Get the free RBI Floating Rate Savings Bonds

Show details

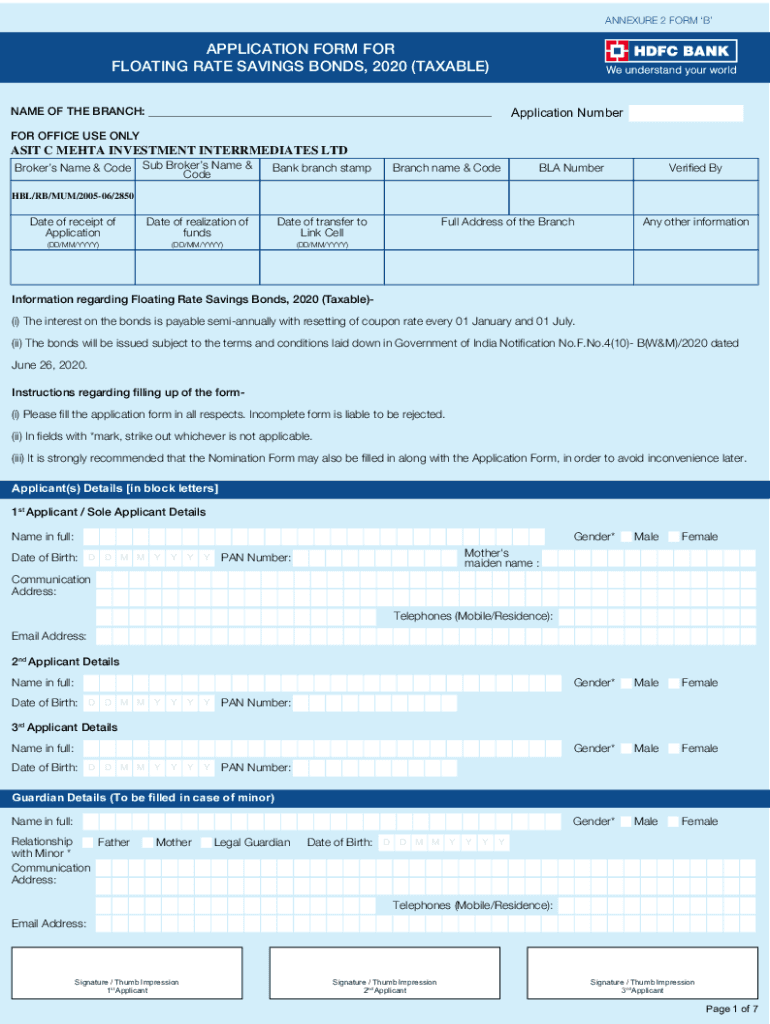

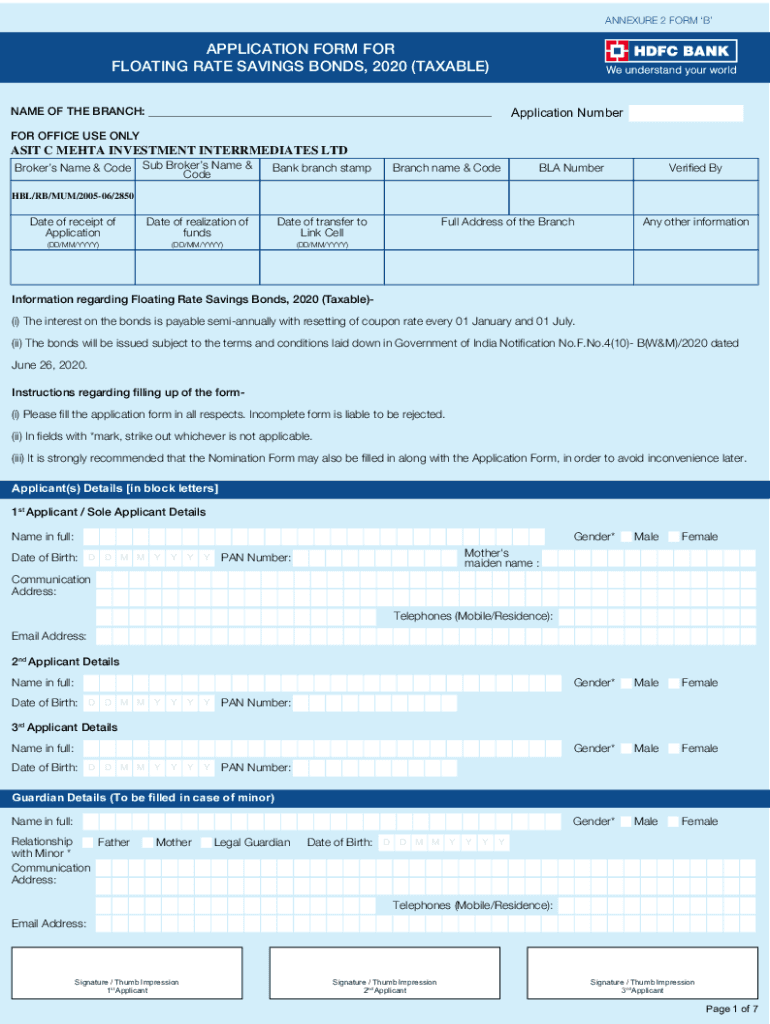

ANNEXURE 2 FORM BAPPLICATION FORM FOR FLOATING RATE SAVINGS BONDS, 2020 (TAXABLE) NAME OF THE BRANCH: ___Application NumberFOR OFFICE USE ONLYASIT C MEHTA INVESTMENT INTERRMEDIATES LTD Sub Brokers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rbi floating rate savings

Edit your rbi floating rate savings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rbi floating rate savings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rbi floating rate savings online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit rbi floating rate savings. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rbi floating rate savings

How to fill out rbi floating rate savings

01

Visit the nearest RBI branch or their official website to obtain the necessary forms for opening a floating rate savings account.

02

Fill out the required personal information, including name, address, contact details, and proof of identity and address.

03

Submit the completed forms along with the necessary documents to the RBI branch or upload them on their website for verification.

04

Wait for the account to be opened and activated by the RBI.

Who needs rbi floating rate savings?

01

Individuals who are looking for a flexible savings option that offers variable interest rates based on market conditions.

02

Those who want to take advantage of potential higher returns by investing in a savings account that adjusts its interest rates periodically.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find rbi floating rate savings?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the rbi floating rate savings in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete rbi floating rate savings online?

pdfFiller has made it easy to fill out and sign rbi floating rate savings. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit rbi floating rate savings on an iOS device?

You certainly can. You can quickly edit, distribute, and sign rbi floating rate savings on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is rbi floating rate savings?

RBI Floating Rate Savings refers to a type of savings account offered by the Reserve Bank of India, where the interest rate is linked to a floating rate benchmark, allowing for adjustments based on market conditions.

Who is required to file rbi floating rate savings?

Individuals and entities holding RBI Floating Rate Savings accounts may be required to file based on their income and financial status for tax purposes.

How to fill out rbi floating rate savings?

To fill out RBI Floating Rate Savings, account holders need to provide personal identification details, account information, and specifics about the funds deposited as required by the regulatory guidelines.

What is the purpose of rbi floating rate savings?

The purpose of RBI Floating Rate Savings is to provide account holders with a means to earn interest on their savings that adjusts according to prevailing interest rates, enhancing their saving potential.

What information must be reported on rbi floating rate savings?

Information that must be reported includes account balance, interest earned during the financial year, and any contributions or withdrawals made throughout the year.

Fill out your rbi floating rate savings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rbi Floating Rate Savings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.