Get the free All Limited Partnerships A - azsos

Show details

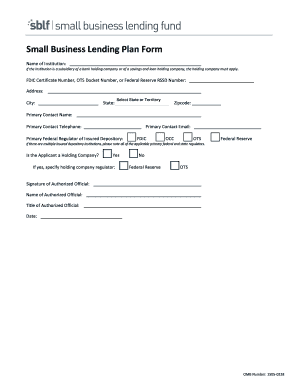

State of Arizona Office of the Secretary of State DO NOT WRITE IN THIS SPACE All Limited Partnerships A.R.S. 29-309 & 29-1103(H) Amendment to Certificate; Restatement SEND BY MAIL TO: Secretary of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign all limited partnerships a

Edit your all limited partnerships a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your all limited partnerships a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing all limited partnerships a online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit all limited partnerships a. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out all limited partnerships a

How to fill out all limited partnerships a:

01

Gather all necessary documents and information: To fill out all limited partnerships forms, you will need to gather important documents such as the partnership agreement, personal information of partners, and financial information. Make sure you have all the required information before starting the process.

02

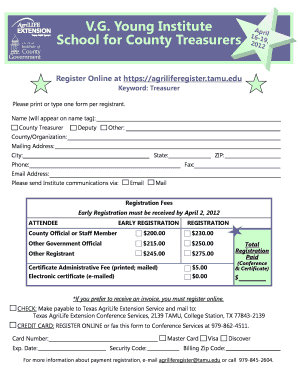

Fill out the general information section: Begin by providing the general information about the limited partnership, including the name, address, and contact details. This section usually appears at the beginning of the form and helps identify the partnership.

03

Identify the partners: In this section, you will need to provide details about each partner involved in the limited partnership. Fill in their names, addresses, social security numbers, and any other required personal information.

04

Outline the partnership agreement: The partnership agreement outlines the terms and conditions of the partnership, including profit-sharing, decision-making processes, and partnership duration. Fill in all the necessary information based on the agreement reached by the partners.

05

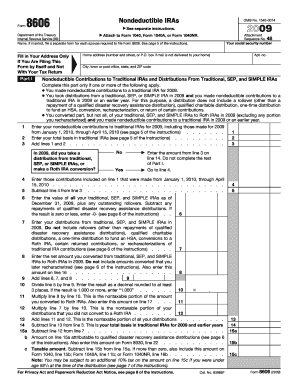

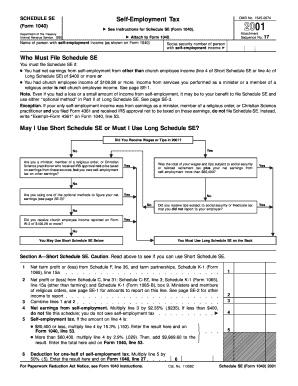

Provide financial information: Limited partnerships often require the disclosure of financial information. Include details such as the initial capital contributions made by each partner, profit and loss sharing ratios, and any additional financial disclosures required by the form.

06

Review and submit the completed forms: Once you have filled out all the required sections, carefully review the filled forms for accuracy and completeness. Make sure all information is correct and that you have not missed any sections. Finally, submit the completed forms to the appropriate authorities, following the specific instructions provided.

Who needs all limited partnerships a:

01

Entrepreneurs and investors: Limited partnerships are commonly used by entrepreneurs and investors to establish a business structure that combines the benefits of a partnership with limited liability for certain partners. This legal structure is often chosen when there is a need for passive investors who do not wish to be actively involved in the business operations.

02

Real estate developers: Limited partnerships are frequently utilized in real estate projects where multiple investors come together to finance a development. In this scenario, the general partner assumes responsibility for managing the project, while limited partners provide the necessary funding.

03

Professional service providers: Professionals such as lawyers, accountants, and doctors may choose to form limited partnerships to pool their resources and expertise. This structure provides a means for professionals to collaborate and share in the profits and risks of their collective endeavors.

04

Family-owned businesses: Limited partnerships can be an effective way for family members to create a formal structure for managing and transferring wealth within the family. By designating certain family members as general partners and others as limited partners, the family can maintain control while providing limited liability protection for certain family members.

05

Joint ventures: Limited partnerships are also utilized in joint ventures where two or more parties collaborate on a specific project or business endeavor while maintaining separate legal identities. This allows each party to have a defined role and share in the risks and rewards of the joint venture.

Overall, anyone seeking to establish a business or investment structure that combines the flexibility of a partnership with limited liability for certain partners may benefit from forming a limited partnership. However, it is important to seek professional advice and thoroughly understand the legal requirements and implications before establishing a limited partnership.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is all limited partnerships a?

All limited partnerships a refers to a type of business structure where there are two or more partners, with at least one general partner and one limited partner.

Who is required to file all limited partnerships a?

All limited partnerships a are required to be filed by the partners or their designated representative.

How to fill out all limited partnerships a?

All limited partnerships a can be filled out by providing information such as the names of the partners, their contributions, and the terms of the partnership agreement.

What is the purpose of all limited partnerships a?

The purpose of all limited partnerships a is to establish a legal framework for the partners to conduct business together while limiting the liability of the limited partners.

What information must be reported on all limited partnerships a?

Information that must be reported on all limited partnerships a includes the names and addresses of the partners, the nature of the business, and the duration of the partnership.

How can I get all limited partnerships a?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the all limited partnerships a in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit all limited partnerships a online?

With pdfFiller, the editing process is straightforward. Open your all limited partnerships a in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit all limited partnerships a in Chrome?

all limited partnerships a can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Fill out your all limited partnerships a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

All Limited Partnerships A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.