Get the free Bail Bond Agency/Branch Office License Application - dol wa

Show details

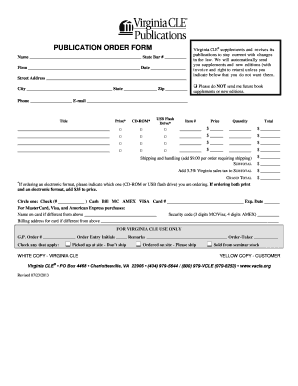

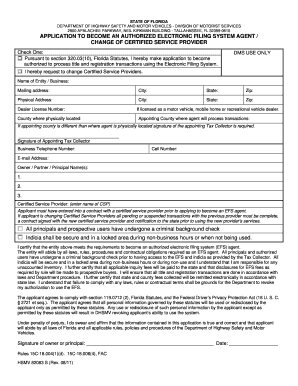

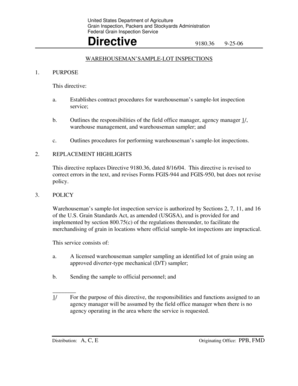

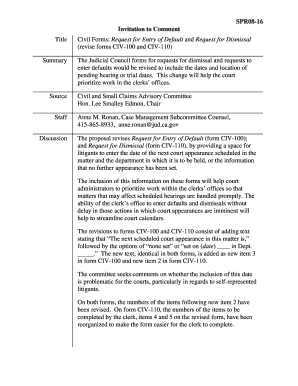

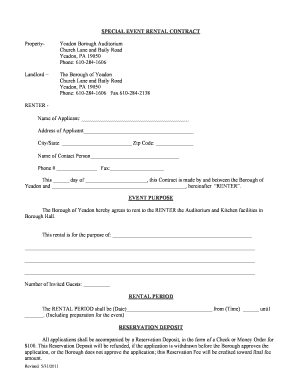

This document is an application form for obtaining a Bail Bond Agency or Branch Office license in the state of Washington. It includes detailed instructions on required documentation, fees for various

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bail bond agencybranch office

Edit your bail bond agencybranch office form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bail bond agencybranch office form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bail bond agencybranch office online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit bail bond agencybranch office. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bail bond agencybranch office

How to fill out Bail Bond Agency/Branch Office License Application

01

Obtain the Bail Bond Agency/Branch Office License Application form from your local regulatory authority or agency website.

02

Fill out the application form with accurate and complete information. This includes your name, address, and business details.

03

Provide the necessary documentation such as proof of identity, background checks, and any required financial statements.

04

Ensure that all applicants (if applicable) are listed and that they also meet licensing requirements.

05

Pay the required application fee, as specified in the application guidelines.

06

Review the application thoroughly for any errors or missing information.

07

Submit the application along with any supporting documents to the appropriate licensing authority.

08

Await approval and be prepared to provide additional information if requested during the review process.

Who needs Bail Bond Agency/Branch Office License Application?

01

Individuals or businesses that wish to operate as a bail bond agency or branch office.

02

Persons looking to provide bail services to defendants in criminal cases.

03

Anyone who wants to comply with state regulations governing the bail bond industry.

Fill

form

: Try Risk Free

People Also Ask about

How much does a bondsman get paid?

What are Top 10 Highest Paying Cities for Bail Bondsman Jobs CityAnnual SalaryMonthly Pay Berkeley, CA $40,253 $3,354 Sitka, AK $39,603 $3,300 San Francisco, CA $38,732 $3,227 Santa Clara, CA $38,609 $3,2176 more rows

How to get a bail bondsman license in Texas?

Pre-Licensing Course and State Exam To become a bail bondsman in Texas, you must complete an 8-hour pre-licensing course from an accredited institution. This course covers the basics of the bail bonds industry, including laws and regulations as outlined in the Texas Insurance Code.

How do I become a bail bond agent in the US?

The most common requirements include: Be 18 years of age or older. Attain a high school diploma or GED equivalent. Take a bail bond pre-licensing course. Pass the state exam. Be able to cover all surety financial obligations. Get endorsed by a surety company.

Is it worth it to be a bail bondsman?

It pays well Although you may not become rich over night while working as a bail bondsman, the earning potential in this career is great. For instance, a bail bondsman working as a part-time agent by just writing three or four bonds a month can make enough income to replace a full-time paying job.

What disqualifies you from being a bail bondsman?

You cannot have any felony convictions. If you have a felony on your record, you are automatically disqualified from becoming a bail bonds agent. Minor offenses can also disqualify you. For example, if you have been convicted of a misdemeanor drug offense within the last 24 months, you are not eligible to apply.

How much commission do bail bondsmen make?

Behind the Scenes: How Bail Bondsmen Make Money In San Diego, this rate is set at 10% by the California Department of Insurance but can be discounted down to a 7% rate. This isn't refundable in the state, so the bondsman keeps the fee as payment regardless.

How much can a bondsman make?

What are Top 10 Highest Paying Cities for Bail Bondsman Jobs CityAnnual SalaryMonthly Pay San Francisco, CA $38,732 $3,227 Santa Clara, CA $38,609 $3,217 Sunnyvale, CA $38,583 $3,215 Livermore, CA $38,561 $3,2136 more rows

How does a bondsman make money?

A bail bondsman is a person or company that posts bail for you (the defendant in a criminal case). Bondsmen are for-profit entities that make money off the fees they charge for bail bond services and for posting bail. They also make money by suing to repossess any property that was used as collateral for the bail bond.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Bail Bond Agency/Branch Office License Application?

The Bail Bond Agency/Branch Office License Application is a formal document that entities must submit to obtain a license to operate a bail bond agency or branch office. It provides regulatory authorities with necessary information about the business and its compliance with legal requirements.

Who is required to file Bail Bond Agency/Branch Office License Application?

Individuals or business entities wishing to establish a bail bond agency or branch office are required to file the Bail Bond Agency/Branch Office License Application. This typically includes bail bond agents, companies, or partnerships that provide bail bond services.

How to fill out Bail Bond Agency/Branch Office License Application?

To fill out the application, applicants must complete all required sections, providing accurate and thorough information about the agency's ownership, business structure, financial information, and any previous legal or regulatory issues. Supporting documents, such as proof of financial stability and background checks, should also be included.

What is the purpose of Bail Bond Agency/Branch Office License Application?

The purpose of the Bail Bond Agency/Branch Office License Application is to ensure that bail bond providers meet legal standards and regulations, promote accountability, protect the public from unauthorized practices, and ensure the integrity of the bail bond industry.

What information must be reported on Bail Bond Agency/Branch Office License Application?

The application must typically report information including the agency's name and address, owners' personal information, financial statements, details of any criminal or disciplinary history, and any relevant licenses or certifications held by the agency or its agents.

Fill out your bail bond agencybranch office online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bail Bond Agencybranch Office is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.