Get the free (6) TAX DEEDED PROPERTIES IN HINSDALE, NH

Show details

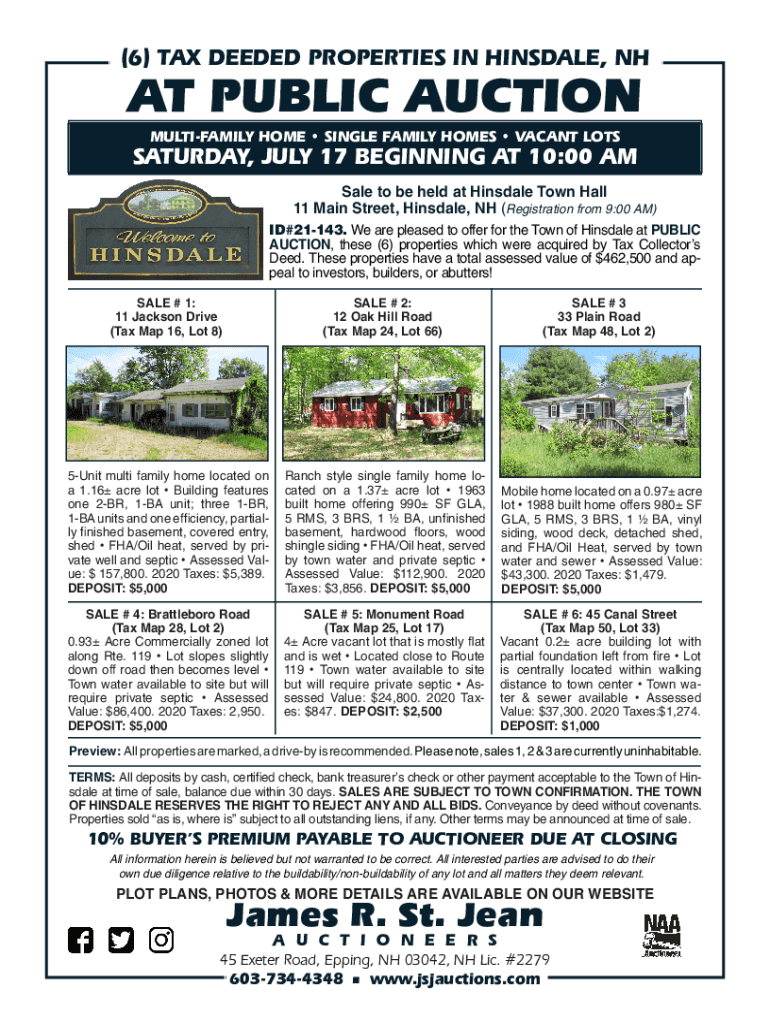

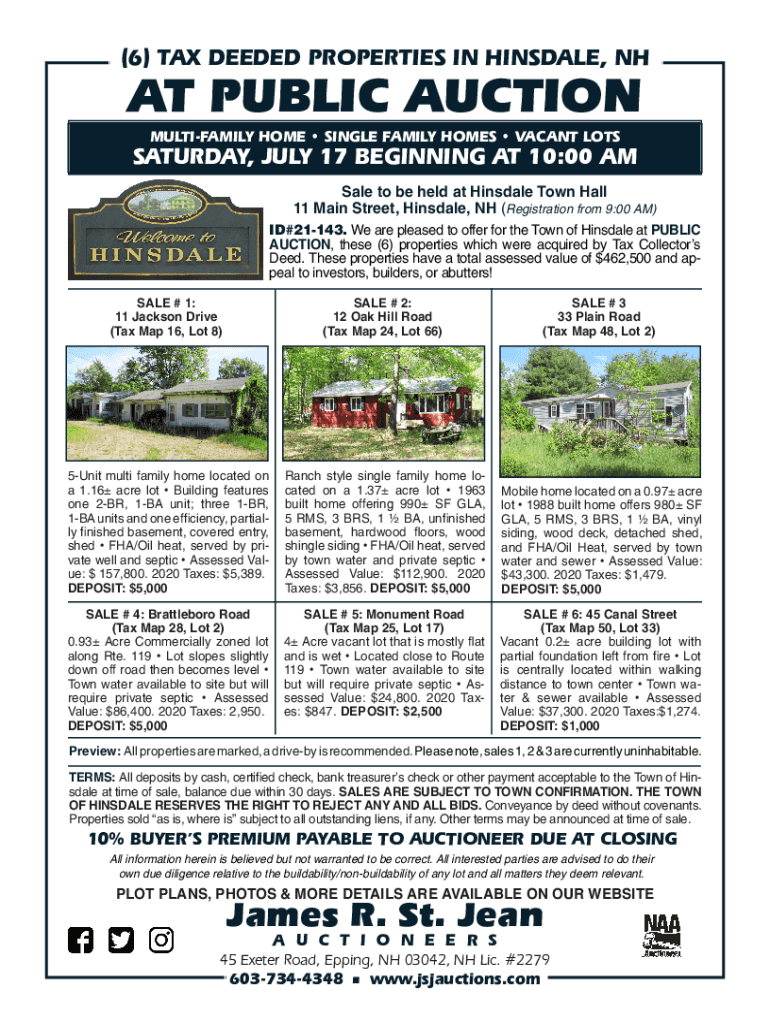

(6) TAX DEEDED PROPERTIES IN HILLSDALE, THAT PUBLIC AUCTION

MULTIFAMILY HOME SINGLE FAMILY HOMES VACANT LOTSSATURDAY, JULY 17 BEGINNING AT 10:00 AM

Sale to be held at Hillsdale Town Hall

11 Main Street,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 6 tax deeded properties

Edit your 6 tax deeded properties form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 6 tax deeded properties form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 6 tax deeded properties online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 6 tax deeded properties. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 6 tax deeded properties

How to fill out 6 tax deeded properties

01

Obtain the necessary forms for tax deed properties from the local tax assessor's office.

02

Fill out the forms accurately with all required information such as property address, tax ID number, and your contact information.

03

Provide any additional documentation requested by the tax assessor's office, such as proof of ownership or payment of outstanding taxes.

04

Submit the completed forms and documentation to the tax assessor's office by the deadline specified.

05

Pay any applicable fees for processing the tax deed properties.

06

Await confirmation from the tax assessor's office that the tax deed properties have been successfully filled out.

Who needs 6 tax deeded properties?

01

Investors looking to acquire valuable properties at a discounted price through tax sales or auctions.

02

Individuals or businesses interested in rehabilitating and reselling tax delinquent properties for profit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 6 tax deeded properties?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the 6 tax deeded properties in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in 6 tax deeded properties without leaving Chrome?

6 tax deeded properties can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I complete 6 tax deeded properties on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your 6 tax deeded properties. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is 6 tax deeded properties?

6 tax deeded properties refer to real estate properties for which a tax deed has been issued, typically indicating that the properties have been acquired due to tax forfeiture and are now the possession of the government or a governmental agency.

Who is required to file 6 tax deeded properties?

Individuals or entities that have acquired tax deeded properties through a tax sale or foreclosure are typically required to file any necessary documentation related to those properties.

How to fill out 6 tax deeded properties?

Filling out the documentation for 6 tax deeded properties generally requires providing information about the properties' legal descriptions, parcel numbers, acquisition details, and any outstanding taxes or assessments.

What is the purpose of 6 tax deeded properties?

The purpose of documenting 6 tax deeded properties is to formalize the transfer of ownership from the government to the new property owner, ensuring compliance with tax laws and regulations.

What information must be reported on 6 tax deeded properties?

Information that must be reported includes the property address, owner's details, tax identification number, legal descriptions, date of acquisition, and any relevant financial obligations or liens.

Fill out your 6 tax deeded properties online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

6 Tax Deeded Properties is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.