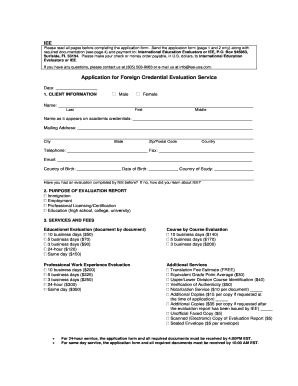

Get the free Mutual Directions® 3 Quarterly Summary

Show details

Mutual Directions 3 Moderate Quarterly Summary Profile as of June 30 2007 except where noted Objective Seeks capital appreciation and income over the long-term by investing in five stock funds and a bond fund.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mutual directions 3 quarterly

Edit your mutual directions 3 quarterly form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mutual directions 3 quarterly form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mutual directions 3 quarterly online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mutual directions 3 quarterly. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mutual directions 3 quarterly

How to fill out Mutual Directions® 3 Quarterly Summary

01

Start by gathering all relevant financial documents for the quarter.

02

Identify the key areas to report on, such as income, expenses, and investments.

03

Fill out each section of the Mutual Directions® 3 Quarterly Summary systematically.

04

For each financial category, input the accurate numbers and data.

05

Double-check your entries for accuracy and completeness.

06

Review the summary to ensure that it reflects accurate quarterly performance.

07

Submit the completed summary to the designated parties or file it as required.

Who needs Mutual Directions® 3 Quarterly Summary?

01

Individuals or families participating in the Mutual Directions® program.

02

Financial advisors managing client accounts under the Mutual Directions® framework.

03

Organizations providing financial assessment or planning services using Mutual Directions®.

Fill

form

: Try Risk Free

People Also Ask about

What is the 90% rule for mutual funds?

Warren Buffett's 90/10 strategy involves allocating 90% of assets to a low-cost S&P 500 index fund and 10% to short-term government bonds. The 90/10 rule offers simplicity, lower fees, and the potential for higher returns.

How do mutual funds work for dummies?

Mutual funds let you pool your money with other investors to "mutually" buy stocks, bonds, and other investments. They're run by professional money managers who decide which securities to buy (stocks, bonds, etc.) and when to sell them.

How do I get a mutual fund summary statement?

In respect of mutual fund investors who have registered their e-mail, the respective Mutual Funds send a PDF of account statement within 5 working days after each financial transaction. However, if investors who have NOT registered their e-mail ID will get only the monthly CAS.

Is it worth investing in mutual funds now?

So, one should continue investing in mutual fund SIPs without taking any bother. When the market is in a bull trend, you get a lesser number of NAVs, whereas when there is a stock market crash, you get a higher number of NAVs. Most importantly, you get an average market return over the period when you invest in SIP.

Is mutual fund a good investment?

Mutual funds are a widely favored investment option, offering a convenient way for individuals to access a diversified and professionally managed portfolio without the need to pick individual securities or actively rebalance their investments.

What are the 4 types of mutual funds?

A mutual fund is a type of investment vehicle where the money collected from various investors is pooled together to invest in different assets including bonds, stocks, and/or money market investments.

What is the summary of a mutual fund?

What are mutual funds? A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. The combined holdings of the mutual fund are known as its portfolio. Investors buy shares in mutual funds.

How do you explain mutual funds?

What are mutual funds? A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. The combined holdings of the mutual fund are known as its portfolio. Investors buy shares in mutual funds.

What are the disadvantages of a mutual fund?

Uncertain returns: Mutual funds do not offer guaranteed returns. Their value is reflected in the Net Asset Value (NAV), which fluctuates daily. A dip in NAV after your investment translates to a loss on your principal amount. Limited control: Investors have no say in where the fund manager invests.

Do you actually make money in mutual funds?

Yes, mutual funds are profitable. However, they come with their own set of risks. They don't guarantee capital protection nor do they guarantee returns. There are certain things you can do to ensure that things within your control are well taken care of.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mutual Directions® 3 Quarterly Summary?

Mutual Directions® 3 Quarterly Summary is a financial reporting document that summarizes the performance and activities of a mutual fund over a designated quarter.

Who is required to file Mutual Directions® 3 Quarterly Summary?

Entities managing mutual funds or investment companies are required to file the Mutual Directions® 3 Quarterly Summary as part of their regulatory reporting obligations.

How to fill out Mutual Directions® 3 Quarterly Summary?

To fill out the Mutual Directions® 3 Quarterly Summary, one must gather the financial data, complete each section concerning fund performance, assets, and liabilities, and ensure compliance with regulatory requirements before submission.

What is the purpose of Mutual Directions® 3 Quarterly Summary?

The purpose of the Mutual Directions® 3 Quarterly Summary is to provide stakeholders, including investors and regulators, with a transparent overview of the fund's financial status and operating results during the quarter.

What information must be reported on Mutual Directions® 3 Quarterly Summary?

The Mutual Directions® 3 Quarterly Summary must report key financial metrics, including total assets, total liabilities, net asset value, investment performance, and any significant changes in fund management or operations.

Fill out your mutual directions 3 quarterly online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mutual Directions 3 Quarterly is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.