Get the free 5501 Oil Severance Tax Electronic Filing Payment Voucher Do not ... - revenue louisiana

Show details

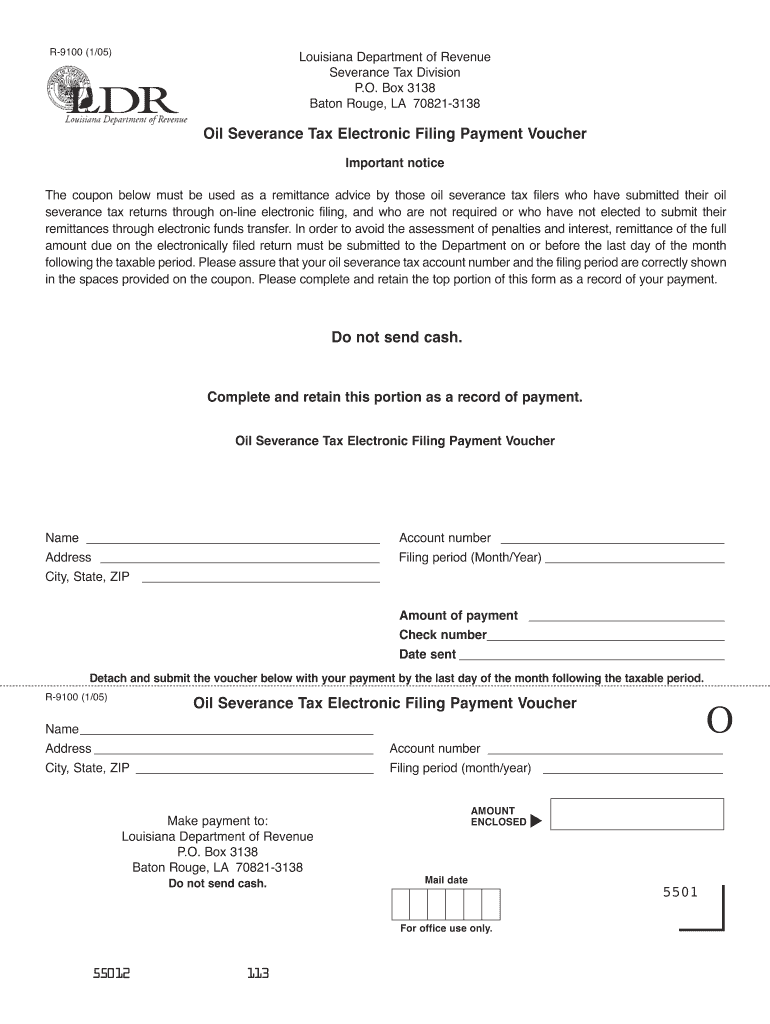

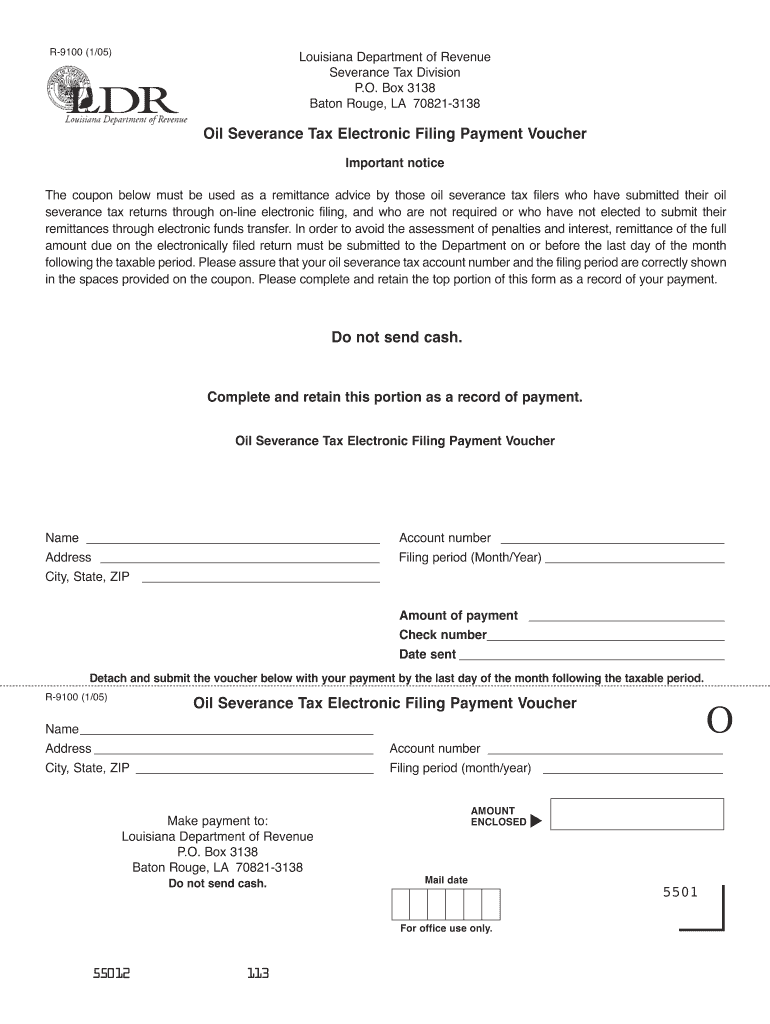

R-9100 (1/05) Louisiana Department of Revenue Severance Tax Division P.O. Box 3138 Baton Rouge, LA 70821-3138 Oil Severance Tax Electronic Filing Payment Voucher Important notice The coupon below

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 5501 oil severance tax

Edit your 5501 oil severance tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 5501 oil severance tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 5501 oil severance tax online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 5501 oil severance tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 5501 oil severance tax

How to fill out 5501 oil severance tax?

01

Gather all necessary information and documents related to the oil severance tax. This may include production and sales records, well production reports, and any relevant permits or licenses.

02

Start by accurately reporting the amount of oil produced during the reporting period. This can usually be found in the production records or well reports.

03

Calculate the oil severance tax liability based on the applicable tax rate, which may vary depending on the jurisdiction. This can often be found in the state or local tax regulations.

04

Report any exemptions or deductions that may apply to reduce the tax liability. This could include certain types of production methods or equipment used, or any other specific incentives provided by the government.

05

Provide accurate information about the operator or company responsible for paying the oil severance tax. This typically includes the legal name, address, and contact information.

06

Ensure that all calculations and information provided are accurate and in compliance with the relevant tax laws and regulations. It's advisable to double-check all entries before submitting the form to avoid any penalties or issues.

Who needs 5501 oil severance tax?

01

Oil producing companies: Any company engaged in the production and extraction of oil is generally required to pay the oil severance tax. This includes both large corporations and smaller independent operators.

