Get the free Bare Gift and Loan Trust Deed and Loan Agreement

Show details

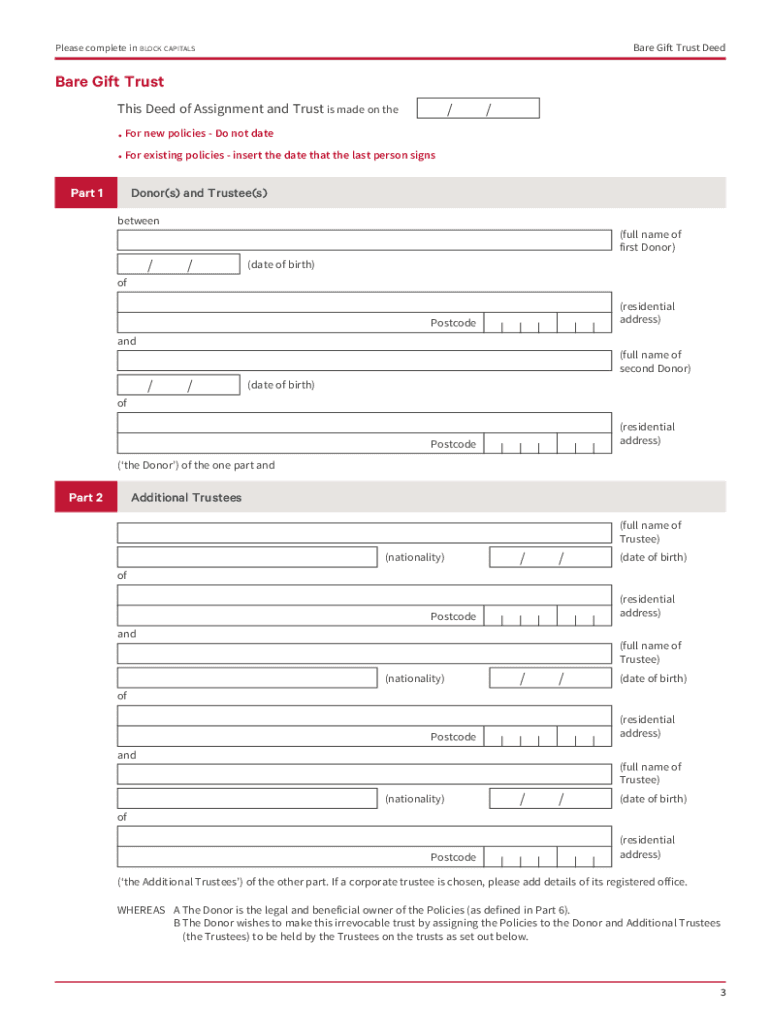

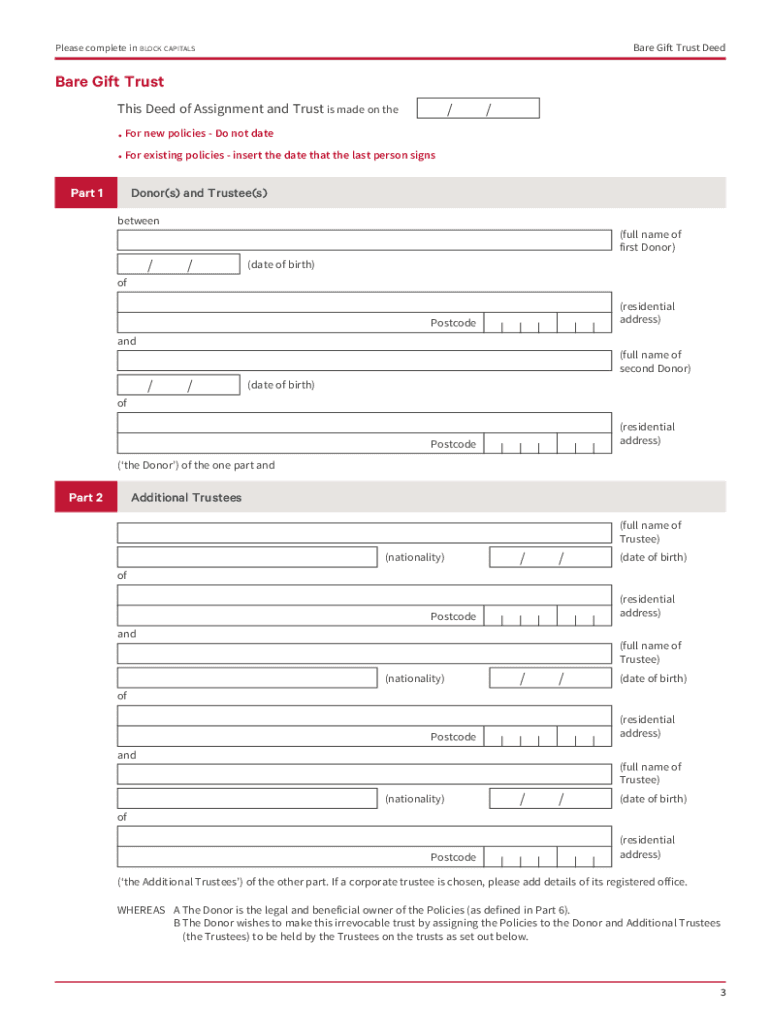

Bare Gift Trust Deed

This trust deed may be used for policies issued by:

Canada Life Limited

Canada Life International Limited

CLI Institutional Limited

Canada Life International Assurance (Ireland)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bare gift and loan

Edit your bare gift and loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bare gift and loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bare gift and loan online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bare gift and loan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bare gift and loan

How to fill out bare gift and loan

01

Identify the giver and receiver of the gift or loan.

02

Determine the value or terms of the gift or loan.

03

Complete a written agreement outlining the terms and conditions of the gift or loan.

04

Have both parties sign and date the agreement.

05

Keep a copy of the agreement for your records.

Who needs bare gift and loan?

01

Individuals who want to transfer ownership of assets to someone else while still retaining certain rights or benefits.

02

Individuals who want to lend money to someone else and ensure that the terms of the loan are legally binding.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send bare gift and loan for eSignature?

bare gift and loan is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I complete bare gift and loan online?

pdfFiller has made it easy to fill out and sign bare gift and loan. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out the bare gift and loan form on my smartphone?

Use the pdfFiller mobile app to fill out and sign bare gift and loan on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is bare gift and loan?

A bare gift and loan refers to a financial arrangement where an individual provides money or property to another individual without requiring repayment, or lends money or property without formal terms of repayment, thus essentially making it a gift.

Who is required to file bare gift and loan?

Individuals who make gifts exceeding the annual exclusion limit set by the IRS or those who provide loans to family or friends without charging interest may be required to file bare gift and loan forms.

How to fill out bare gift and loan?

To fill out bare gift and loan forms, one should include information such as the names and addresses of the parties involved, the amount or value of the gift or loan, the date it was given, and any terms or conditions attached.

What is the purpose of bare gift and loan?

The purpose of filing bare gift and loan forms is to ensure compliance with tax regulations and to report transfers of wealth that may have tax implications.

What information must be reported on bare gift and loan?

Information that must be reported includes the donor's and recipient's details, the amount or value of the gift or loan, the date of the transaction, and any applicable terms or conditions.

Fill out your bare gift and loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bare Gift And Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.