Get the free PAYROLL PROCEDURES MANUAL - sco ca

Show details

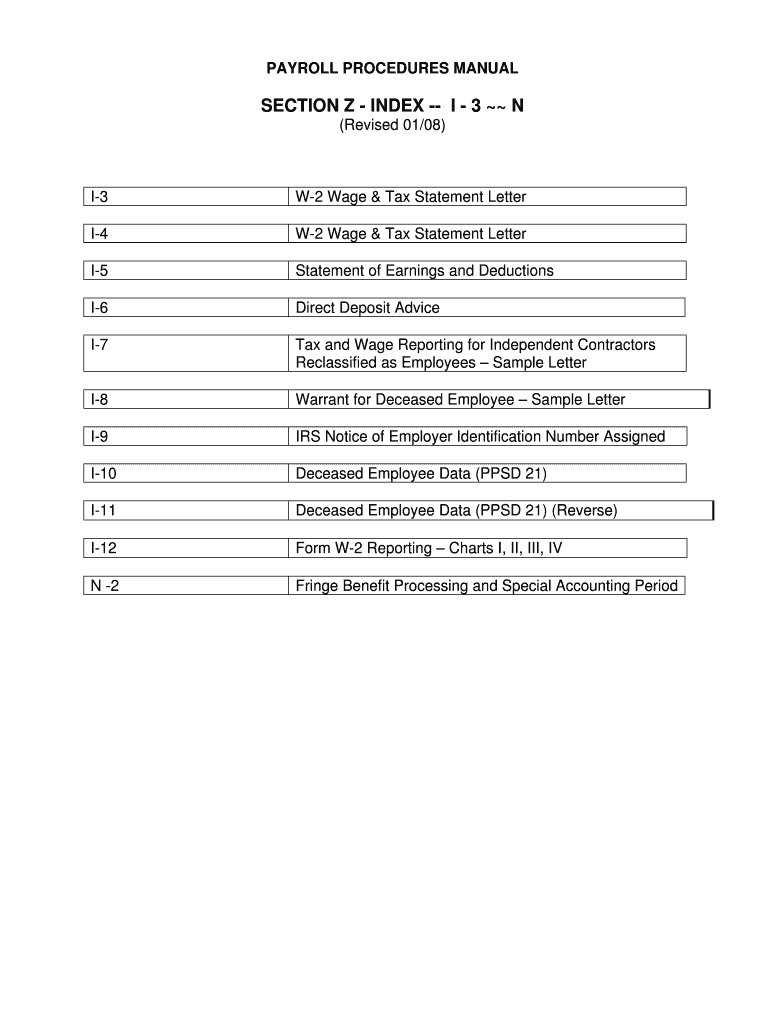

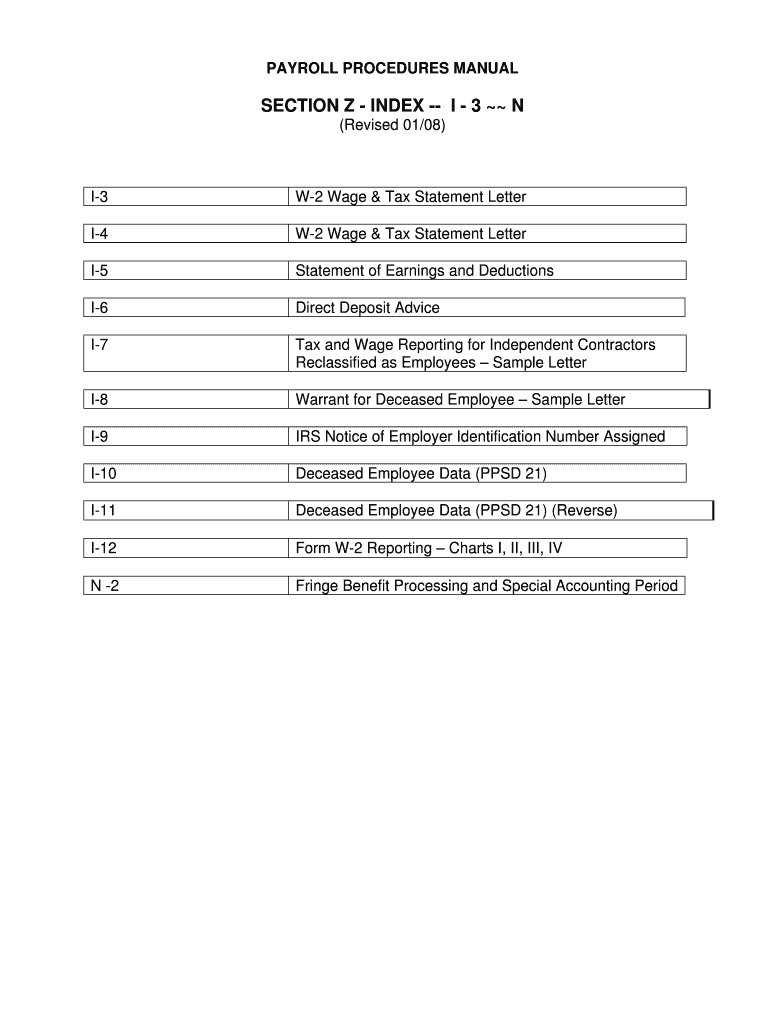

PAYROLL PROCEDURES MANUAL SECTION Z INDEX -- - 3 N (Revised 01/08) I-3 W-2 Wage & Tax Statement Letter I-4 W-2 Wage & Tax Statement Letter I-5 Statement of Earnings and Deductions I-6 Direct Deposit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payroll procedures manual

Edit your payroll procedures manual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll procedures manual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payroll procedures manual online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit payroll procedures manual. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll procedures manual

How to fill out a payroll procedures manual?

01

Start by organizing the content: Before filling out the payroll procedures manual, it is essential to organize the content in a structured manner. Divide it into relevant sections such as employee information, timekeeping, payroll processing, deductions, and reporting. This will make it easier to fill in the necessary information later.

02

Gather information: Collect all the relevant information required for the manual. This may include details about the company's payroll policies, employee benefits, tax regulations, and any specific procedures unique to your organization.

03

Document step-by-step processes: Break down each payroll process into clear and concise steps. For example, explain how to record employee hours, calculate gross pay, deduct taxes, process direct deposits, and generate payroll reports. Use bullet points or numbered lists to make it easier to follow.

04

Provide examples and templates: To ensure clarity, include examples and templates where necessary. This could be sample timesheets, paycheck stubs, or tax forms that employees can refer to when filling out the required information.

05

Include regulatory compliance information: Since payroll procedures are subject to various legal regulations, make sure to include information on compliance with federal, state, and local laws. Provide links or references to relevant resources for further understanding.

06

Review and refine: Once the initial draft of the manual is complete, review it thoroughly for accuracy, consistency, and completeness. Pay attention to grammar and formatting to ensure the document looks professional and is easy to understand.

Who needs a payroll procedures manual?

01

