Get the free Enrolled agents who have your own practice : r/taxpros

Show details

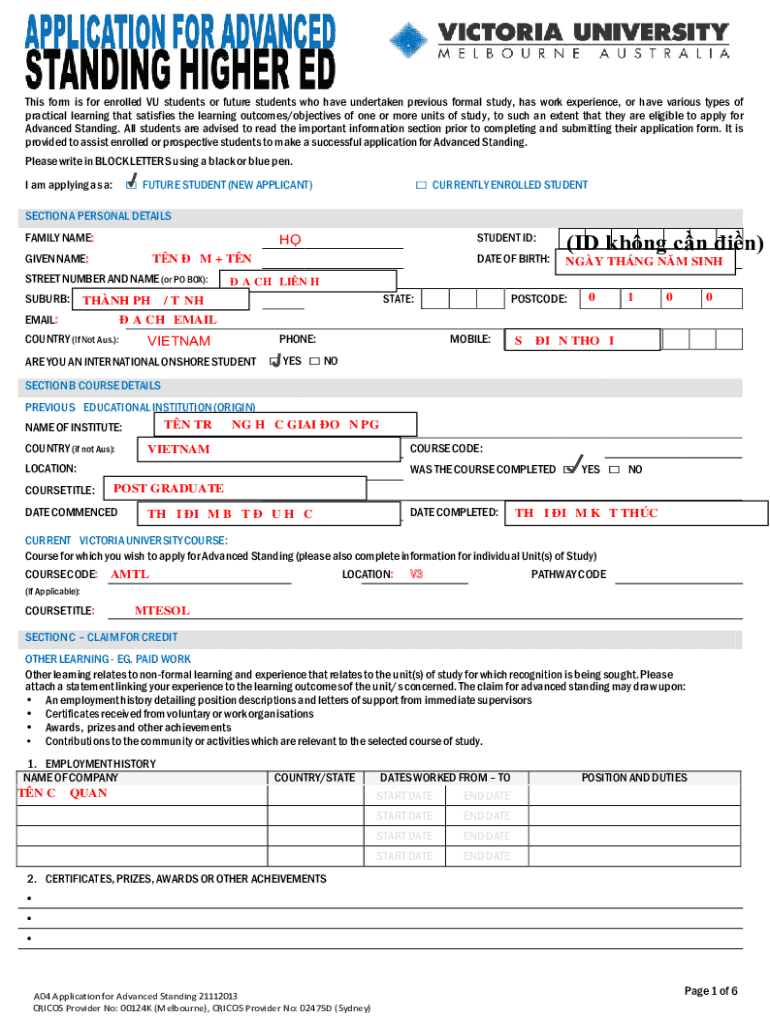

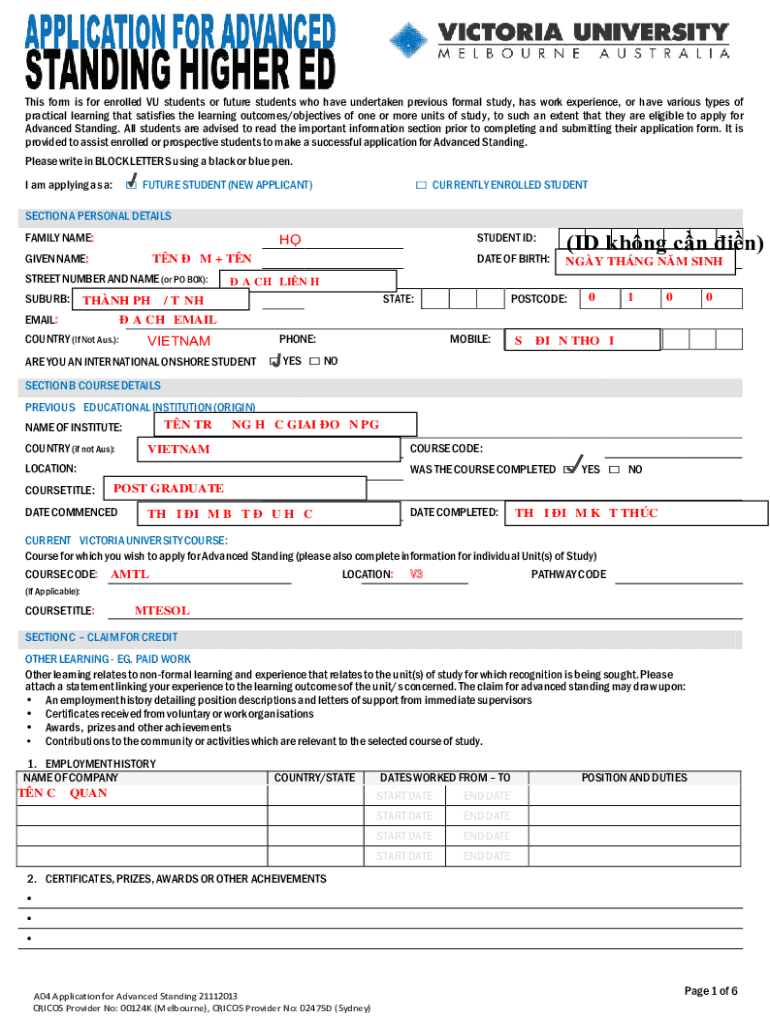

This form is for enrolled VU students or future students who have undertaken previous formal study, has work experience, or h ave various types of practical learning that satisfies the learning outcomes/objectives

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign enrolled agents who have

Edit your enrolled agents who have form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your enrolled agents who have form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing enrolled agents who have online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit enrolled agents who have. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out enrolled agents who have

How to fill out enrolled agents who have

01

Obtain a PTIN (Preparer Tax Identification Number) from the IRS.

02

Pass the Special Enrollment Examination (SEE).

03

Submit to a background check.

04

Complete the application form.

05

Pay the enrollment fee.

06

Wait for approval from the IRS.

Who needs enrolled agents who have?

01

Individuals and businesses who require assistance with tax preparation and planning.

02

Those looking for representation before the IRS during audits, appeals, and collections.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my enrolled agents who have directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your enrolled agents who have and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get enrolled agents who have?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific enrolled agents who have and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I edit enrolled agents who have on an iOS device?

Use the pdfFiller mobile app to create, edit, and share enrolled agents who have from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is enrolled agents who have?

Enrolled agents are federally authorized tax practitioners who have the privilege to represent taxpayers before the Internal Revenue Service (IRS). They may also have completed specific requirements or undergone a background check.

Who is required to file enrolled agents who have?

Any individual or entity that wishes to represent clients in tax matters before the IRS must file with enrolled agents. This includes tax professionals who require a license to act on behalf of clients.

How to fill out enrolled agents who have?

Filling out the representation paperwork involves completing Form 2848, Power of Attorney and Declaration of Representative, and submitting it to the IRS along with any required documentation.

What is the purpose of enrolled agents who have?

The purpose of enrolled agents is to provide taxpayers with knowledgeable representation, ensuring compliance with tax laws and helping to resolve any issues that arise with the IRS.

What information must be reported on enrolled agents who have?

The information that must be reported includes the taxpayer's name, taxpayer identification number, address, and description of the tax matters for which representation is authorized.

Fill out your enrolled agents who have online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Enrolled Agents Who Have is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.