Get the free Business Tax Receipt Application (Commercial)

Show details

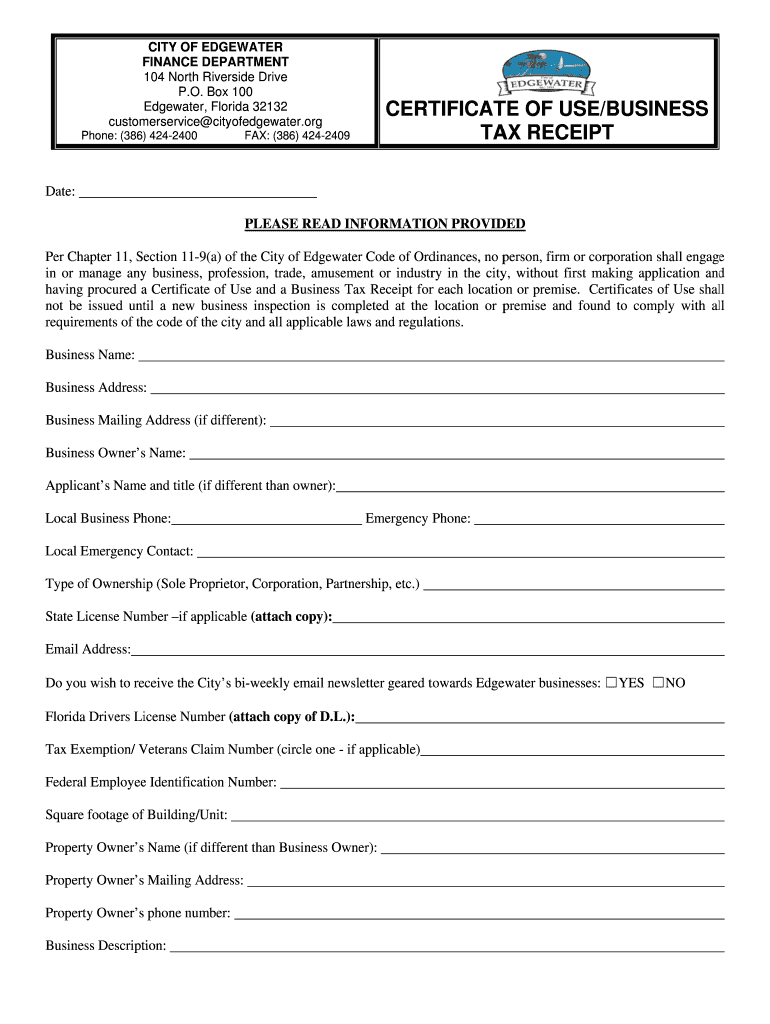

CITY OF ED EDGEWATER FINANCE DE F DEPARTMENT T 104 North Riv version Drive P.O. BO 100 ox Edgewater, Florida 32132 F custom preservice c cityofedgewat TER.org Phone: (386) 424-2400) CERT TYPICAL OF

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business tax receipt application

Edit your business tax receipt application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business tax receipt application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business tax receipt application online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit business tax receipt application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business tax receipt application

How to fill out a business tax receipt application:

01

Begin by obtaining the necessary forms: Contact your local government agency or visit their website to download or request the business tax receipt application form.

02

Provide your business information: Fill in your legal business name, address, phone number, email address, and any other required contact details.

03

Determine your business type: Specify the nature of your business, whether it is a sole proprietorship, partnership, corporation, or any other legal entity.

04

Select the appropriate tax category: Identify the specific tax category that corresponds to your business activities. Common tax categories include retail, professional services, manufacturing, food service, and others.

05

Estimate your annual gross receipts: Provide an estimate of your business's annual gross receipts or revenue. This will help determine the tax rate or fee applicable to your business.

06

Fill out any additional required information: The application may ask for further details about your business activities, licenses, permits, and other relevant information. Make sure to complete all sections accurately.

07

Attach any necessary documents: Some business tax receipt applications may require you to provide additional documentation, such as a copy of your business license or a certificate of occupancy. Check the application guidelines to ensure you include any required attachments.

08

Calculate and pay the required fees: Based on your business type and estimated gross receipts, calculate the appropriate tax or fee amount. Include a check or money order payable to the designated government agency, or follow the instructions for online payment, if available.

09

Review and submit the completed application: Carefully review all the information provided on the application form for accuracy and completeness. Once satisfied, submit the application along with the required payment and attachments to the designated government office.

Who needs a business tax receipt application:

01

Small business owners: Small businesses, whether operating as sole proprietors, partnerships, or corporations, usually need to obtain a business tax receipt. This applies to a wide range of industries, from retail stores and restaurants to service providers and contractors.

02

Entrepreneurs starting a new business: Individuals starting a new business venture must typically apply for a business tax receipt to comply with local regulations and taxation requirements.

03

Established businesses changing location: If your business is relocating to a new address within the same jurisdiction, you may be required to update your business tax receipt application to reflect the new location.

04

Residents engaging in home-based businesses: Home-based business owners are often required to apply for a business tax receipt to operate legally and maintain compliance with local zoning and tax regulations.

05

Professional service providers: Professionals such as doctors, lawyers, accountants, consultants, and other professional service providers often need a business tax receipt to practice and offer their services within a specific jurisdiction.

06

Non-profit organizations: Certain non-profit entities, especially those engaged in commercial activities or fundraising efforts, may be required to obtain a business tax receipt.

It's important to note that specific requirements and regulations surrounding business tax receipts may vary depending on your location. Therefore, it's recommended to consult with your local government agency or seek professional advice to ensure compliance with all applicable regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is business tax receipt application?

Business tax receipt application is a form that businesses must fill out in order to obtain a license to operate legally.

Who is required to file business tax receipt application?

All businesses, including sole proprietors, partnerships, corporations, and LLCs, are required to file a business tax receipt application.

How to fill out business tax receipt application?

To fill out a business tax receipt application, businesses must provide information such as their name, address, type of business, number of employees, and revenue.

What is the purpose of business tax receipt application?

The purpose of the business tax receipt application is to ensure that businesses are operating legally and that they are paying the appropriate taxes.

What information must be reported on business tax receipt application?

Businesses must report information such as their name, address, type of business, number of employees, and revenue on the business tax receipt application.

How can I send business tax receipt application to be eSigned by others?

Once your business tax receipt application is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find business tax receipt application?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the business tax receipt application in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit business tax receipt application on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign business tax receipt application on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your business tax receipt application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Tax Receipt Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.