Get the free Texas Automotive Oil Fee Report

Show details

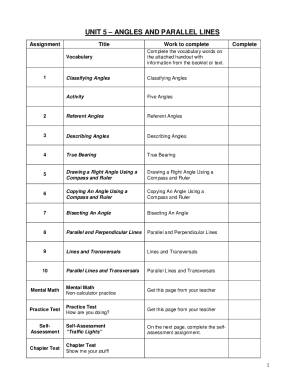

AB CD Remember to print and sign your report. 66-103 (Rev.3-13/9) b. Texas Automotive Oil Fee Reports a. b 69100 I c. Fee payer number Do not write in shaded areas. e. d. Filing period b h. g. Name

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign texas automotive oil fee

Edit your texas automotive oil fee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas automotive oil fee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing texas automotive oil fee online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit texas automotive oil fee. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out texas automotive oil fee

How to fill out the Texas automotive oil fee:

01

Obtain the necessary forms: Begin by downloading or requesting the Texas automotive oil fee form. This form can typically be found on the official website of the Texas Comptroller of Public Accounts.

02

Gather required information: Collect all the required information before starting to fill out the form. This may include your personal details, business details (if applicable), and relevant transaction information.

03

Accurately fill out the form: Carefully enter the information requested on the form, ensuring its accuracy. Double-check all details to avoid any mistakes or inaccuracies that could lead to delays or issues.

04

Calculate the oil fee: Texas automotive oil fee calculation is based on the total number of gallons of oil sold during a reporting period. Use the provided instructions or refer to the Texas Comptroller's guidelines to correctly calculate and report the fee owed.

05

Submit the form: Once you have filled out the form and calculated the oil fee, submit it to the Texas Comptroller's office either electronically or via mail, as directed on the form.

06

Keep copies for your records: Make sure to keep a copy of the submitted form for your records. It's important to have proof of submission in case any discrepancies arise in the future.

Who needs the Texas automotive oil fee?

01

Automotive oil sellers: Any individual or business engaged in the sale of automotive oil in Texas is required to pay the automotive oil fee.

02

Retailers: Retailers that sell automotive oil directly to consumers, whether through physical stores or online platforms, fall under the scope of the Texas automotive oil fee requirement.

03

Distributors and wholesalers: Distributors and wholesalers involved in the distribution of automotive oil within Texas are also obligated to pay the automotive oil fee.

04

Importers: Importers bringing automotive oil into Texas from other states or countries must comply with the Texas automotive oil fee regulations.

It's crucial for those who meet the aforementioned criteria to understand and fulfill their obligations related to the Texas automotive oil fee to avoid penalties or legal consequences.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is texas automotive oil fee?

The texas automotive oil fee is a fee imposed on the sale of motor oil in the state of Texas.

Who is required to file texas automotive oil fee?

Retailers or sellers of motor oil are required to file the texas automotive oil fee.

How to fill out texas automotive oil fee?

To fill out the texas automotive oil fee, retailers must report the total amount of motor oil sold and calculate the fee owed.

What is the purpose of texas automotive oil fee?

The purpose of the texas automotive oil fee is to fund environmental programs and initiatives in the state of Texas.

What information must be reported on texas automotive oil fee?

Retailers must report the total amount of motor oil sold and calculate the fee owed.

How can I manage my texas automotive oil fee directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your texas automotive oil fee along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send texas automotive oil fee to be eSigned by others?

To distribute your texas automotive oil fee, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I sign the texas automotive oil fee electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your texas automotive oil fee.

Fill out your texas automotive oil fee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Automotive Oil Fee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.