Get the free What Required Minimum Distribution Is And How To ...

Show details

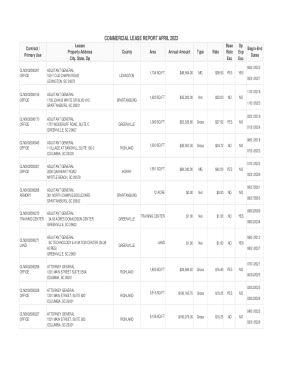

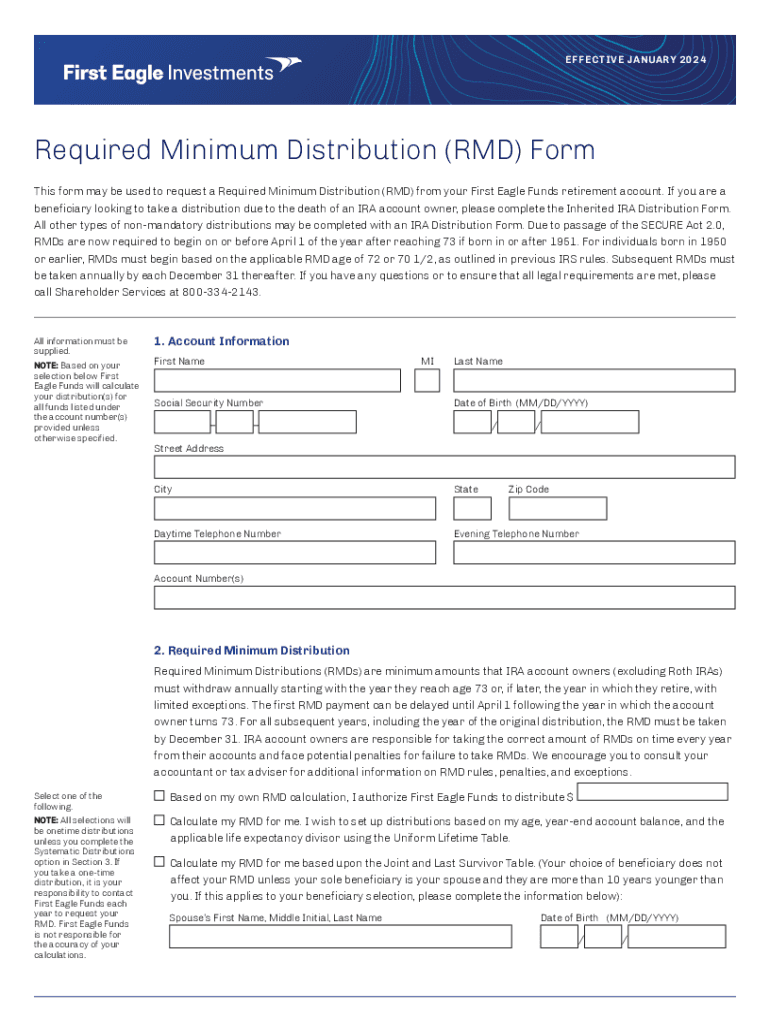

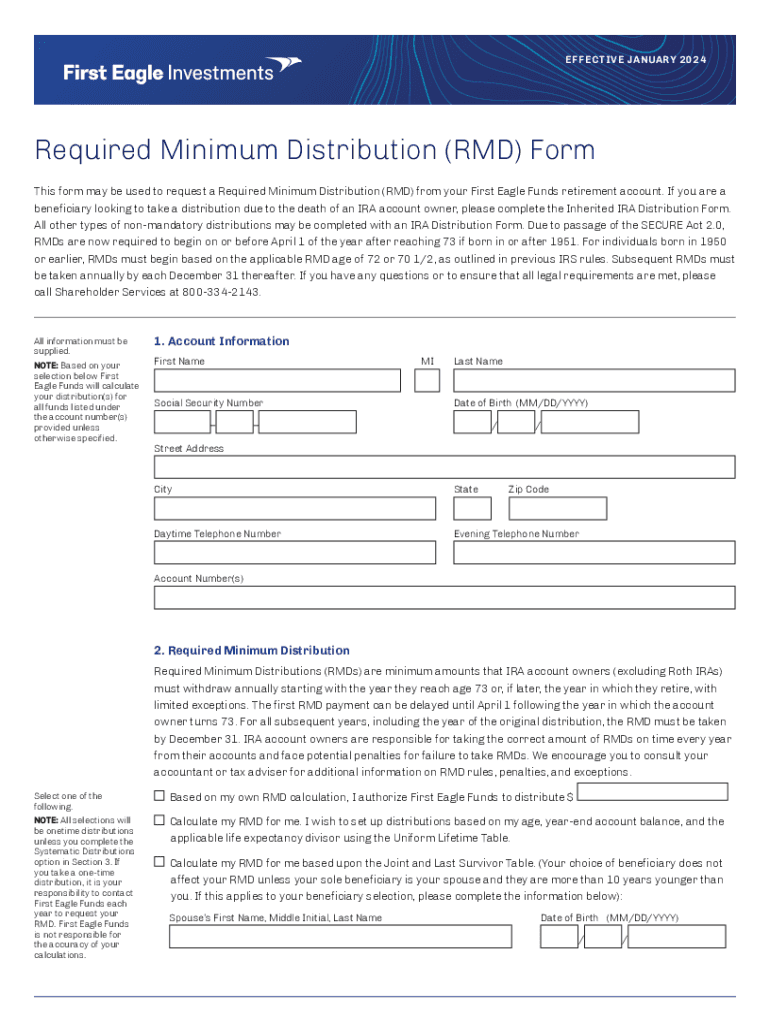

EFFECTIVE JANUARY 2024Required Minimum Distribution (RMD) Form This form may be used to request a Required Minimum Distribution (RMD) from your First Eagle Funds retirement account. If you are a beneficiary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign what required minimum distribution

Edit your what required minimum distribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what required minimum distribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing what required minimum distribution online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit what required minimum distribution. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out what required minimum distribution

How to fill out what required minimum distribution

01

Determine your required minimum distribution (RMD) by using the IRS tables based on your age and account balance.

02

Identify all of your retirement accounts that are subject to RMDs.

03

Calculate the total RMD amount due for the year across all of your accounts.

04

Decide if you want to take the RMD amount from one specific account or spread it out across multiple accounts.

05

Take your RMD amount by the deadline (usually December 31st) to avoid penalties.

Who needs what required minimum distribution?

01

Those who have reached age 72 (or 70 1/2 for those who turned 70 1/2 before January 1, 2020) and have traditional retirement accounts such as a 401(k) or IRA are required to take RMDs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify what required minimum distribution without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your what required minimum distribution into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an eSignature for the what required minimum distribution in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your what required minimum distribution right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I fill out what required minimum distribution on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your what required minimum distribution, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is what required minimum distribution?

The required minimum distribution (RMD) is the minimum amount that a retirement account owner must withdraw annually from their retirement accounts once they reach a certain age, typically 72 years old.

Who is required to file what required minimum distribution?

Individuals who own retirement accounts such as 401(k)s and traditional IRAs are required to take RMDs if they are 72 years old or older, or if they inherit an IRA.

How to fill out what required minimum distribution?

To fill out the required minimum distribution, account holders should calculate the RMD amount using the IRS life expectancy tables and account balances, then report it as necessary on tax forms, typically using Form 1099-R.

What is the purpose of what required minimum distribution?

The purpose of the required minimum distribution is to ensure that individuals do not defer taxes on their retirement savings indefinitely and to begin taxing retirement withdrawals.

What information must be reported on what required minimum distribution?

The information that must be reported includes the amount withdrawn, the account balance, and the account holder's age, along with any applicable tax withheld.

Fill out your what required minimum distribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Required Minimum Distribution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.