Get the free how tax reform will grow our economy and create jobs ...

Show details

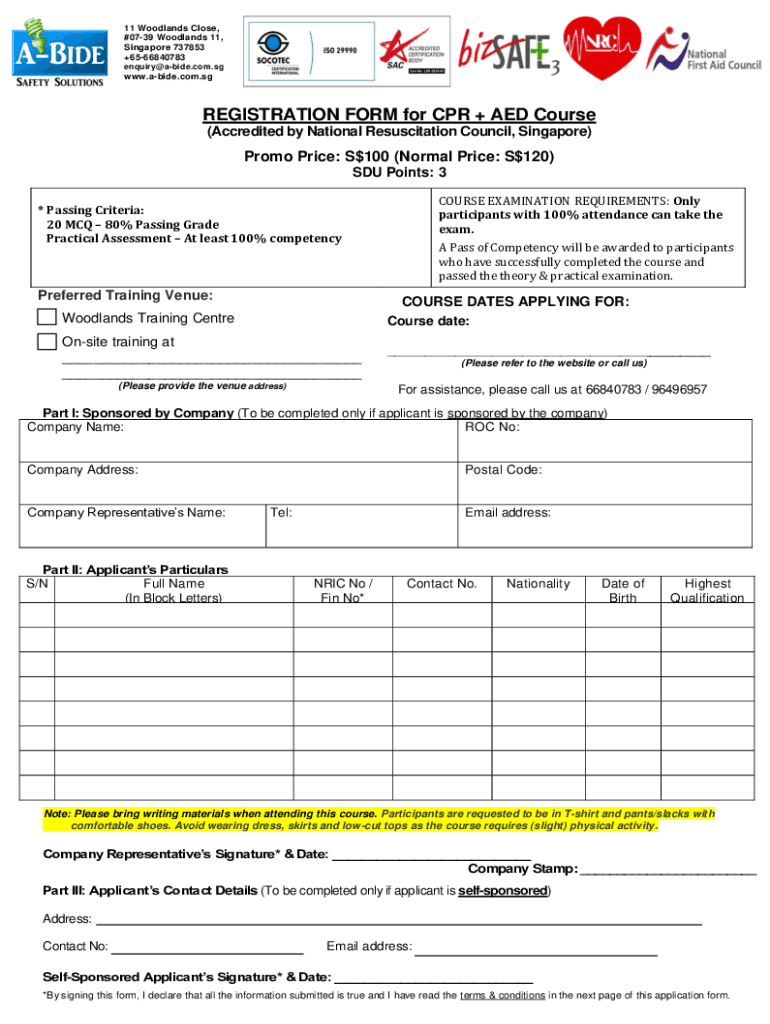

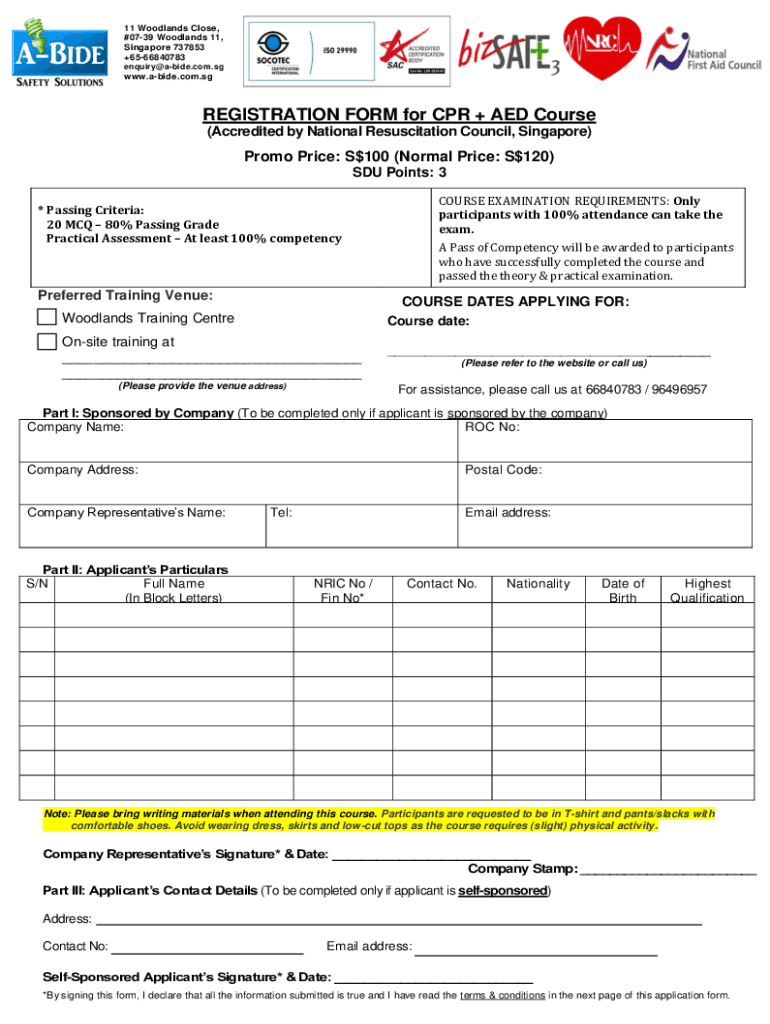

11 Woodlands Close, #0739 Woodlands 11, Singapore 737853 +6566840783 enquiry@abide.com.sgwww.abide.com.sgREGISTRATION FORM for CPR + AED Course (Accredited by National Resuscitation Council, Singapore)Promo

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how tax reform will

Edit your how tax reform will form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how tax reform will form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit how tax reform will online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit how tax reform will. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how tax reform will

How to fill out how tax reform will

01

Gather all necessary documents such as income statements, receipts, and tax forms.

02

Determine your filing status and eligibility for any tax credits or deductions.

03

Fill out the tax reform section of the appropriate tax form, making sure to follow any provided instructions.

04

Double-check all information for accuracy before submitting your tax return.

05

Consider seeking assistance from a tax professional if you are unsure about how to fill out the tax reform section correctly.

Who needs how tax reform will?

01

Individuals who are required to file a tax return

02

Taxpayers who want to take advantage of any new tax laws or provisions

03

People who want to ensure they are complying with current tax regulations

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify how tax reform will without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your how tax reform will into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I get how tax reform will?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the how tax reform will in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute how tax reform will online?

With pdfFiller, you may easily complete and sign how tax reform will online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

What is how tax reform will?

Tax reform refers to changes made to the tax system, which may include adjustments to tax rates, deductions, credits, and filing procedures to improve efficiency and fairness in tax collection.

Who is required to file how tax reform will?

Individuals and entities whose taxable income meets certain thresholds, including employees, business owners, and self-employed individuals are generally required to file tax returns under the tax reform regulations.

How to fill out how tax reform will?

To fill out tax forms related to the tax reform, individuals should gather their financial records, use the appropriate tax forms provided by the IRS or tax authorities, follow the instructions for each section, and ensure all required information is accurately reported.

What is the purpose of how tax reform will?

The purpose of tax reform is to simplify the tax code, promote economic growth, and ensure a fair distribution of tax burdens among individuals and businesses.

What information must be reported on how tax reform will?

Taxpayers must report their income, deductions, credits, and any other relevant financial information as required by the tax code under the new tax reform provisions.

Fill out your how tax reform will online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How Tax Reform Will is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.