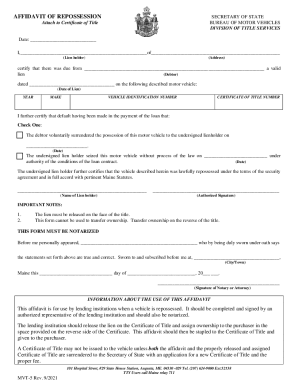

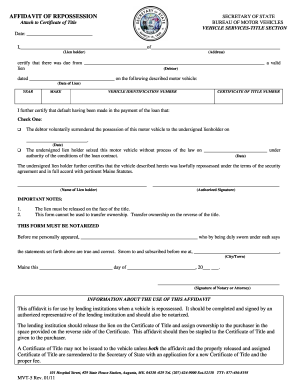

ME MVT-5 2013 free printable template

Get, Create, Make and Sign affidavit of repossession form

How to edit affidavit of repossession form online

Uncompromising security for your PDF editing and eSignature needs

ME MVT-5 Form Versions

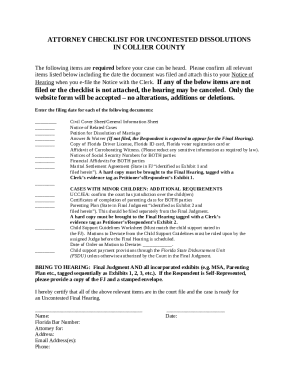

How to fill out affidavit of repossession form

How to fill out ME MVT-5

Who needs ME MVT-5?

Instructions and Help about affidavit of repossession form

Hello everybody is Steve Williams founder and president of the credit repair shop we're going to talk about repossession today because we get a lot of questions about repossessions a lot of customers are dealing with this and a lot of people are dealing with repossessions you know owner credit reports, or they might be where there a repossession is happening to them right now so what we're going to do is we're going to go through your rights when it comes to dealing with repossession, and I've got my notes here so I hopefully I don't forget anything out on here but let's first let's go into the beginning process uh, but you had bought a car and then now you either couldn't afford to pay much due to you lost your job, or you got downsized where you're not making as much money, or you're just playing a simple you can't afford to pay for the car because you're not managing your household expenses the right way, so first you're going to start getting calls from the lender they're going to be asking you know can you why you're not paying or when you're going to make the payments most people run they don't answer the phone, or they just say I don't know I lent the money or whatever one strategy that you can use that I always tell my customers is that if you are in trouble financially something that you can do is you can ask your lender to do an affianced of your payment's you can some of them will do up to six months depending on the hardship that you have and if you can prove the hardship you could get a three to six month deferment of your payment's that's where they'll put the payments on the back of your car loan and that'll allow you to get some breathing room and what I always tell clients is done't go shopping with that money use that money to get caught up on other bills so you when your car payment comes back around you're able to afford it, or you're able to catch up on the car payment now when it comes to what a lender is going to do because we're our lender has legal contracts with where they got the money from and this is where a lot of people don't understand they're like well why can't I go and get the car back after it goes through this process and this is the reason why I'm going to make it clear to you all lent loans in we're dealing with car loan right now there's going to be a three to six month process where it's going to be considered where they're going to charge it on this is where they consider the debt as a hundred percent bad as if they're not going to be able to get the loan back into good standing once it goes through the charged-off process even if you came with the money to that lender that specific lender they are not legally able allowed to take that money and that's what I think that's where big misconception comes when people talk about charge-offs and when they charge off the debt that doesn't mean the debt goes away that means that the debt has moved into a different legal status when it goes into what they're...

People Also Ask about

What is the repossession code in Idaho?

How do I repossess a car in Idaho?

How do I repossess a car in New Mexico?

What are the repo laws in Oklahoma?

How do I file a repo title in Oklahoma?

How do you get around a repossession?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send affidavit of repossession form for eSignature?

Can I create an electronic signature for signing my affidavit of repossession form in Gmail?

How do I fill out affidavit of repossession form using my mobile device?

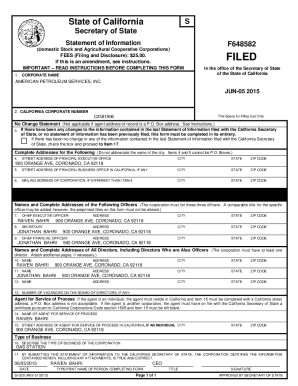

What is ME MVT-5?

Who is required to file ME MVT-5?

How to fill out ME MVT-5?

What is the purpose of ME MVT-5?

What information must be reported on ME MVT-5?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.