Get the free Islamic Microfinance - A Real Hope for Poor

Show details

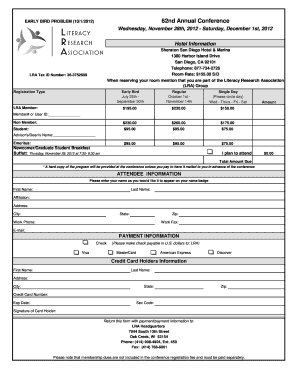

Registration FormPlease complete and return by email, regular mail or fax. Please note that the name and title you give here will be printed on certificates.Sponsorship Information Title:Prof.Dr.Mr.Ms.Mrs.OtherFull

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign islamic microfinance - a

Edit your islamic microfinance - a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your islamic microfinance - a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing islamic microfinance - a online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit islamic microfinance - a. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out islamic microfinance - a

How to fill out islamic microfinance - a

01

Contact an Islamic microfinance institution to obtain the application form.

02

Fill out the application form with accurate personal and financial information.

03

Provide the necessary documentation such as proof of income, identification documents, and business plans.

04

Submit the completed application form and documents to the Islamic microfinance institution.

05

Await approval from the institution and comply with any additional requirements for disbursement of funds.

Who needs islamic microfinance - a?

01

Small business owners who are looking for interest-free financing options based on Islamic principles.

02

Individuals with limited access to traditional banking services who want to support ethical and socially responsible financial practices.

03

Entrepreneurs who prefer financing options that align with their religious beliefs and values.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify islamic microfinance - a without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your islamic microfinance - a into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit islamic microfinance - a on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share islamic microfinance - a on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I fill out islamic microfinance - a on an Android device?

Complete your islamic microfinance - a and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is islamic microfinance - a?

Islamic microfinance is a form of financial service that adheres to Islamic law (Sharia) principles, providing small loans and financial support without charging interest (Riba), often utilizing profit-sharing or partnership models.

Who is required to file islamic microfinance - a?

Individuals or organizations engaged in providing Islamic microfinance services are typically required to file relevant documentation to regulatory authorities, including microfinance institutions and/or non-governmental organizations offering such services.

How to fill out islamic microfinance - a?

Filling out an Islamic microfinance application involves providing personal information, financial history, purpose of the loan, and adhering to the Islamic financing principles, ensuring that all information is accurate and complies with regulatory requirements.

What is the purpose of islamic microfinance - a?

The purpose of Islamic microfinance is to provide financial inclusion and support for small entrepreneurs and low-income individuals in a manner that is Sharia-compliant, promoting ethical investments and community development.

What information must be reported on islamic microfinance - a?

Reporting on Islamic microfinance typically includes details on client demographics, loan amounts, repayment schedules, profit-sharing arrangements, and adherence to Sharia-compliant principles.

Fill out your islamic microfinance - a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Islamic Microfinance - A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.