Get the free W13-03, Revision of wage garnishment form instructions - courts ca

Show details

Judicial Council of California ? Administrative Office of the Courts 455 Golden Gate Avenue. San Francisco, California 94102-3688 www.courts.ca.gov/policyadmin-invitationstocomment.htm INVITATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign w13-03 revision of wage

Edit your w13-03 revision of wage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w13-03 revision of wage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit w13-03 revision of wage online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit w13-03 revision of wage. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

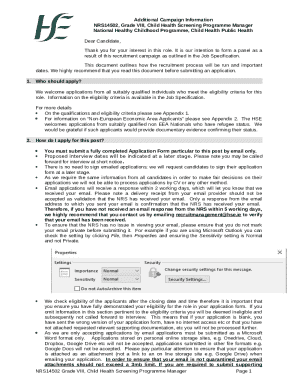

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out w13-03 revision of wage

How to fill out w13-03 revision of wage:

01

Gather all necessary information: Before filling out the w13-03 revision of wage form, make sure you have all the required information such as employee details, payroll information, and any changes that need to be made.

02

Fill out employee details: Provide accurate information about the employee, including their name, address, social security number, and any identification numbers provided by your organization.

03

Provide payroll information: Enter the employee's current wage details, including their hourly rate or salary, any overtime rate if applicable, and the number of hours they work per week.

04

Make changes, if necessary: If the purpose of filling out the w13-03 revision of wage form is to make adjustments to the employee's wage, indicate the changes that need to be made. This could include a wage increase or decrease, changes in benefits, or any other modifications to the employee's compensation.

05

Review and double-check: Once you have completed filling out the form, review all the information you have entered to ensure its accuracy and completeness. Any errors or missing information might cause delays or complications in processing the revision of wage.

Who needs w13-03 revision of wage?

01

Employers: Employers or HR departments typically need the w13-03 revision of wage form to manage changes in employee wages. Whether it's adjusting pay rates, implementing raises, or updating benefit structures, employers use this form to officially document and track such revisions.

02

Employees: In some cases, employees may request a revision of their wage if they believe there has been a mistake or if they are eligible for a raise or change in compensation. Employees can initiate the revision process by filling out the w13-03 form and submitting it to their employer for review and approval.

03

Payroll administrators: Payroll administrators or specialists may require the w13-03 revision of wage form to accurately update payroll records and ensure that payments are made correctly based on the revised wage information. They use this form as a reference to reflect the changes in an employee's compensation structure.

Note: The w13-03 revision of wage form may vary depending on the specific organization or country. It is always recommended to consult with the relevant authorities or refer to your employer's guidelines to ensure you are using the correct form and following the appropriate procedures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is w13-03 revision of wage?

The w13-03 revision of wage is a form used to report any changes or updates to an employee's wage information.

Who is required to file w13-03 revision of wage?

Employers are required to file the w13-03 revision of wage if there are any changes or updates to an employee's wage information.

How to fill out w13-03 revision of wage?

To fill out the w13-03 revision of wage, employers must provide the updated wage information for the employee in the designated sections of the form.

What is the purpose of w13-03 revision of wage?

The purpose of the w13-03 revision of wage is to ensure accurate and up-to-date wage information for employees.

What information must be reported on w13-03 revision of wage?

The w13-03 revision of wage must include the employee's name, employee ID, previous wage information, and updated wage information.

How can I send w13-03 revision of wage to be eSigned by others?

When your w13-03 revision of wage is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete w13-03 revision of wage online?

Filling out and eSigning w13-03 revision of wage is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit w13-03 revision of wage online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your w13-03 revision of wage to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Fill out your w13-03 revision of wage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

w13-03 Revision Of Wage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.