Get the free Budgets for Fiscal Year 2002 - msde maryland

Show details

MARYLAND STATE DEPARTMENT OF EDUCATION Division of Special Education/Early Intervention Services NONPUBLIC SPECIAL EDUCATION SCHOOL BUDGET PACKET FISCAL YEAR 2016 Guidelines and Instructions January

We are not affiliated with any brand or entity on this form

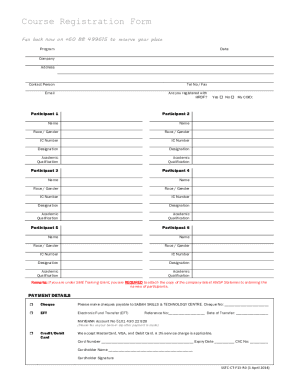

Get, Create, Make and Sign budgets for fiscal year

Edit your budgets for fiscal year form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your budgets for fiscal year form via URL. You can also download, print, or export forms to your preferred cloud storage service.

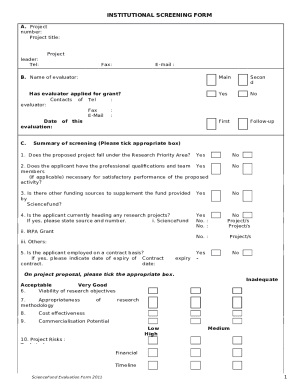

Editing budgets for fiscal year online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit budgets for fiscal year. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

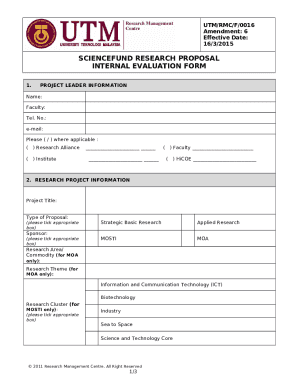

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out budgets for fiscal year

How to Fill Out Budgets for Fiscal Year:

01

Start by gathering all financial documentation from the previous year, including income statements, expense reports, and balance sheets.

02

Analyze the past year's financial performance to identify trends, areas of improvement, and any potential risks or challenges.

03

Set financial goals and objectives for the upcoming fiscal year. Consider factors such as revenue growth targets, expense reduction strategies, and investment opportunities.

04

Create a detailed revenue forecast based on historical data, market analysis, and projected sales or income. Account for any anticipated changes in pricing, product mix, or customer behavior.

05

Assess all fixed and variable expenses for the upcoming year. This includes salaries, utilities, rent, marketing costs, supplies, and any other operating expenses. Consider any potential cost-saving measures or efficiency improvements.

06

Allocate resources appropriately by assigning budgets to various departments or cost centers. This ensures that each area of the organization has the necessary funds to operate effectively and achieve their objectives.

07

Implement a system for tracking and monitoring expenses throughout the year. Regularly review budget performance and adjust as necessary to maintain financial control and make informed decisions.

08

Involve key stakeholders in the budgeting process, such as department heads, finance personnel, and executives. Collaborative input and buy-in from the relevant parties help to ensure accurate and realistic budgets.

09

Communicate the budget to all employees and stakeholders to foster transparency and accountability. This allows everyone to understand the financial goals and constraints of the organization and helps promote responsible financial behavior.

10

Regularly review and update the budget throughout the fiscal year as circumstances change, new information becomes available, or unforeseen events arise.

Who Needs Budgets for Fiscal Year?

01

Individuals: Individuals who want to manage their personal finances effectively or plan for major expenses, such as buying a house or starting a business, can benefit from creating a budget for the fiscal year.

02

Small Businesses: Small business owners need budgets for fiscal years to track their income, expenses, and profitability. It helps in managing cash flow, making strategic business decisions, and staying on top of financial obligations.

03

Nonprofit Organizations: Nonprofits rely on budgets for fiscal years to allocate limited resources efficiently, manage fundraising efforts, and ensure compliance with grant requirements. It helps in demonstrating financial responsibility and planning for the sustainability of the organization.

04

Government Entities: Government agencies at various levels use budgets for fiscal years to allocate funds to different departments, implement policies, and provide public services. It ensures accountability, financial discipline, and effective resource distribution.

05

Corporations: Large corporations need budgets for fiscal years to plan and allocate resources across different departments or business units. It aids in setting performance targets, managing investments, and tracking profitability.

06

Educational Institutions: Schools, colleges, and universities create budgets for fiscal years to plan for educational programs, facilities maintenance, staff salaries, and student services. It helps in optimizing resources, estimating tuition fees, and ensuring financial stability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is budgets for fiscal year?

Budgets for fiscal year are financial plans outlining estimated revenue and expenses for a specific time period.

Who is required to file budgets for fiscal year?

Various entities such as government agencies, organizations, and businesses are required to file budgets for fiscal year.

How to fill out budgets for fiscal year?

Budgets for fiscal year should be filled out by detailing expected income sources and anticipated expenses.

What is the purpose of budgets for fiscal year?

The purpose of budgets for fiscal year is to help in financial planning, decision-making, and accountability.

What information must be reported on budgets for fiscal year?

Information such as projected revenues, anticipated expenses, and budget allocations must be reported on budgets for fiscal year.

How can I edit budgets for fiscal year from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your budgets for fiscal year into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make edits in budgets for fiscal year without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your budgets for fiscal year, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit budgets for fiscal year on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as budgets for fiscal year. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your budgets for fiscal year online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Budgets For Fiscal Year is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.