02

Individual oil well owners: In some cases, individuals or groups who own and operate oil wells may also be responsible for paying the oil severance tax. This can often apply to private landowners who lease their property for oil extraction.

03

State or local governments: The oil severance tax is an important source of revenue for many state and local governments. Therefore, these governing bodies may require companies or individuals engaged in oil production within their jurisdictions to pay the tax.

Note: The specific requirements for who needs to pay the 5501 oil severance tax may vary depending on the laws and regulations of the jurisdiction in which the oil production takes place. It is important to consult the relevant authorities or seek professional tax advice to determine the specific obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 5501 oil severance tax directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign 5501 oil severance tax and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I sign the 5501 oil severance tax electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your 5501 oil severance tax.

How do I fill out 5501 oil severance tax using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign 5501 oil severance tax and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is 5501 oil severance tax?

5501 oil severance tax is a tax imposed on the extraction of oil from the ground.

Who is required to file 5501 oil severance tax?

Oil companies or individuals who extract oil are required to file 5501 oil severance tax.

How to fill out 5501 oil severance tax?

To fill out 5501 oil severance tax, the taxpayer must provide information on the amount of oil extracted and pay the corresponding tax.

What is the purpose of 5501 oil severance tax?

The purpose of 5501 oil severance tax is to generate revenue for the government from the extraction of oil resources.

What information must be reported on 5501 oil severance tax?

The information reported on 5501 oil severance tax includes the amount of oil extracted, the location of extraction, and the tax due.

Fill out your 5501 oil severance tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

5501 Oil Severance Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.