Get the free Private Equity in France: Overview - Practical Law

Show details

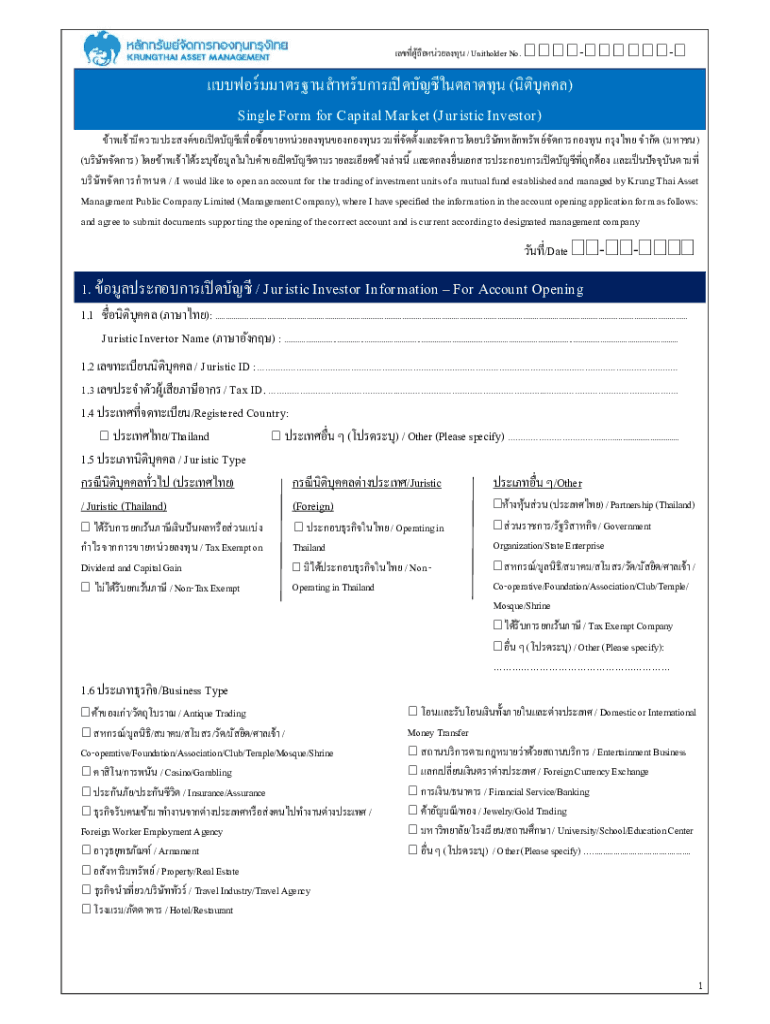

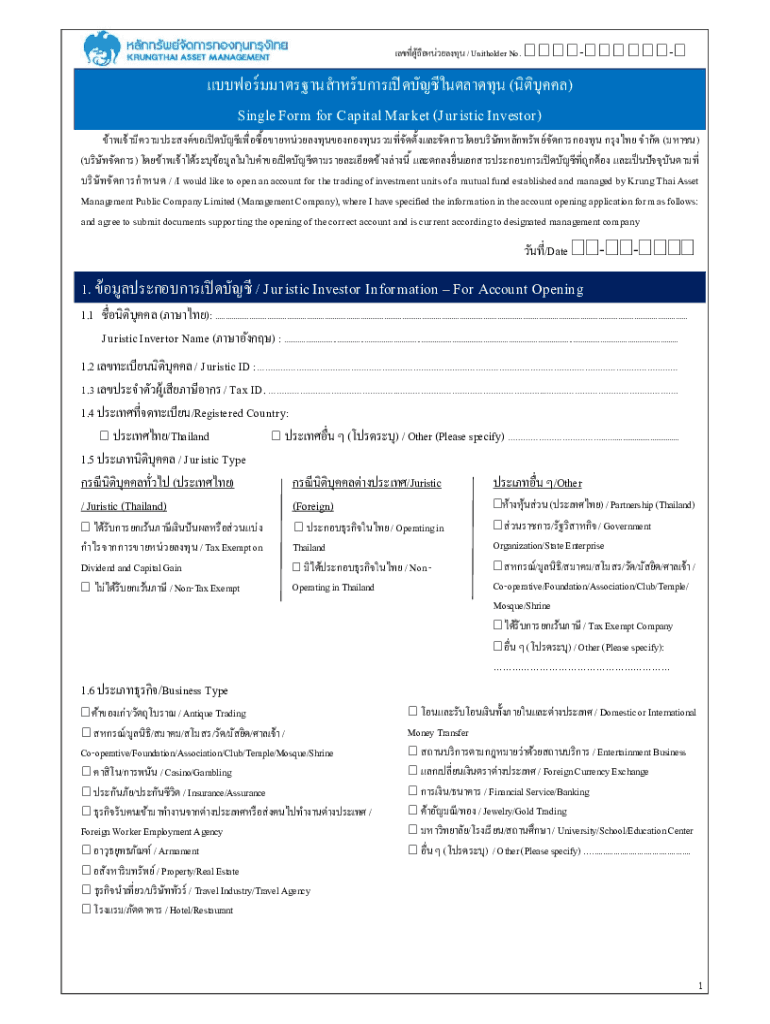

/ Unitholder No. ()

Single Form for Capital Market (Juristic Investor)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign private equity in france

Edit your private equity in france form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private equity in france form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit private equity in france online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit private equity in france. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out private equity in france

How to fill out private equity in france

01

Research different private equity firms in France to find the right match for your investment goals.

02

Contact the chosen private equity firm to express your interest in investing with them.

03

Meet with the firm to discuss your investment objectives, risk tolerance, and potential returns.

04

Provide necessary documentation and information to the firm for evaluation.

05

Negotiate terms and conditions of the investment agreement with the firm.

06

Make an initial capital contribution as per the agreed terms.

07

Monitor the performance of the investment and stay engaged with the firm for updates.

08

Evaluate the results of the investment and decide on next steps based on performance.

Who needs private equity in france?

01

Entrepreneurs looking to finance their businesses and accelerate growth.

02

Established companies seeking capital for expansion, acquisitions, or restructuring.

03

Investors interested in diversifying their portfolios and gaining exposure to different sectors.

04

Institutions or funds looking to participate in the French market and leverage local expertise.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get private equity in france?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific private equity in france and other forms. Find the template you want and tweak it with powerful editing tools.

Can I sign the private equity in france electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your private equity in france and you'll be done in minutes.

Can I create an eSignature for the private equity in france in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your private equity in france and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is private equity in France?

Private equity in France refers to investments made in private companies or the acquisition of public companies with the intention of taking them private. It involves raising capital from investors to acquire equity stakes in companies that are not publicly traded.

Who is required to file private equity in France?

Entities involved in private equity transactions, including investment funds, management companies, and sponsors, are required to file private equity reports in France.

How to fill out private equity in France?

To fill out private equity reporting in France, entities must provide detailed information regarding their investment activities, including the companies they invest in, financial data, and compliance with regulatory requirements.

What is the purpose of private equity in France?

The purpose of private equity in France is to provide capital for companies looking to grow, restructure, or stabilize operations. It aims to generate high returns for investors by improving the companies' performance and exiting through sales or public offerings.

What information must be reported on private equity in France?

Reported information typically includes details about the investment strategy, portfolio companies, financial statements, performance metrics, and compliance with applicable regulations.

Fill out your private equity in france online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Private Equity In France is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.