Get the free Tax Sale Cambria County Pa

Show details

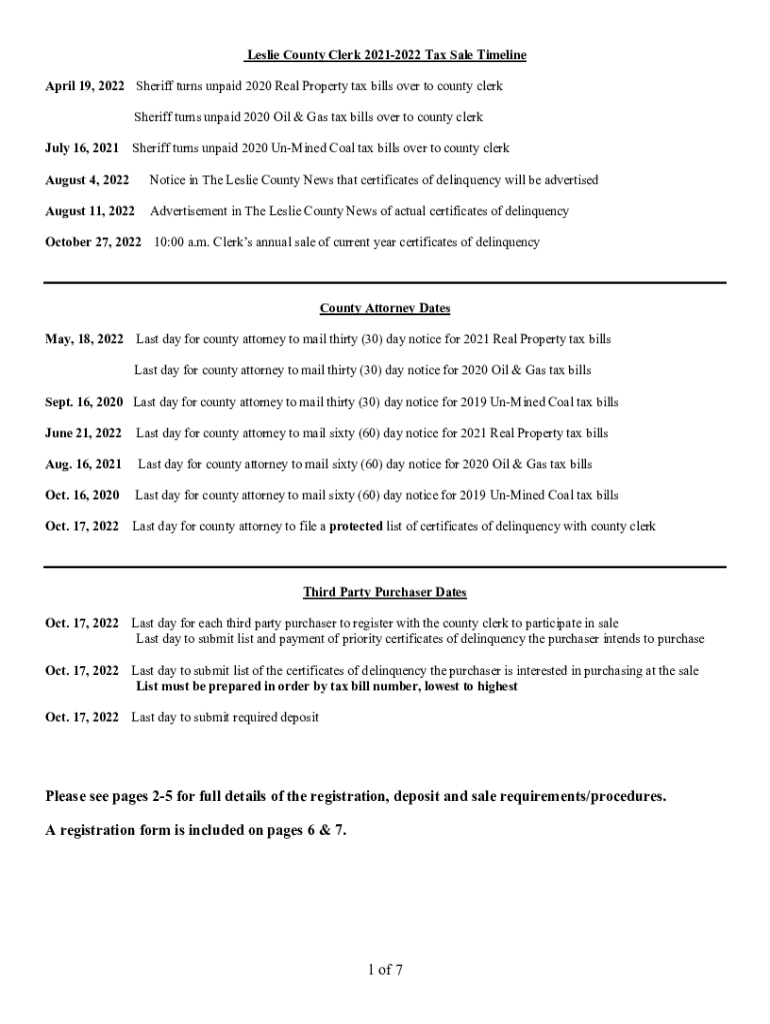

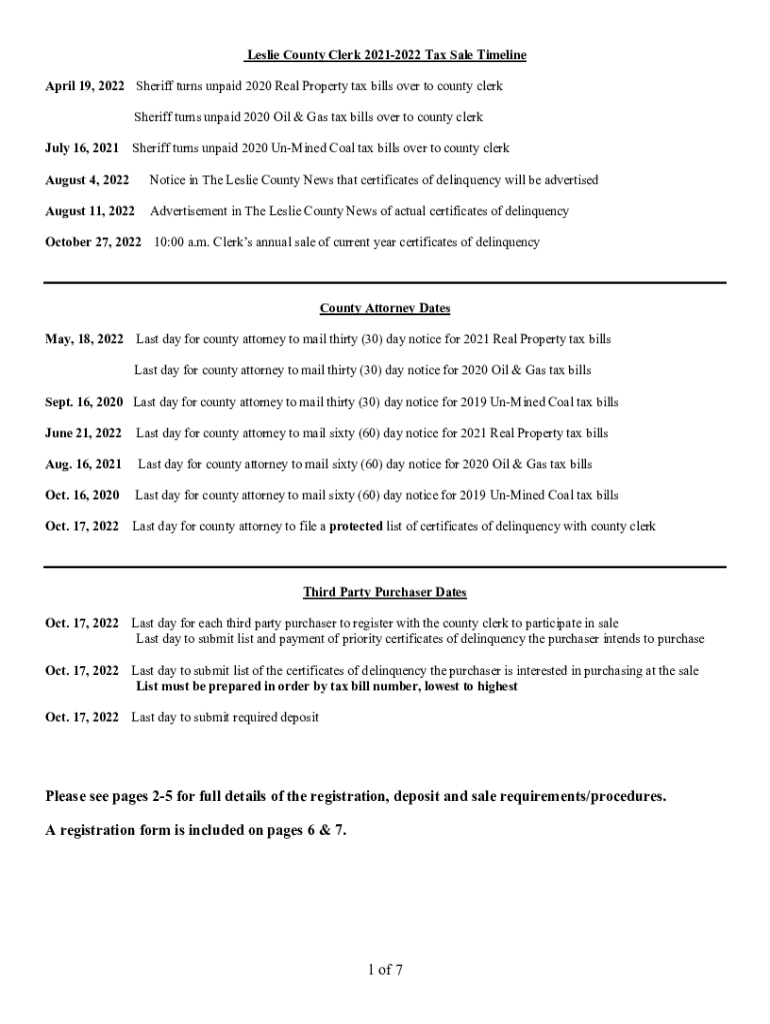

Leslie County Clerk 20212022 Tax Sale Timeline April 19, 2022 Sheriff turns unpaid 2020 Real Property tax bills over to county clerk Sheriff turns unpaid 2020 Oil & Gas tax bills over to county clerk

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax sale cambria county

Edit your tax sale cambria county form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax sale cambria county form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax sale cambria county online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax sale cambria county. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax sale cambria county

How to fill out tax sale cambria county

01

Obtain a list of properties that will be available for tax sale in Cambria County.

02

Review the list of properties and determine which ones you are interested in purchasing.

03

Attend the tax sale auction in person or online.

04

Register to bid on the properties you are interested in.

05

Follow the auctioneer's instructions when bidding on properties.

06

If you are the winning bidder, pay the necessary deposit and complete the purchase paperwork.

07

Pay the remaining balance on the property within the specified timeframe.

08

Complete any additional paperwork required to transfer ownership of the property.

Who needs tax sale cambria county?

01

Property investors looking to purchase real estate at a discounted price.

02

Individuals or businesses looking to acquire property for development or investment purposes.

03

Homeowners looking to purchase a new property at a lower cost.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax sale cambria county in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your tax sale cambria county and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I get tax sale cambria county?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the tax sale cambria county in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out the tax sale cambria county form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign tax sale cambria county. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is tax sale cambria county?

Tax sale in Cambria County refers to the process by which properties are sold due to unpaid property taxes. This process allows local governments to recover owed tax revenue by auctioning off properties that have delinquent taxes.

Who is required to file tax sale cambria county?

Anyone who owns property in Cambria County and has unpaid taxes owed on that property is subject to the tax sale process. Additionally, tax collectors and municipal authorities may file for tax sales related to delinquent tax collections.

How to fill out tax sale cambria county?

To fill out the tax sale form in Cambria County, you must provide detailed information about the property, the owner, the tax delinquency, and ensure that all required documents are attached. It is advisable to consult the local tax office for specific forms and instructions.

What is the purpose of tax sale cambria county?

The purpose of tax sale in Cambria County is to recover unpaid property taxes, thereby ensuring that local governments have the necessary funds for public services. It also serves to promote the responsible ownership of properties by holding owners accountable for their tax obligations.

What information must be reported on tax sale cambria county?

The information that must be reported includes the property address, owner's name, amount of delinquent taxes, assessed value of the property, and any other relevant financial details or liens against the property.

Fill out your tax sale cambria county online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Sale Cambria County is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.