Small businesses: Small businesses with limited resources or experience in payroll processing can greatly benefit from having a payroll procedures manual. It provides guidance and ensures consistent payroll practices, reducing the risk of errors or non-compliance.

02

HR professionals: Human resources professionals responsible for managing payroll need a comprehensive manual to ensure they are following the correct procedures and acting in accordance with legal requirements. A well-defined manual can also be helpful when training new HR staff members.

03

Employees: Employees who handle their own time tracking, expense reporting, or payroll information can refer to the payroll procedures manual for guidance. It acts as a reference document, helping them understand their rights and obligations while ensuring accuracy in submitting their payroll information.

Overall, a well-crafted payroll procedures manual benefits both employers and employees, providing clarity, consistency, and compliance in payroll processing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is payroll procedures manual?

The payroll procedures manual is a document that outlines the step-by-step process for handling payroll tasks within an organization.

Who is required to file payroll procedures manual?

All employers are required to have a payroll procedures manual in place to ensure compliance with labor laws and regulations.

How to fill out payroll procedures manual?

The payroll procedures manual can be filled out by HR professionals or payroll specialists who are knowledgeable about payroll processes.

What is the purpose of payroll procedures manual?

The purpose of the payroll procedures manual is to establish consistent payroll practices, ensure accuracy in payroll processing, and provide guidance to employees.

What information must be reported on payroll procedures manual?

The payroll procedures manual should include information on payroll schedules, tax withholding procedures, employee benefits, and payroll software usage.

How can I send payroll procedures manual to be eSigned by others?

When your payroll procedures manual is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit payroll procedures manual online?

The editing procedure is simple with pdfFiller. Open your payroll procedures manual in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit payroll procedures manual in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing payroll procedures manual and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Fill out your payroll procedures manual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Procedures Manual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.