

What information must be reported on tax-forfeited land sales?

Information that must be reported includes the property description, sale price, buyer details, and any outstanding property taxes or liens.

Fill out your tax-forfeited land sales online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax-Forfeited Land Sales is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.