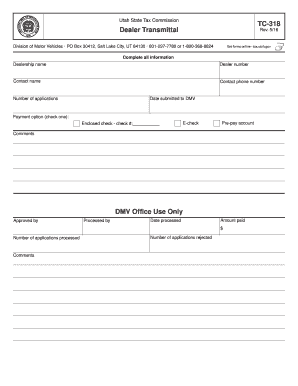

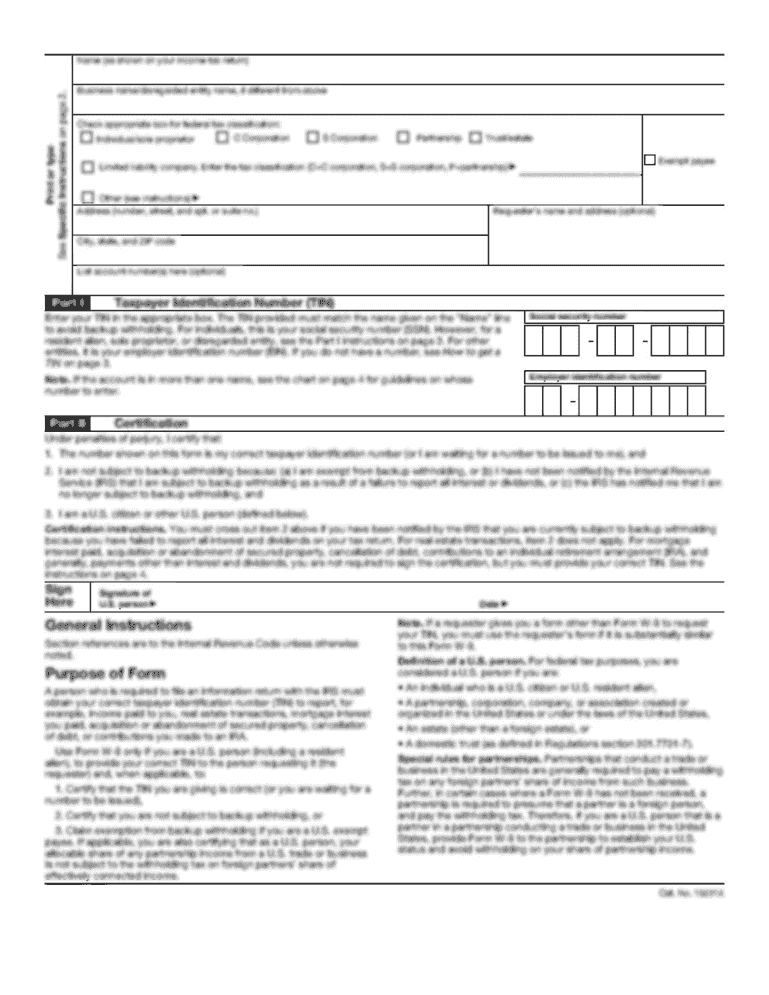

UT TC-318 2012 free printable template

Show details

TC-318. Rev. 7/12. Get forms online Gautama.gov. Division of Motor Vehicles PO Box 30412, Salt Lake City, UT 84130 801-297-7780 or 1-800-368-8824.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-318

Edit your UT TC-318 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-318 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT TC-318 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UT TC-318. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-318 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-318

How to fill out UT TC-318

01

Begin by downloading the UT TC-318 form from the official website or obtain a physical copy.

02

Fill in your personal information at the top of the form, including your name, contact details, and address.

03

Provide the details of the transaction or operation for which you are filling out the form.

04

Attach any required supporting documentation that may be needed for the transaction.

05

Review the completed form to ensure all information is accurate and legible.

06

Sign and date the form where indicated, confirming that all information provided is true to the best of your knowledge.

07

Submit the form online or deliver it to the appropriate office as instructed.

Who needs UT TC-318?

01

Individuals or businesses that are engaging in specific transactions or requests requiring official documentation.

02

Accountants or financial professionals preparing tax-related filings or appeals that involve this form.

03

Any parties involved in legal proceedings that necessitate the use of UT TC-318 for compliance or record-keeping purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is commission tax in NYC?

If you do not agree with a penalty or decision made by the Oklahoma Oklahoma Tax Commission, you have the right to file an appeal and ask for reconsideration. In the case of a department appeal, an official petition must be completed with the Tax Commission within sixty days after mailing of notice of assessment.

Who do I call about tax issues?

The Tax Commission informs taxpayers about their obligations so everyone can pay their fair share of taxes, and it must enforce Idaho's laws to ensure the fairness of the tax system with those who don't voluntarily comply.

What does the Idaho state Tax Commission do?

An Oklahoma tax power of attorney (Form BT-129), otherwise known as the Oklahoma Tax Commission Power of Attorney, is a form that provides you the opportunity to appoint a tax professional or other person to represent your interests in front of the tax commission.

How do I contact the Oklahoma Tax Commission?

Section 231 - Tax Warrants A. If any tax, imposed or levied by any state tax law, or any portion of such tax, is not paid before the same becomes delinquent, the Oklahoma Tax Commission may immediately issue a warrant under its official seal.

Why am I getting a letter from the Idaho State Tax Commission?

The Tax Commission might need to verify your identity. This helps safeguard your information and keeps your refund from going to criminals. You could receive one of three letters: A PIN letter that asks you to enter a personal identification number (PIN) we provided to confirm you filed the tax return we received.

How does Idaho state tax work?

Idaho has a 6.00 percent state sales tax rate, a 3.00 percent max local sales tax rate, and an average combined state and local sales tax rate of 6.02 percent. Idaho's tax system ranks 17th overall on our 2022 State Business Tax Climate Index.

What is power of attorney Idaho State Tax Commission?

An Idaho tax power of attorney, or “Form bL375E,” is a designation that allows someone else to be able to handle a citizen's tax filing with the Idaho State Tax Commission. The taxpayer can use the fields to define the exact tax matters for which the agent will be approved to represent them.

Do I have to pay Idaho state taxes?

You must file individual income tax returns with Idaho if you're any of the following: An Idaho resident. A part-year Idaho resident with income from Idaho sources or income earned while an Idaho resident. A nonresident of Idaho with income from Idaho sources.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my UT TC-318 directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your UT TC-318 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I modify UT TC-318 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your UT TC-318 into a dynamic fillable form that you can manage and eSign from anywhere.

Where do I find UT TC-318?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific UT TC-318 and other forms. Find the template you need and change it using powerful tools.

What is UT TC-318?

UT TC-318 is a tax form used in Utah for reporting certain tax transactions and claims related to tax credits.

Who is required to file UT TC-318?

Any taxpayer who is claiming a tax credit or refund related to specific tax transactions in Utah is required to file UT TC-318.

How to fill out UT TC-318?

To fill out UT TC-318, taxpayers must provide their identification information, details of the tax credits being claimed, and any supporting documentation as required by the form's instructions.

What is the purpose of UT TC-318?

The purpose of UT TC-318 is to facilitate the reporting and processing of tax credits and refunds for eligible taxpayers in Utah.

What information must be reported on UT TC-318?

Information that must be reported on UT TC-318 includes the taxpayer's identification details, the type of tax credit claimed, the amount of the credit, and any relevant supporting information or documentation.

Fill out your UT TC-318 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-318 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.